Money market funds aim to offer a cash-like level of stability and liquidity to investors along with higher returns than could be found in a bank or building society. They look to achieve this by investing in short-term cash deposits or short-term bonds, which is why they’re considered a low-risk option.

A variety of instruments are traded in the money markets including certificates of deposit, commercial paper, treasury bills. Bonds, especially those of short duration, are another mainstay of money market funds.

Bonds fall under the broader category of fixed-income securities. These are loans made to both governments and individual companies in exchange for a return of the original capital outlay, plus a regular (yearly or half-yearly) interest payment known as the ‘coupon’.

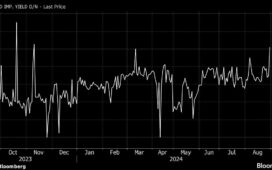

Once in issue, bonds are traded on secondary markets where their price will fluctuate according to supply and demand. A bond’s yield is calculated as the interest paid divided by its market value and moves in the opposite direction to its price.

A handful of ratings agencies weigh up the credit worthiness of various bond issuers and their ability to pay back their debts, from countries to individual businesses. A triple A rating is regarded as extremely secure with ratings diminishing in quality as rankings progress down the alphabet.

Read more about bonds here. UK government bonds are also known as gilts and you can find out more about them here.

Money market funds typically aim to produce a return over and above the Bank of England’s Bank Rate or the Sterling Overnight Index Average (Sonia), a benchmark for short-term lending between financial institutions.

The Bank Rate is the influential rate of borrowing announced 10 times a year by the Bank’s Monetary Policy Committee. At the time of writing, the Bank Rate has been raised 13 consecutive times since December 2021 to stand at 5%.

The interest paid by money market funds varies with bond market yields, which themselves are closely linked to the Bank Rate. When the Bank Rate rises, so too will yields and therefore the interest that is paid out from these funds. The reverse is true, so if the Bank Rate falls there will be an associated drop in income as well.