cogal/E+ via Getty Images

I have just returned to the United States from Europe.

One thing that struck me on the tour was that the U.S. dollar is doing very well, thank you!

I have been to Europe numerous times, times when the U.S. dollar felt strong…and times when the U.S. dollar felt weak.

This time, there was no doubt left in my mind.

It is always interesting to me on trips to speak with a large cross-section of the people I meet; to hear what they are thinking, what they are doing, and their general viewpoint on things.

This helps me to match what I see in markets with the general tenor of talk in the community.

So I spoke with business people, market participants, general shoppers, and as many people that would engage in conversation with me.

I have found this to be, throughout my career, a “side-means” of testing the attitudes that exist in the market.

Yes, it is a very judgmental approach, but I have always found it helpful.

My conclusion this time…the U.S. dollar is doing very well against the Euro.

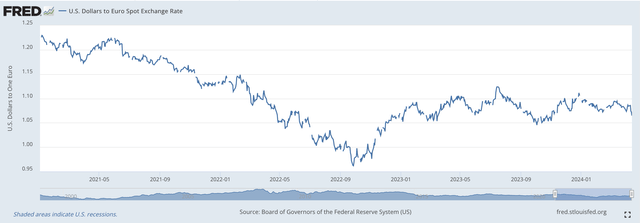

And, here is a picture of the performance of the U.S. dollar against the Euro since the beginning of 2021.

U.S. Dollar to the Euro (Federal Reserve)

At the close on Tuesday, it took about $1.0700 to purchase one Euro.

But, the important thing that I took away from my trip to Europe was the general feeling of the U.S. dollar exchange. There was nothing but “good feelings” around all dollar activity. There was nothing but “good feelings” about U.S. economic behavior. In fact, the general feeling about the U.S. and about the U.S. dollar was very, very positive.

But, as usual, if the U.S. dollar is strong, people complain about the U.S. misusing its power. Oh, well……….

The U.S. dollar has been doing very well during the Biden administration. The chart begins around the time Biden was inaugurated. Parity between the U.S. dollar and the Euro came about in 2022.

This was accomplished as there was a “bull run” toward the dollar and as Russia fully invaded Ukraine.

There is now a growing feeling that the U.S. dollar will rise to achieve parity with the Euro in the near future.

I think there is a good chance that this will occur. Not in the next month or so, but maybe by the end of the year.

I believe that this would be consistent with what the Federal Reserve is currently trying to achieve. And, as other countries move before the U.S. to drop their policy rates, this will only add reason for the move.

As can be seen in the chart presented above, the last time parity was achieved was in 2022.

From early 2023, the value of the Euro has fluctuated between $1.05 and $1.10.

Numerous things were happening in government budgets and in government monetary policy in the 2023-24 period.

In the U.S., the Federal Reserve engaged in a round of quantitative tightening beginning March 2022. The Federal Reserve was going through a process of raising its policy rate of interest.

And, other governments around the world, including the European Central Bank, were considering raising interest rates and tightening up on monetary policy.

During this period of transition, uncertainty was visibly present in global markets as investors tried to discern which way governments were going to act to combat inflation and move policy variables.

Stephanie Stacey, writing in the Financial Times, reviews the period when the Federal Reserve, along with other central banks around the world, were suggesting that policy interest rates were about to come down.

At one time, Ms. Stacey writes, investors were pricing in six…yes, six…policy rate changes during 2024.

Now, the expectations have changed. Investors have seen the latest data, data that produced signs that the “stubborn inflation” is now withdrawing from the scene and that economic growth might drop into a recession.

Now, investors are struggling with a future in which they believe that the likelihood of even two reductions in the Fed’s policy rate of interest will occur in 2024.

It is now different in the Eurozone. In March, the annual rate of inflation in Europe dropped to 2.4 percent…close to the ECB’s 2.0 percent target. Furthermore, economic growth remains modest in the European Union.

Ms. Stacey writes, “The IMF said last week that the U.S. economy was on track to grow 2.7 percent in 2024…more than triple the pace of the Eurozone.”

Things have changed.

Things have changed throughout the world.

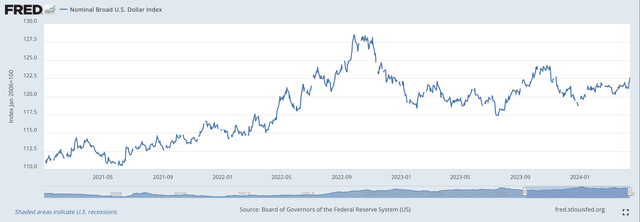

The U.S. dollar has gotten stronger when measured against other countries throughout the world. Here we see this reflected in a more general exchange rate index.

Nominal Broad U.S. Dollar Index (Federal Reserve)

The story is the same.

The Federal Reserve has tightened up on U.S. monetary policy “relative” to what central banks have done throughout the world.

As a consequence, the value of the U.S. dollar appears to be moving toward a stronger position.

And, my opinion is that this effort is not really being opposed in political circles.

After all, a “strong” dollar along with a “stronger” economy, low unemployment, and moderating inflation is not such a bad menu for an incumbent president.

And, although the Federal Reserve may not have been specifically shooting for a stronger dollar, my feeling is that it is something that would not be rejected.

In fact, if, under current circumstances, the Federal Reserve could keep its policy interest rate at least where it is and see the economy grow at an annual rate of growth in 2024 of 2.7 percent, then I believe that they would “grab onto” the opportunity.

And, if the value of the U.S. dollar can remain very strong…what more could Jerome Powell and the Federal Reserve ask for?

Within this picture, the Fed could reduce its policy rate of interest slowly, following reductions that will occur in the European Central Bank, and in other central banks around the world. In this way…the U.S. dollar would remain strong.

What more could the Federal Reserve want?

In fact, what more could U.S. investors want?

The Fed’s policy rate of interest would move in a downward direction, but in a way that would keep the value of the U.S. dollar very, very strong…and would underwrite the stronger growth rate of the economy!

Financial markets should love this result. This would be very positive for investors because the stronger the U.S. is globally, the better the performance of financial markets should be.

Could this not happen?

Of, course, the future might not work out this way. There is great uncertainty all around us.

One of the uncertainties is the Federal Reserve.

The Federal Reserve has really done a good job over the past two years or so. But, these are unusual times. The Fed doesn’t have a good roadmap about the future. Will it continue to perform? Will it be faced with substantial distortions caused by huge debt loads, political events, Mid-Eastern upheavals, or world wars? So many unknowns.

Keep your eye on the U.S. dollar.

As Paul Volcker informed us, “a nation’s exchange rate is the single most important price in its economy.”

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.