AlxeyPnferov/iStock via Getty Images

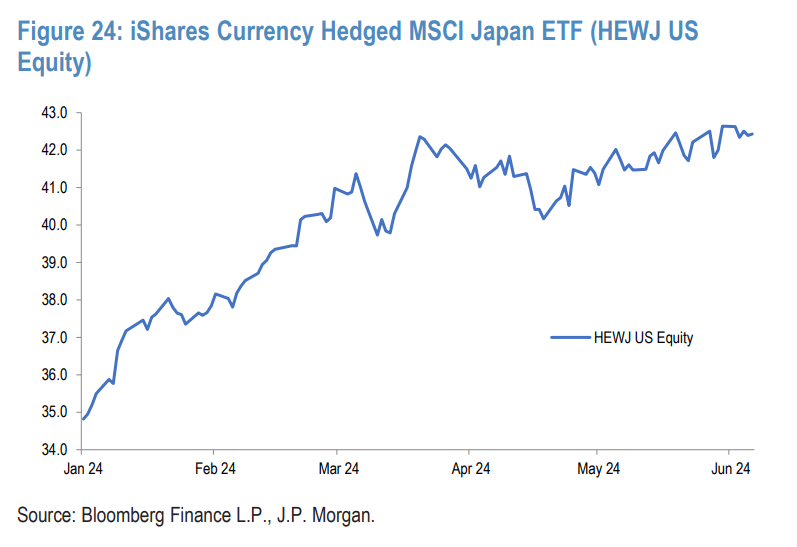

Japanese equities currency hedged (NYSEARCA:HEWJ) are one of J.P. Morgan’s favorite trades, and they are surpassing many global ETFs, according to a Global Asset Allocation report.

The iShares Currency Hedged MSCI Japan ETF (HEWJ) has produced a dollar return of 21.5% year-to-date. The index is up 0.14% from a month ago, and up 34.20% from exactly a year ago.

It has outperformed the Nasdaq (QQQM), which is up 16.67%; the S&P 500 (SP500), up 12%; the Euro Stoxx 50 (FEZ), up 10.5%; the FTSE 100 (UKX), up 7.6%; and the MSCI Emerging Markets (EEM), up 4%.

Also, according to the first quarter data from the Ministry of Finance’s corporate survey, this theme is supported “as economy-wide profit margins continue to trend higher, and are at their all-time highs across sectors,” wrote Analyst Marko Kolanovic.