By Dr. Rikki Racela, WCI Columnist

By Dr. Rikki Racela, WCI Columnist

When I read Dr. Jim Dahle’s excellent post on choosing the best small cap value ETF, I was floored by how different the performances of these ETFs were despite their indexes all tracking small and value factors. My written financial plan calls for an asset allocation of 10% small cap value, and since I do my investing at Fidelity, I chose FISVX, which is Fidelity’s Small Cap Value Index Fund. It has the lowest expense ratio of any small cap value index fund—even beating Vanguard’s cheapest small cap value ETF, VBR, at a rock bottom cost of 5 basis points.

But to my dismay, after reading Jim’s post, I looked under the hood of FISVX to see the small cap value index it tracked, and there it was on my computer screen: the Russell 2000 Value Index. According to Jim, this small cap value index is simply inferior, saying, “I don’t know what it is about Russell indexes, but the performance of index funds that track them never is very impressive to me.”

After uttering a few expletives, I went to work digging into why the Russell 2000 Value Index truly sucks compared to other small cap value indexes. The following will outline my research, as well as some behavioral biases that impeded my ditching this inferior index. My hope is you will come away learning why you should avoid tracking this crappy index for your small cap value tilt and overcome the cerebral heuristics that might block your ability to change and sell a suddenly non-desirable asset in your portfolio.

Why the Russell 2000 Value Index Might Underperform

The Russell 2000 Value index is not the same as other small cap value indexes, despite supposedly tracking both the small and value factors. If you look up its fact sheet, the index mentions its construction as:

“. . . includes those Russell 2000 companies with relatively lower price-to-book ratios, lower I/B/E/S forecast medium-term (two-year) growth and lower sales per share historical growth (five years). The index is completely reconstituted annually.”

By this definition, the Russell 2000 Value will take all companies that fit value characteristics out of 2,000 small companies. This causes it to have way more securities than other small cap value indexes. For example, another small cap value index is the S&P SmallCap 600 Value Index. Similar to Russell, this index will take the small cap parent index and, among those securities, siphon the stocks that fit value characteristics. But this is out of a parent index of only 600 stocks, not 2,000 like the Russell. There exists a concentration risk that you are taking with the S&P SmallCap 600 Value Index that you are not taking with the Russell 2000 Value. You might say, “Well, Rik, isn’t it better to diversify your investments to make the most money in the long run?” In general, the answer is yes, but that is only applicable if we are investing to capture the equity risk premium in a risk-adjusted way.

To help explain, let’s listen to the oracle of Omaha who said, “Diversification is protection against ignorance. It makes little sense if you know what you are doing. A lot of great fortunes in the world have been made by owning a single wonderful business. If you understand the business, you don’t need to own very many of them.”

You and I, as individual investors, might not know what we are doing (I am, after all, a neurologist; not a finance guy). But Fama and French, who defined the small and value factor premiums, sure do, and when you concentrate these small and value factors, the premium might be even better than if you didn’t concentrate these small cap value securities.

More information here:

How Do You Evaluate and Compare Mutual Funds and Exchange Traded Funds?

Sector Differences

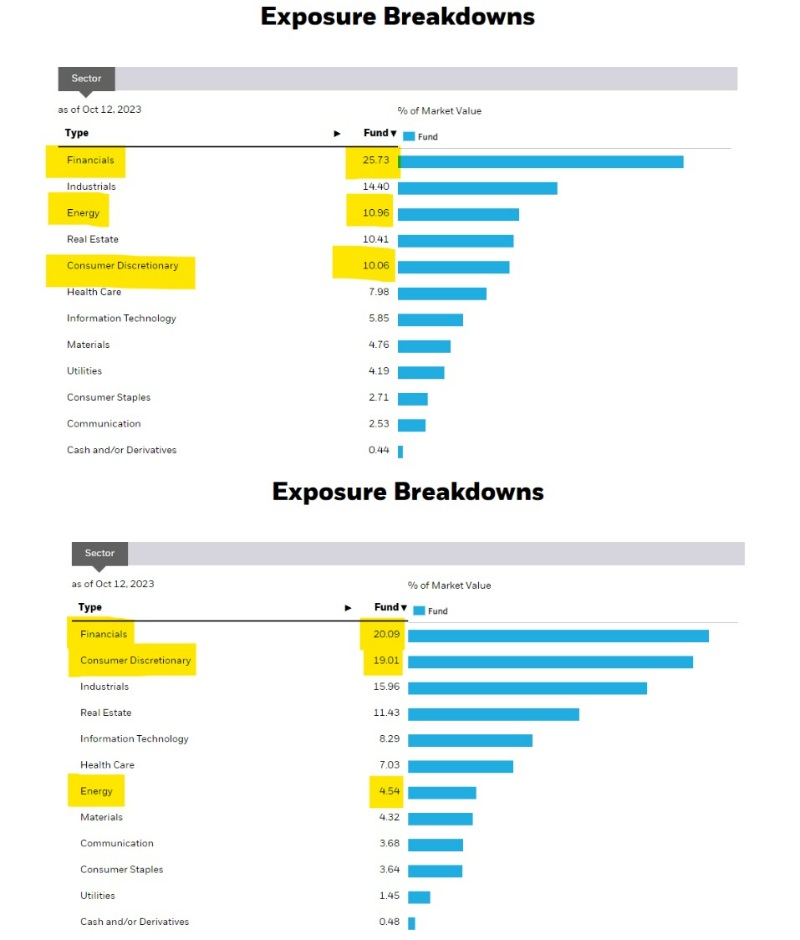

Another difference in the Russell 2000 Value index vs. other small cap value indices is sector weighting, which can also skew return. Let’s look at IWN and IJS, iShares products that track the Russell 2000 Value and S&P SmallCap 600 Value indexes, respectively:

As one can see, there is as much as a 5% difference in the financial and energy sectors and up to a 10% difference in the consumer discretionary sector. You might remember how well financials did in 2008, right? Such sector differences can expose these indexes to sector risk, despite them tracking the small cap value factors.

Problems with a Predictable Index Reconstitution

The most pertinent cause of such return differences in the small cap value indexes is index construction. The Russell 2000 Value Index suffers from a predictable reconstitution of its companies annually at the end of June. This allows investors to “front-run” the index, making some of the companies that will be included in the index more expensive when funds that track the Russell 2000 Value purchase those securities.

In other words, these companies may enter the index and be somewhat less valuey because they have already been bought at lower prices by savvy investors before they even entered the Russell Index. A long-running discussion on the Boglehead forum regarding the Russell indexes can be found here. Even more detrimental might be the “negative momentum” that the predictable reconstitution creates. According to Brzenk, Phillip, et al., “A Tale of Two Small-Cap Benchmarks: 10 Years Later” (beware of the S&P bias of the paper here), the “winners” of the Russell 2000 Value no longer meet small or value criteria and are sold out of the index, while the “losers” of the Russell 1000 tend to meet the small cap value criteria and are bought by the Russell 2000 Value. Funds tracking the Russell 2000 Value are selling their winners and buying losers every June. This could cost up to 1.3% in expected premium!

Another problem with just reconstituting the index once a year is that you may miss intra-year swings of companies going from growth to value and large to small. For example, Wes Crill, senior investment director and VP at Dimensional Fund Advisors, mentioned on the Bogleheads Live podcast that small cap value went gangbusters from Q4 2020 to Q1 2021. A rise in small cap value had not been seen like this since post-World War II, and yet small cap value indexes like the Russell 2000 Value would have missed much of that action while lying complacent. The Russell 2000 Value would have missed those newly minted small cap value companies in the few months leading up to Q4 2020, and it also would not have cleansed itself and retained companies that were no longer small and valuey until June 2021. Crill said that as much as 12.5% of all small value companies may not be included in the index at any one time, creating a value drag of as much as 35-40 basis points per year. What a drag indeed!

The S&P SmallCap 600 Value Index is another popular small cap value index that has outperformed the Russell 2000 Value. Unlike the Russell, the S&P SmallCap 600 Value reconstitutes on an ongoing, as-needed basis, depending on changes in the size of companies and other criteria. This makes it much harder to front-run or create any “negative momentum.” It also avoids any intra-year changes that occur in companies shifting in and out of small cap value criteria. You might also notice the “600” regarding the S&P SmallCap 600 Value vs. the “2000” of the Russell 2000 Value. Because more securities are included in the Russell, turnover is higher, which adds cost and eats away at potential return. Finally and most importantly, as cited by the Brzenk paper, the S&P SmallCap 600 includes a profitability screen in its index where, “The sum of the most recent four consecutive quarters’ as-reported earnings should be positive, plus the most recent quarter.” So, in addition to the small and value factors, you are also capturing the “profitability” factor in the S&P SmallCap 600 Value.

In the end, it seems that the Russell 2000 Value index just plain sucks. Investing in this index might get you the small cap value premium, but that is after the premium is eaten up by the yearly predictable reconstitution of the index. The way the index is constructed can result in front-running, capturing a “negative momentum” factor, lacking as much as 1/8 of the value companies resulting in value drag, and missing out on including the “profitability” factor that other small cap value indexes are capturing. It’s trying to capture the small cap value premium with two hands tied behind its back while wearing a blindfold.

It should have no place in my portfolio.

More information here:

Value Tilt – Don’t Give Up On Your Small Cap Value Strategy

Avantis vs. Vanguard: Does It Make Sense to Switch Up Your Portfolio?

Behavioral Biases When Trying to Ditch FISVX

Now that I know I don’t want FISVX in my portfolio anymore, how should I ditch it? My small cap value tilts lie in tax-advantaged accounts, including Roths for my wife and me and my wife’s 401(k), so there are no tax consequences or a lack of availability for investing in non-Russell small cap value funds. The actual difficulty in selling out of FISVX and buying some other small cap value fund is, what else, behavioral.

The following list is some of the behavioral biases that I experienced when trying to sell my formerly beloved FISVX:

- Endowment Effect: A well-known bias where you attach more value to something you own than to something you don’t. It’s well-characterized by Richard Thaler’s experiment on his students regarding a coffee mug he had just given them. When asked, “How much would you sell this mug for?” most students said a cost way above the actual price of the cheaply made mug. When he asked the students to whom he had not given a free mug, “How much would you pay for this mug?” most students mentioned a price much lower than the owners of the mugs. Just like the free mug, I have grown attached to FISVX, and it’s hard for me to sell.

- Status Quo Bias: Our brains, along with our bodies, are inherently lazy, and they want to conserve energy. This leads to a bias to keep things the way they are. If I found a cozy cave that protects me from being eaten by lions and tigers and bears (oh my!), my status quo bias will protect me from changing locations and I will survive. Meanwhile, my unbiased cave buddy who didn’t have this bias became lunch. His non-status quo bias gene was not passed on. My brain says, “I’ve survived my investing career thus far; will getting out of FISVX really affect my survival? Maybe I should just keep it there?” Also, it’s so easy to invest in this mutual fund, whereas many other low-cost small value funds are actually ETFs, where I will have to make an effort of putting in orders when the market is open. Man!

- Loss Aversion/Rationalization/Regret Aversion: Aahh shoot, did I invest in FISVX and then lose money compared to other small cap value funds? Maybe I shouldn’t sell and lock in that loss (loss aversion)? Maybe the Russell 2000 Value will have its day in the sun (rationalization)? And what if the Russell 2000 Value Index shoots back up (regret aversion)?

- Analysis Paralysis: There is an endless amount of research you can do regarding small cap value index construction, factor loading in the different small cap value indices, Sharpe and Sortino ratios, etc. And wanting to read all this research would, in the end, delay me from ever selling FISVX.

- Affinity Bias: Boy, I love me some Fidelity! I started with the company when it had a solo 401(k) that would accept my Northwestern Mutual traditional IRA rollover that was preventing me from doing the Backdoor Roth. It also had the cheapest low-cost variable annuity where I could take my stupid whole life policies that cost me $50,000 and make up that loss tax-free. Its customer service is stellar, and its expense ratios even undercut the mighty Vanguard. This makes it tough for me to want to sell FISVX.

- Halo Effect: Didn’t Jack Bogle say, “You get what you don’t pay for”? He loved low-cost index funds, and I love Jack Bogle. FISVX is the cheapest small cap value index fund, exemplifying Saint Jack’s “costs matter” mentality. How can I sell something that exemplifies Saint Jack?

Fighting These Biases

All of that is what was going through my mind as I chose to ditch FISVX, and you know what I did? I shot down these biases! It doesn’t matter if I owned FISVX for the past four years—the feeling of the endowment effect is not going to suddenly make it capture the small cap value premium better. I shouldn’t let status quo bias stop me from selling FISVX—the evidence is clearly outlined and my own research suggests that the Russell 2000 Value is not capturing the small cap value premium as intended. And there is zero, zilch, nada, not a modicum of evidence that the inferior construction of the Russell 2000 Value will have its day in the sun and outperform the other small cap value indexes, so I should just cut my losses and not rationalize keeping FISVX. No amount of research will erase the evidence that I have now accumulated, so I shouldn’t let analysis paralysis stop me from selling. As for affinity bias, Fidelity is a great company, but it is in no way improving the inferior way the Russell 2000 Value is trying to capture the small cap value premium.

Finally, we love Jack Bogle, but FISVX is 2 basis points cheaper than VBR (the cheapest Vanguard small cap value ETF) and 10 basis points cheaper than VIOV (a more small and valuey Vanguard small cap value ETF). That is a $2-$10 difference a year for every $10,000 I have invested. Five hours before writing this column, I paid $20 for a Blue Moon while watching The Nutcracker at our local performing arts center. For half the price of a theater beer, you can more accurately capture the small cap value, and that difference can be as much as 200 basis points.

It’s like buying a Yugo. For those who did not live in the ’80s, the Yugo was the cheapest car you could get. And it showed. Notoriously unreliable, it gained fame for being the worst car ever created. It clearly violated Einstein’s principle of simplicity that “Everything should be made as simple as possible, but not simpler.” The Yugo was too simple and too poorly made. It exemplified being, “Pennywise and pound foolish.” Drivers would have been better off spending a few extra bucks driving a car that would last longer with fewer repairs. That would have saved more money and more angst in the long run.

Yes, I am comparing FISVX, which tracks the Russell 2000 Value Index, to a Yugo—it might be the cheapest small cap value index out there, but it is horribly unreliable. Hondas and Toyotas were more expensive than Yugos in the 1980s, but they have a legendary track record for reliability and durability. Some Hondas and Toyotas from the 1980s are still on the road today. When Jack Bogle thought about low-cost index funds, I think he meant buying Hondas/Toyotas, not Yugos. I bought a small cap value Yugo. It’s time to get a Honda.

My Honda, bought used in 2019 at 3 years old with 9,990 miles for $18,000. Cheers to maxing out depreciation before buying!

More information here:

The 1 Portfolio Better Than Yours

Yes, Risk Tolerance Can Be Modified: You Just Have to Rewire Your Brain

My Small Cap Value Honda

As Morgan Housel once pointed out about Warren Buffett who dumped airline stocks in 2020 despite his favorite holding period being forever, Warren is an example of “. . . always being patient, but never being stubborn” (Season 1, episode 27 of The Morgan Housel Podcast). I want to be patient while keeping my small cap value tilt, but I don’t want to be stubborn sticking with the cheapest index when new information presents itself.

So, I sold FISVX, but what did I choose?

I went with VBR, which tracks the CRSP Small Value Index. It is not as small or valuey as other small cap value indexes, but it is dirt cheap, which is what my written financial plan instructs. And there is no evidence that the CRSP Small Value Index suffers from the same construction problems as the Russell 2000 Value. Finally, I can just buy more of it to make up for it being less small and valuey. My asset allocation was 65% total US, 25% total international, and 10% small cap value. My new asset allocation is 50% total US, 25% total international, and 25% small cap value because I recognize that the 25% small cap value isn’t truly all small value because VBR is not as small or valuey. This is a big adjustment, but I think it’s a reasonable change in my asset allocation after realizing I had bought a Yugo. Since I’ve looked under the hood of my new Honda and realized it’s not as small and valuey as I would like, I need to pump more money into VBR.

Some might think, “Rik, what about DFA or Avantis small cap value ETFs?” Great question! Even Jim has gone with Avantis, and based on the Halo Effect bias (yes, Jim, I do picture a halo over your head for all that you’ve done!), I was very tempted to use Avantis funds. But going back to our written financial plan, my wife and I had chosen to do low-cost passive index funds. The VBR expense ratio of 7 basis points is lower than the 25 basis points of AVUV. Despite that only being an 18-point difference, that’s a guaranteed 18 basis points in my pocket if AVUV doesn’t outperform.

Also, active managers have to overcome expenses and their own inherent biases when they outperform. I mentioned a handful of them above, and when it comes to active management, you are introducing a human being who is subject to these biases. Then, there is a problem of too many inflows. What happens if AVUV gets so popular that it sees tons of money flow its way? Counterintuitively, this is a terrible problem for an active manager to have. This may force a lot of the fund’s money to go into cash so that its underlying securities maintain their small and value properties.

Finally, there is manager risk. What happens when the current AVUV managers retire? Can the new managers maintain the proper profitability screen on their small cap value funds just as well as the current managers? Just when you think it would be easy to find active manager successors, chew on this for a second. When Peter Lynch, one of the few active fund managers who had outperformed the S&P during his tenure with the Magellan Fund at Fidelity, retired in 1990, he was replaced initially by Morris Smith who only lasted two years and then by Jeffrey Vinik who only lasted four years. Combined, they only beat the S&P 500 51% of the time, according to Retirement Researcher. So much for finding a long-term replacement!

If I had to continue my car comparison of small cap value index funds, Avantis would be a Tesla Model 3. It’s the cheapest Tesla model, and yet it still has the newest and sleekest EV technology that Tesla has to offer. But it is still more expensive than a Honda, and it has the added risk that I’ll run out of juice without a charging station nearby—whether that manifests as human biases, high inflows, or managerial risk. In the end, it is all about reaching my goals, and no matter what car I’m driving, I am determined to keep on the road and stay the course. My Honda just makes me more confident I’ll get there.

What do you think? Is the Russell 2000 Value really that bad? Have you made changes in your small cap value or other factor funds before? Were Yugos really that awful? Do you think I’m making a good decision with the Honda (VBR) over the Tesla (Avantis)? Comment below!