They are also optimistic about the medium-term earnings growth prospects for Indian companies, as well as the country’s long-term growth outlook, he told This Week in Asia.

“There are pockets of irrational exuberance in parts of the mid-cap and small-cap [stock] space but that is largely due to irrational expectations on the part of non-institutional investors,” Prasad said.

The country’s gross domestic product grew by 8.2 per cent in the financial year that ended on March 31, exceeding the government’s 7.6 per cent forecast and cementing India’s status as the world’s fastest-growing major economy.

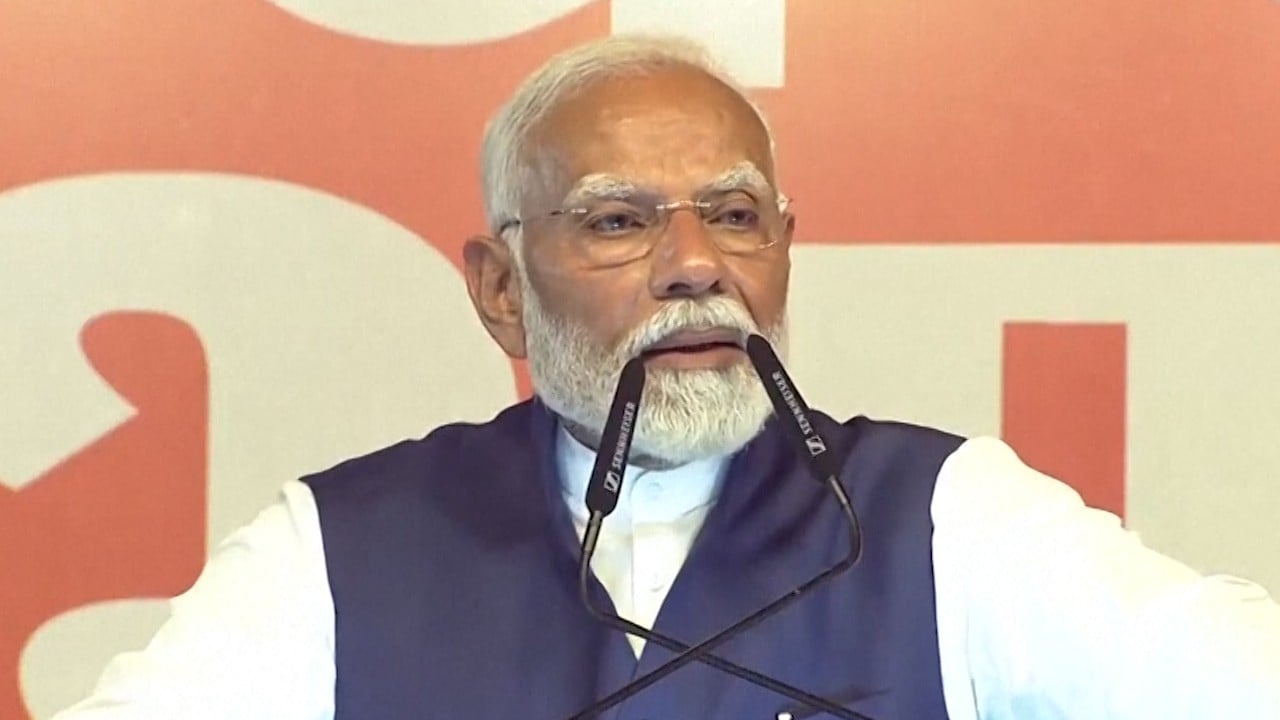

Going forward, investors remain bullish that the Modi government will unveil more investor-friendly programmes, including easier taxation measures, in the next budget, which is expected to be introduced during parliament’s budget session starting on July 22.

Observers will also be monitoring whether the government moves to facilitate easier land purchases and greater flexibility around land use, among other potential measures.

“India is also perceived by many as a beneficiary of shifts in the geopolitical landscape,” it said, noting that the country accounted for 15.4 per cent of global economic growth last year, compared to 7.1 per cent for Europe.

The survey also highlighted that India’s fintech sector is experiencing “explosive” growth, with substantial room to expand as a significant portion of the Indian population remains unbanked, extending beyond just basic banking services.

To that end, the Indian government has laid the foundation for a robust public digital infrastructure that enables a host of transparent mobile-based payment transactions, allowing consumers to instantly open bank accounts and transfer money.

More than one-fifth of India’s adult population was unbanked as of 2021, according to the World Bank.

“There’s a large section of Indian households, which are underserved by the banking industry. Fintechs, by partnering with banks, are bringing down the cost of delivery of financial services significantly,” said Rohan Lakhaiyar, a partner at accounting and consulting services firm Grant Thornton Bharat.

Financial services firms have emerged as front-runners in India’s recent stock market rally – a marked shift from about a decade ago, when Indian banks were burdened with high levels of non-performing loans due to a less robust regulatory framework, coupled with digitisation efforts.

India’s central bank recently reported that banks’ bad loan ratios have now slipped to multi-year lows of 2.8 per cent as of March, and are expected to fall further to 2.5 per cent by next financial year.

Most banks and non-banking financial companies remain reasonably valued, even after the recent market run-up, according to Kotak’s Prasad.

“Almost all banks have a higher share of retail loans in their overall loan book,” he said, highlighting that this category is more diversified compared to other segments.

Domestic cushion

Part of the exuberance in India’s stock markets has stemmed from the country’s increased weighting in a crucial global index – Morgan Stanley’s MSCI index. Expectations that HDFC Bank would get an even higher weighting further bolstered market sentiment this week.

The underlying investment sentiment is being underpinned by domestic retail investors who have been diversifying away from traditional bank deposits and towards capital markets, according to Grant Thornton Bharat’s Lakhaiyar.

“The young Indian demographic is less risk averse than [the] previous generation and are actively investing in stock markets,” he said, adding that these investment trends suggest a self-perpetuating cycle for India’s capital markets.

That trend has resulted in domestic mutual fund assets under management growing by 35.5 per cent in the financial year that began this past April, according to recent data.

“The prime movers of the market currently are domestic investors who are pumping more money in,” said V.K. Vijaykumar, chief investment strategist at Geojit Financial Services.

Despite hopes about Modi ushering in further reforms, there are some concerns that the government may be tempted to introduce a more populist budget to boost welfare spending, after winning fewer parliamentary seats than expected in the recent elections.

ANZ Bank said in a report on Friday that “a step up in welfare spending is on the cards”. The bank also projected that India will be able to meet its fiscal deficit targets of 0.45 per cent of GDP by the 2026 financial year, underpinned by strong overall economic growth.