The latest Consumer Price Index release indicates stabilizing, if not abating, inflationary conditions. Still, the persistence of rising prices over the last few years has generated increased investor interest in new inflation-hedging strategies, such as real asset funds.

Diversified real asset funds are designed to be a one-stop solution for investing in an array of stock and bond sectors that have historically benefited from higher inflation.

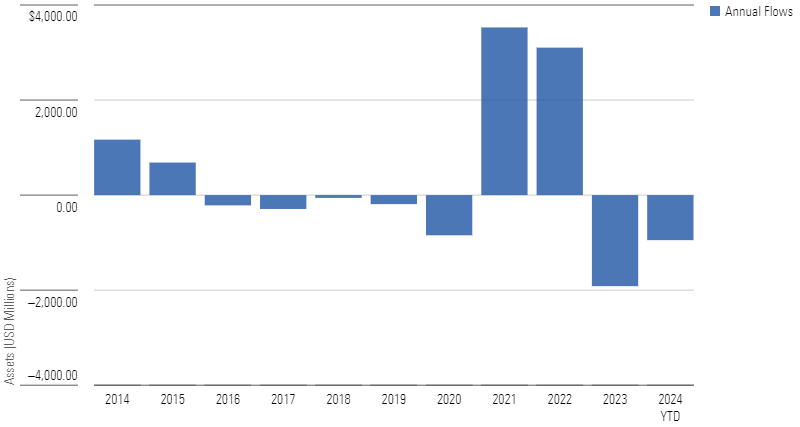

Investors piled into these funds during the inflationary environments of 2021 and 2022, putting more than $6 billion of net deposits into them, but have since reversed course. Investors pulled roughly 2.8 billion from the start of 2023 through the first five months of 2024.

Here, we’ll look at how these funds invest, how they’ve performed, and how investors should think about using them going forward.

What Are Diversified Real Asset Strategies?

We define diversified real asset strategies as funds that target investments that are resilient in the face of rising inflation, as measured by the Consumer Price Index.

A substantial portion of these funds’ assets should be invested in a combination of inflation-linked bonds such as US Treasury Inflation-Protected Securities, commodities, and equities and fixed-income within the real estate, energy, basic materials, utilities, infrastructure, and agriculture industries.

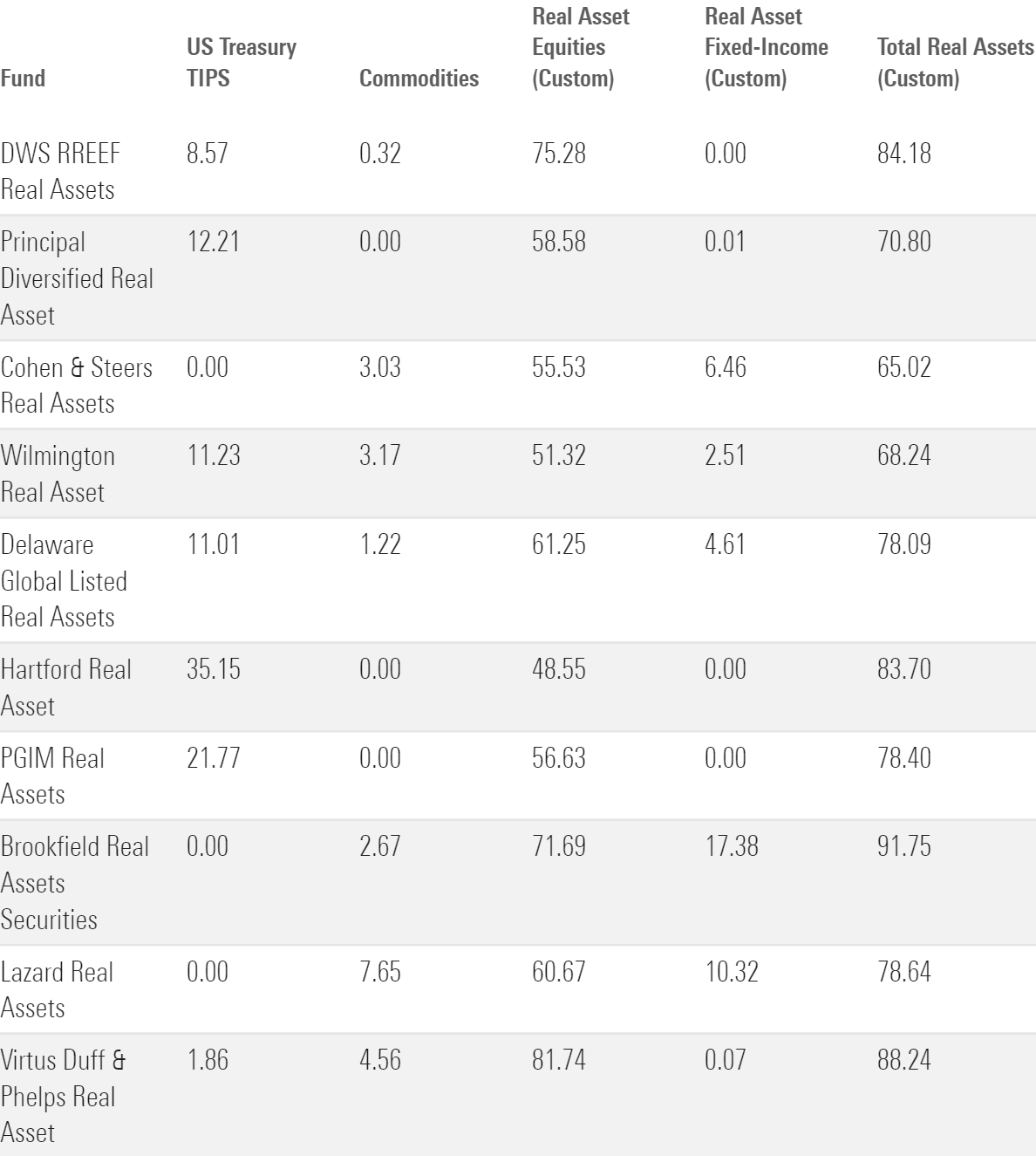

Exhibit 2 shows the 10 largest diversified real asset funds that fit our criteria.

Although these strategies all tend to own similar securities, how much they own of each can vary widely. Exhibit 3 shows the breakdown of key asset classes for each of the funds.

Footnote: Custom data columns are the author’s calculations. Real asset equity is sum of portfolio exposure to equity economic sectors basic materials, energy, industrials, real estate, and utilities. Real asset fixed income is a sum of portfolio exposure to fixed-income secondary sector basic materials, energy, industrials, real estate, and utilities. Total real assets is a sum of portfolio exposure to U.S. TIPS, commodities, real asset equity, and real asset fixed-income.

Real asset strategies tend to follow a similar pattern of allocation:

- They heavily utilize equities as their primary vehicle for exposure to inflation-sensitive industries such as energy, industrials, and utilities.

- Conversely, fixed income usually sees more-muted allocations, though it tends to be used for similar sector exposures as seen in equity allocations.

- Commodities also play a much more muted role.

- US TIPS serve as more of a ballast to the approach, but the level of reliance on the exposure can vary from portfolio to portfolio. Some funds use the vehicle as a staple of their portfolio, while others limit the exposure in favor of the higher performance potential of stocks in inflation-sensitive industries.

How Have Real Asset Strategies Done?

As real asset funds typically target total returns via inflation-sensitive securities, their excess returns relative to the Consumer Price Index (US Bureau of Labor Statistics CPI All Urban Seasonally Adjusted) are a good measure of their performance.

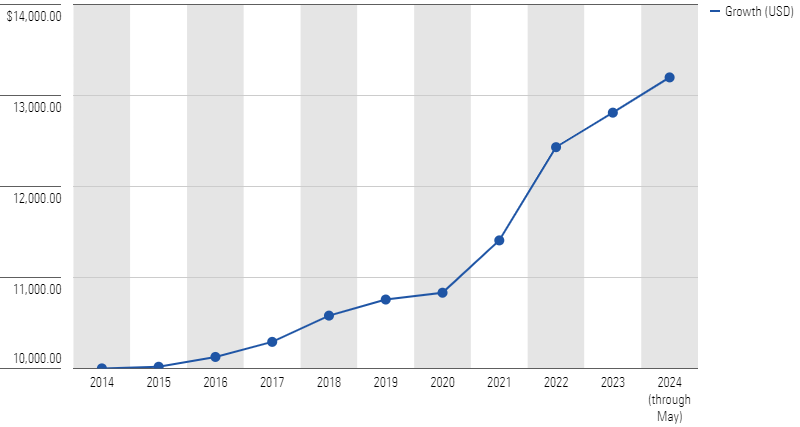

The last decade demonstrates a good test bed as well, with the markets experiencing both low and high rates of inflation since 2014. You can see the drastic shift in inflation conditions through the growth of CPI, which is shown in Exhibit 4.

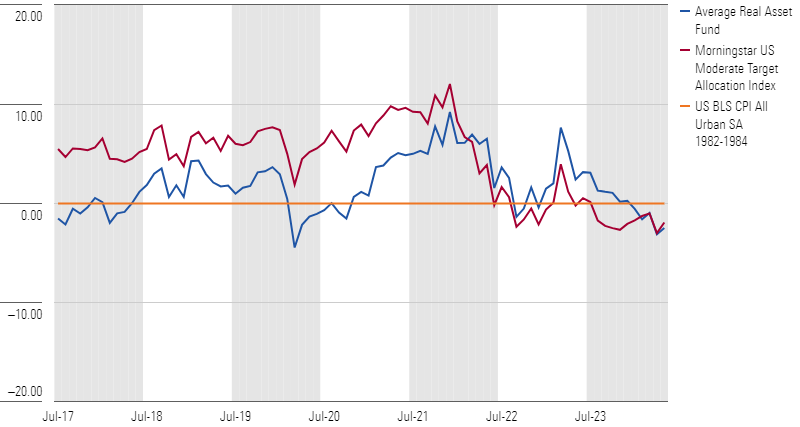

Exhibit 5 shows the average three-year rolling excess returns of the real asset strategy sample group in relation to CPI since 2014.

As you can see, the typical real asset strategy demonstrated a capability to seize tailwinds from inflationary pressures, with average returns outpacing CPI in the second half of 2020 as broader markets rebounded from the coronavirus-driven selloff. By March 2022, the real asset peer group started to outpace the excess returns of the Morningstar US Moderate Target Allocation Index, a good representation of more traditional 60% equity/40% bond portfolios.

However, the real asset cohort did not maintain that trajectory for long.

As inflation persisted through 2022, the excess returns of the typical real asset fund diminished. In the first quarter of 2023, real asset strategies benefited from a broader equity rebound—due to the typically high equity allocation of their portfolios—which also buoyed the index. However, as inflationary conditions continued through the rest of 2023 and into 2024, the typical real asset fund struggled to keep up with CPI. The concentrated focus on inflation-sensitive industries in the typical real asset fund meant they missed out on broader market opportunities while remaining sensitive to global pressures on areas like energy.

Over the last decade, the typical real asset strategy demonstrated a capability to seize on inflationary tailwinds in certain market conditions. However, the sustainability of those results remains unproven over longer time horizons.

Real asset strategies are generally designed to work in conjunction with a more typical portfolio, but this requires careful timing to capture inflationary pressures for rather short-term benefits. For typical investors, this may be more work than is necessary to achieve long-term goals.