Dec. 13, 2023

This paid piece is sponsored by Marsh McLennan Agency.

The property insurance market is experiencing significant changes and challenges, impacting both insurers and policyholders. To gain a deeper understanding of the current landscape, Jarrold Muller and Mike Barber, risk management consultants with Marsh McLennan Agency in Sioux Falls, shared insights and strategies for navigating this evolving market.

Market hardening and catastrophic events

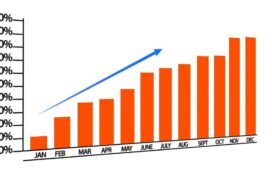

One of the prevailing trends in the property insurance market is market hardening. Insurers are witnessing rate increases, which have led to some clients experiencing significant challenges in adjusting their budgets. “No one likes to see rate increases, but in the past, we could work with clients to find a way to absorb a 5 to 10 percent increase,” Muller said.

Jarrod Muller

According to the Marsh McLennan Agency Business Insurance Market Trends and Observations report, rate increases averaged 14 percent for catastrophe-exposed property in the third quarter of 2023, down from 19 percent in the previous quarter. The report indicates that there may be some positive shifts on the horizon for some risks.

Factors such as storms and their frequency, as well as catastrophic events, play a crucial role in driving these changes. The market’s response to such events can be abrupt, leading to adjustments in rates and pricing.

Muller said providing timely and accurate information is important to help clients plan and prepare for market changes. “We form a partnership with our clients that will help position them in the best possible position with underwriters,” he said.

Agriculture sector and risk evaluation

Many of Mike Barber’s clients are in agriculture, a sector that tends to be property-heavy. He emphasizes that these clients face unique challenges, and renewals and new business proposals in this sector have been particularly difficult, with property being the primary driver of insurance costs.

As a result, Barber said discussions with clients are shifting. “We’re starting to talk more about reevaluating what insurance is for, talking more about self-insurance and protection from devastating and catastrophic events rather than a more typical minor inconvenient event.” Barber said clients are considering self-insurance and even exploring the possibility of liability-only coverage for their structures.

Mike Barber

Barber also recommends that clients consider geographic dispersion of properties.

“Underwriters prefer to see a diversified portfolio of locations rather than concentrated value in a single area,” he said. While this may seem unconventional, it is an important conversation to have when considering new property investments. Ultimately, Barber added, the decision lies with the client, but dispersing property locations can be advantageous in terms of risk management.

Reinsurance and market dynamics

Reinsurance markets play a significant role in shaping the property insurance market. Insurers rely on reinsurance to cover losses, especially in regions prone to natural disasters. Recent events, such as derechos in the Midwest, have led to substantial payouts from reinsurers. This, in turn, affects overall market dynamics. Insurers and policyholders are part of a larger equation, and the relationship with carriers becomes crucial in navigating these market shifts.

Both Muller and Barber highlight the importance of focusing on risk improvement to optimize pricing. “Underwriters are willing to take on pricing risks for clients who are seen as best in class in terms of risk management,” Muller said.

Barber added that from a reinsurance perspective, clients in the Upper Midwest were previously in a “relatively safe place,” sheltered from events that affect coastal markets. “Now, we see multibillion-dollar losses all over the map, and there is a trickle-down effect.” He emphasizes that relationships with insurance carriers and underwriters are crucial in these situations.

That’s where a trusted adviser with an understanding of underwriting factors and the criteria used to evaluate properties and strong relationships with carrier partners becomes crucial. “We can help clients position themselves favorably and present the best underwriting scenario to insurers,” Muller said.

Considerations for clients

The property insurance market is undergoing significant changes, driven by factors such as market hardening, catastrophic events and reinsurance dynamics. Clients are exploring alternative approaches to insurance and risk management, and a focus on risk improvement can put property owners in the best position to navigate market shifts and prepare for the future.

There is not a one-size-fits-all approach when it comes to managing risk, and Marsh McLennan Agency has a track record for strong performance in shifting market conditions through broad market access. To learn more about putting your organization in the best position, reach out to [email protected] or [email protected].