meshaphoto

Written by Nick Ackerman, co-produced by Stanford Chemist.

The latest financial report is available for the Western Asset Investment Grade Income Fund (NYSE:PAI). Income generation for the fund has increased a touch year-over-year and quarter-over-quarter as the turnover begins to happen in this higher rate environment. Though with an investment-grade focused fund, the weighted average life of the portfolio is quite long, it can be a slow process.

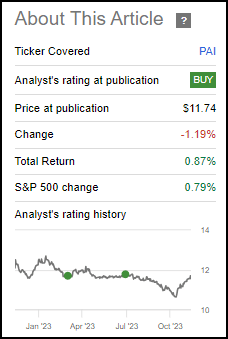

Additionally, since our last update for PAI, the fund has bumped up its distribution once again after they had already bumped it up a touch for October and November payouts. These weren’t significant increases, but any increase is welcomed. Since that previous update, risk-free rates had surged, causing shares of PAI to slide. However, it seems just as fast as those rates surged, they came crashing down, and that saw this fund have a “V” shape recovery.

PAI Performance Since Prior Update (Seeking Alpha)

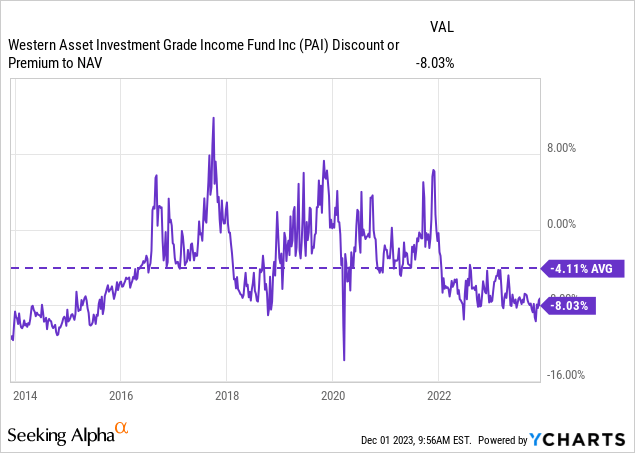

The fund’s discount this time has come full circle back to nearly what it was at the time of our previous update. That is to say, the discount remains historically wide, making it a potentially worthwhile investment choice for conservative investors.

The Basics

- 1-Year Z-score: -0.68

- Discount: -8.03%

- Distribution Yield: 4.93%

- Expense Ratio: 0.77%

- Leverage: N/A

- Managed Assets: $119.65 million

- Structure: Perpetual

PAI’s investment objective is “a high level of current income, along with capital appreciation.” To achieve this, the fund “provides a portfolio of primarily investment grade debt, including government securities, bank debt, commercial paper, and cash/cash equivalents.” They “emphasize team management and extensive credit research expertise to identify attractively priced securities.”

Given the relatively low-yielding instruments that this fund holds, it’s helpful to see that the fund’s expense ratio is relatively low for a closed-end fund. With no leverage being utilized in the fund, there are no additional costs that we need to factor in for a total expense ratio. That also takes away the uncertainty of having to worry about elevated downside risks and volatility (as well as the potential benefit of upside that it could bring.)

It also means not having to worry about leverage costs rising if inflation starts heading in the wrong direction and the Fed has to increase interest rates. However, the outlook and probabilities are favoring rate cuts sooner rather than later. At the very least, it doesn’t seem that higher rates are in the cards for next year at this time.

Performance – Attractive Discount

Investment-grade debt-focused funds have faced significant pressure due to typically higher effective durations that they have. That’s driven by being relatively lower-yielders and having longer maturities as well. The weighted average life of PAI’s portfolio comes to 11.99 years with an effective duration of 6.87 years. That means that for every 1% change in interest rates, PAI’s underlying portfolio is anticipated to move by 6.87%.

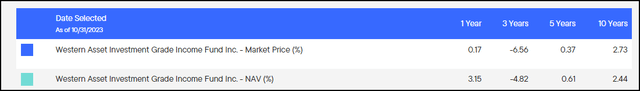

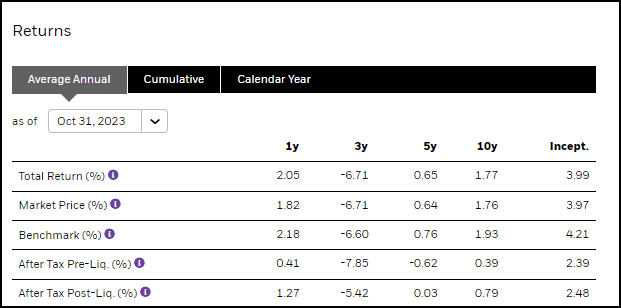

The aggressive rate hikes that the Fed went with through 2022 and bumping rates up higher in 2023 definitely hit the fund. That pushed the longer-term annualized performances to barely be positive, and on a 3-year basis, we even have negative total return results.

PAI Annualized Results (Western Asset)

This wasn’t just PAI performing poorly, but the passively managed iShares iBoxx Investment-Grade Corporate Bond ETF (LQD) showed similar poor results over the longer term. LQD invests in a portfolio that currently has 13.08 years for an average maturity and a duration of 8.32 years. That makes it even more sensitive to interest rate changes, and we can see that through even worse 10-year results.

LQD Annualized Returns (BlackRock)

LQD could be a fantastic play in terms of being a rate pivot play like PAI. Having a higher duration means that the rebound should be even harder for LQD. In fact, we can see that in the last 1-year period, that is what happened with LQD outperforming.

However, I feel that PAI offers a leg up for potentially a better outcome longer term if the fund can see its discount narrow. While it isn’t guaranteed to see its discount narrow, at least historically speaking, PAI is currently trading at an attractive discount. In several periods, the fund was even pushed up to trade at premium levels on several occasions.

Ycharts

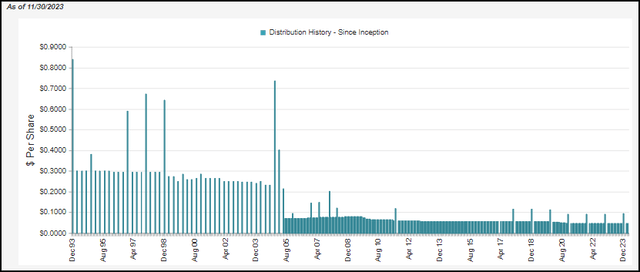

Distribution – Receives Another Bump

The fund has given investors another small distribution bump with the latest announcement, taking it up to $0.0485 per month. This was after they had bumped it up in their prior announcement as well.

PAI Distribution History (CEFConnect)

The longer we stay in a higher-rate environment, the more chances there will be to see continued increases going forward. Alternatively, should rates be cut aggressively, we could see income generation also fall back down. In that scenario, though, that’s when we should see that offset through appreciation.

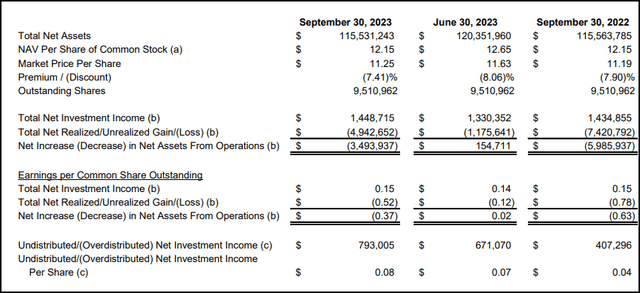

The latest quarterly report once again puts the net investment income at $0.15 per share. That was the same as it was a year ago, but if you look at what the overall NII was, it was an increase of nearly 1%. This definitely isn’t a massive increase, but fixed-rate investment-grade yields with their longer-term maturities are like turning a giant cruise ship – it doesn’t happen overnight!

PAI Quarterly Financials (Western Asset)

Given the recently raised distribution, the payout ratio did pare down from where it was in our prior update. That said, it still stands at a fully covered 103% level.

For tax purposes, the entire distributions for 2021 and 2022 were classified as ordinary income. As a fixed-income focused fund, this is to be expected, and that means it would often be best held in a tax-sheltered account.

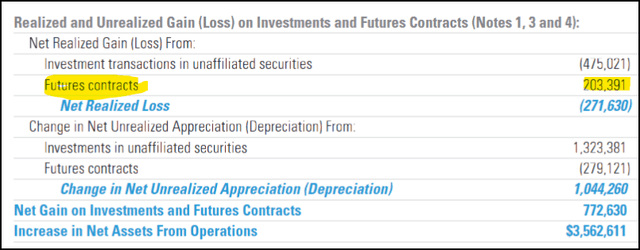

PAI’s Portfolio

Along with a portfolio of mostly investment-grade focused debt instruments, PAI’s management team will also incorporate futures contracts into their strategy. They are both long and short various U.S. Treasury contracts, and this is another way they can hedge against rates. In their latest semi-annual report, this contributed to some realized gains but it wasn’t overall a huge factor in moving the fund. What they realized for futures contracts was offset by what they lost in terms of their unrealized futures contracts bucket.

PAI Realized/Unrealized Gains/Losses (Western Asset (highlights from author))

The fund’s portfolio turnover rate has also been quite low in the last few years. Their latest six-month period shows a turnover of 7%, with 2022 and 2021 at 17% and 18%, respectively. That’s generally meant that the overall fund hasn’t tended to see any dramatic shifts. This isn’t that uncommon for some funds, but prior to this, the lowest turnover rate in the previous three years was 41%.

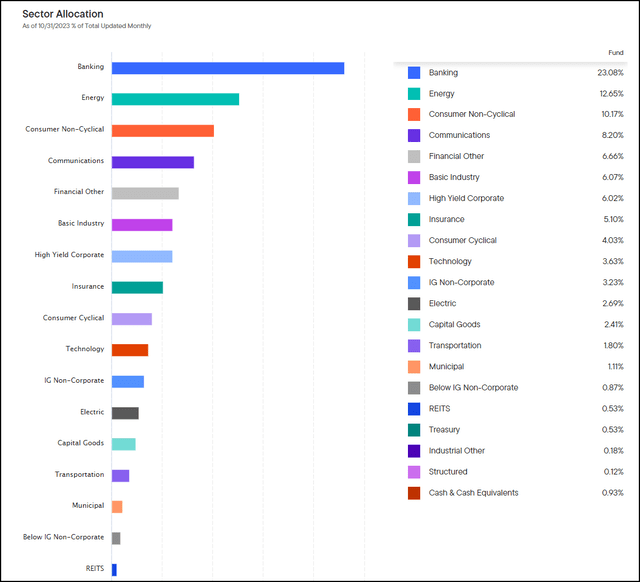

In total, the fund lists 438 different holdings. That provides plenty of diversification for the fund overall. These are spread across various sectors as well, though the banking sector does command a fairly outsized weighting to the portfolio.

PAI Sector Allocation (Western Asset)

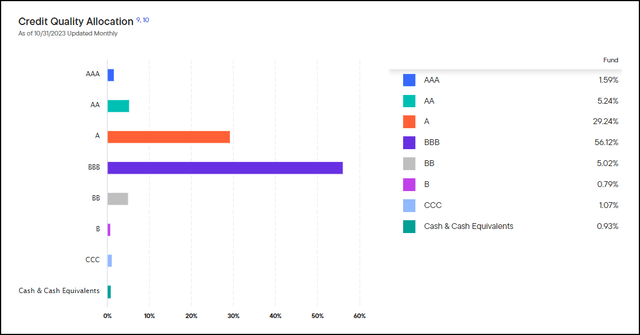

Moving onto the credit quality, we can see that the vast majority of the portfolio is classified as investment-grade. Of course, we would expect this given their investment policy and just simply the name of the fund. That said, the bulk of the portfolio is sitting right on only the first rung of investment-grade quality at BBB.

PAI Credit Quality (Western Asset)

Reflecting the low turnover reported by the fund, we haven’t seen a meaningful shift in either the sector allocations for the fund or the credit quality.

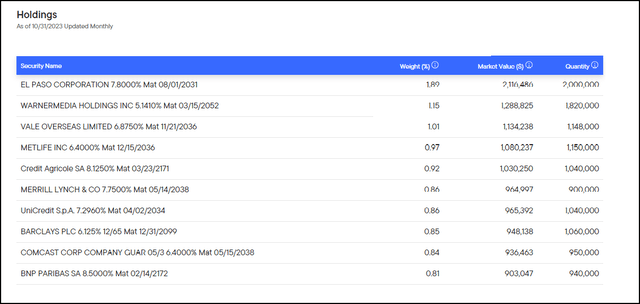

Additionally, and probably with little surprise given the above, the fund’s top holdings haven’t shifted dramatically either. We can also see the portfolio’s diversification shining through on this level, with no one position commanding an overly dominant weight.

PAI Top Ten Holdings (Western Asset)

Conclusion

Overall, the idea of owning PAI in my portfolio, as I’ve been accumulating through the latter half of 2023, is to take the ‘barbell approach’ on interest rates. Holding both higher-duration and lower-duration assets seemed to make sense without a clear direction on which direction interest rates may go in the short term. However, ultimately, the expectation is that rates will go down over the next couple of years, so PAI can be a good fit to benefit from interest rates going lower in the future.

On top of this, the fund’s discount is historically wide, also making it a worthwhile candidate for potential discount contraction to provide another added boost to the total return. The fund doesn’t employ leverage, so it won’t benefit as significantly as its leveraged peers. This is another way to play it more conservatively.

In general, I’ve invested fairly aggressively with a heavy emphasis on equity exposure through leveraged closed-end funds. This fund helps balance out that larger, more aggressive side with what could further become a tactical play in the next couple of years. My assumption is the worst-case scenario is that I end up with a fund that only pays a relatively mediocre distribution rate but, on the other hand, doesn’t become too detrimental overall.