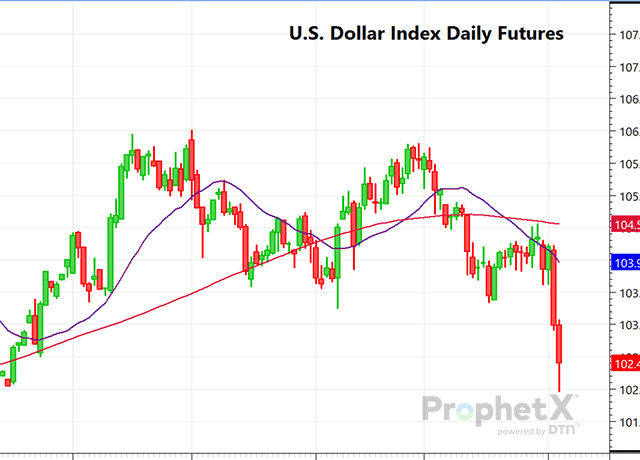

Monday morning, the U.S. Dollar Index September futures plunged to lows not seen since early March. That would normally be very supportive for U.S. wheat export prospects as our wheat becomes cheaper to world importers. That, coupled with the anticipated sharp decline in major exporter world wheat supplies including those from the Black Sea and European Union, and the newfound competitiveness of U.S. wheat FOB prices should surely bode well for a rally. Oh, and add to that a combined net-short position by managed money funds of close to 120,000 contracts combined between Kansas City and Chicago, and the near-record short positions in corn and soybeans, and you have the recipe for some sort of price rally. However, early Monday, the ongoing slide in world equity and energy markets seems to be taking a front seat to wheat fundamentals.

The weather features another 10 days of rain for the Russian spring wheat belt, compromising quality and quantity; excess rain has impacted France and Germany yield and quality as well. I’ve got to think that not only cheap U.S. soft red winter, but also high protein U.S. winter and spring wheat, will be sought by world millers. Only time will tell. However, right now, the bears are still in control.