England’s wine industry is ageing like a fine Sussex red. Blind tastings have proved that homegrown vintages punch well above their weight compared to established brands, and tours of English vineyards are attracting wine aficionados from all over the world.

Yet while the quality of reds and whites are improving rapidly, it’s sparkling wine that’s catching the eye of connoisseurs and courageous investors alike. Production of English sparkling grew by a third to 8.3 million bottles in 2022.

Spying an opportunity, French Champagne houses are snapping up real estate in Kent, Sussex and Hampshire. Pommery, Taittinger and the Cava behemoth Henkell Freixenet have all bought vineyards in the region, hoping to capitalise on the British wine boom.

As the industry has expanded, so too have the opportunities to make money from English wine as an investment. The market is still in its infancy, but with heightened risk comes opportunity.

Here, Telegraph Money explains how to boost the odds of lucrative returns.

Nyetimber has been tipped as one of England’s top vineyards to keep an eye on

Credit: James Ratchford

The basics of wine investing

The theory of wine investment is straightforward. You buy wine, store it and sell it later when its value has risen. The quality and scarcity of fine wine tends to appreciate over time, along with its price.

Because wine is a physical, tangible asset, like property or gold, it typically performs well against inflation. The kicker is that that wine can spoil if kept under the wrong conditions.

Only some wines are good enough to make the cut. Less than 1pc of the wine produced around the world is considered “investment grade” due to its quality, brand equity, limited supply, vintage appeal and ageing potential.

Will Hargrove, associate director at fine wine merchant Corney & Barrow, says investing in wine should never be done with a time horizon of less than five to 10 years.

He says: “You need to be able to weather the ups and downs of what goes on in the world.”

“When you buy and store wine, you’re going through a transition where the wine stops being available on the shelves to being available on the secondary market, hopefully at a higher price, although that’s not always the case.

“Anyone investing in wine is relying on the consumer to be buying the wine and drinking it, because eventually the wine will go off.”

English sparkling wine producer Nyetimber is based in West Chiltington, Sussex

Credit: Chris Gorman

Which English wines to invest in

Because the investment market for English wines is still developing, there are no safe bets when it comes to choosing a vintage.

Mr Hargrove says: “The quality [of English wine] is massively on the up, especially among sparkling, but there are some good whites too and the odd red starting to creep in.

“The problem from the point of view of investing is, no-one knows how these wines are going to age, so it’s a very tricky thing to get right.”

However, Matthew Small, senior portfolio manager at wine merchant Cru Wine, says that savvy investors should consider fledgling English vintages, particularly sparkling.

He adds: “The market is up and coming, but the quality is improving and getting to that level that we’d call investment grade.”

Among the best investment-grade English wines, according to Mr Small, are Nyetimber’s 1086 Prestige Cuvée – at around £150 a bottle for the 2010 vintage – and Gusbourne’s Fifty One Degrees North, whose 2016 vintage retails for £195. “These are the two real quality wines at the moment.”

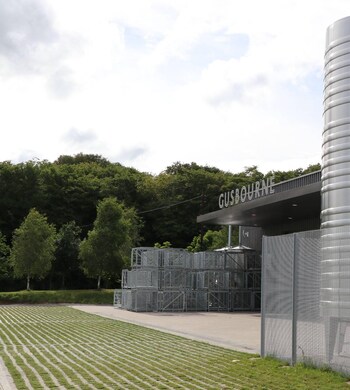

Gusbourne is one of just two vineyards in England and Wales that has publicly listed shares to buy and sell

Credit: My Tenterden

If you compare 1086’s critic score against one of the most famous Champagnes – Dom Perignon – for the same 2010 vintage, Nyetimber scores 17.5 out of 20, compared to Dom Perignon’s 18.5.

The quality is similar, but Nyetimber is only making around 3,000 bottles a year, compared to the five million produced by Dom Perignon, which makes it “super rare”, according to Mr Small.

In theory, this should make it more expensive. But the fact that the Dom Perignon 2010 vintage retails for around 20pc more than Nytimber’s 1086 shows why small vineyards are at a disadvantage: brand recognition.

Mr Small says: “Brand is one of the biggest determinants of price, as with all luxury goods. With wine the main three factors are brand, critic’s score, and supply.

“Dom Perignon is a globally recognised brand, and has massive distribution channels, massive history in every global market. Nyetimber is trying to build that.

“If you’re going to invest in English sparkling, you’re basically making the play that their brand is going to increase over time.

“Then the question is: what is the life expectancy of these wines? Or what we call the ‘drinking window’. How long have we got for Nytimber to become a globally recognised brand and for the price to go up?”

Nyetimber has been known to produce very high end, special edition runs of wine

Credit: Nyetimber

Nytimber’s 1086 is given a drinking window of around 10 years by wine ratings index Jancis Robinson.

The relatively short timescale shows why investing in English sparkling is more of a gamble, according to Mr Small.

“For riskier investments you want a longer drinking window to give an opportunity for the brand recognition to increase.”

“I’m not saying it won’t happen, but a 10-year drinking window isn’t a huge amount of time for a brand to become massive.

“These English sparkling wine houses are ‘up and comers’. They’re a bit riskier – but you can potentially make the biggest return.”

Grape picking at Breaky Bottom vineyard in East Sussex

Credit: Alamy Stock Photo/Andrew Hasson

How to fit English wine into your portfolio

Because of the higher risks involved in buying English wine, the smart move is to balance out the investment with safer bets elsewhere.

Mr Small says: “The two key questions for an investor are: what’s your time horizon and what’s your risk tolerance?

“Unless you have massive risk tolerance, English wine has a small percentage to play in that portfolio.

“You would probably want under 5pc invested in English sparkling. Invest by all means, but alongside other more established regions.”

Bordeaux makes up around 40pc of the fine wine investment market, down from its near monopoly before 2012, but still the biggest share of a single region. Bordeaux traditionally has been the least volatile segment of the market and also the most liquid (pun intended).

“If someone wants low-risk wine, I would say they should go with Bordeaux. If they’re more returns-focused I would say Champagne and Burgundy, which increased by around 70pc from 2020 to 2021,” Mr Small says.

“You can get these incredible spikes in certain regions. That’s why it’s important to have exposure to all the regions, including England, in a way that matches your risk tolerance.

Brut and Rosé by Chapel Down, England’s largest winemaker

Credit: Chapel Down

“It’s very difficult to know when a region’s going to spike, but when it does, as long as you have some exposure to it you’re going to take advantage.”

When considering which wines to invest in, Mr Small says Wine-Searcher is “a great tool”. The website offers a comprehensive database of all wines on the market and is used by merchants and investment houses to sell their bottles.

“Wine-Searcher also has critic scores and drinking windows. You can easily flick between wines to see how they rank.

“It’s basically a Google search for all wines. It’s got all that information on there.”

Investing in vineyards

If you don’t want to invest in the bottles of wine a vineyard produces, you can invest in the vineyard itself.

However, while there are over 700 vineyards in England and Wales, only two – Chapel Down and Gusbourne – have publicly listed shares to buy and sell.

Chapel Down is Britain’s biggest winemaker, accounting for 30pc of the English sparkling wine market. After spending years on the small online stock market Aquis Exchange, Chapel Down is now listed on the Alternative Investment Market (AIM) as it targets a larger pool of investors.

Gusbourne is also listed on London’s junior market, and was trading at 74p a share in December 2023. Early investors who bought in 2008 when Gusbourne was first listed have seen their shares double in value.

Buying shares in British vineyards can be a rollercoaster ride, however. Chapel Down shares peaked at 110p in September 2018 and were trading at 53p a share in December 2023, valuing the company at around £90m.

Yet there is optimism in the market. Chapel Down has secured major sponsorship deals, including with English Cricket and Ascot races in 2024.

Gusbourne said its sales increased by 25pc over the first six months of 2023. The producer has 230 acres of mature vines in Kent and West Sussex and spent £1.7m in 2023 on acquiring more land for cultivation.

Mr Hargrove points to Nyetimber and Breaky Bottom, one of England’s veteran producers, as the top vineyards to keep an eye on, and consider investing in when the opportunity arises. “What they’re producing is very good,” he says. “You could say the same of Chapel Down or Gusbourne.

“Some producers, and Nyetimber would be one of them, are doing high-end, very special, limited edition runs.

“It’ll be interesting to see if these sorts of wines become collector items that people keep and sell later on.”

The easiest way to buy shares is through a broker, such as AJ Bell or Hargreaves Lansdown, although remember you will be charged a fee to buy and sell as well as a holding or “platform” fee.

Storing your wine

If you are buying bottles of wine as an investment, you could choose to store it yourself. But be warned: maintaining optimal conditions is essential to ensure the wine remains at the highest quality possible, and doesn’t undermine your investment when you eventually come to sell.

Mr Small says: “When you invest in wine you’re effectively a custodian of the wine. You’re storing it until it’s in its perfect drinking window. Then someone will buy it who doesn’t want to store it but just wants to drink the wine when it’s at its best.”

However, if you are serious about building a portfolio, experts agree that storing your vintages “in bond” is the best option.

Buying in bond means your wine investment is stored in a specialist warehouse approved by HM Revenue & Customs.

Mr Short says: “If you’re buying these very expensive wines, a thing we call ‘provenance’ is essential – that’s the quality of the wine and how well it’s been kept.

“When you store in bond you know it’s been stored in perfect humidity, light and temperature conditions.

“If you have a very rare bottle of wine but it was stored in someone’s cellar you have no idea how it’s been kept. Then you can struggle to sell that on. Storing in bond means there’s an audit trail. You know it’s been kept and stored properly.”

Wine can also be insured to its market value when stored in bond, reducing the financial risk if something goes wrong.

The tax benefit of in-bond storage is one of the biggest draws. Wine buyers are usually hit with a double-whammy of alcohol duty and then 20pc VAT on top of the duty and the price of the bottle.

But when wine is stored in bond you only have to pay tax on it when you take it out of storage, and if you decide to sell the wine while in bond, you will avoid paying duty or VAT altogether.

What’s more, if you choose to have your wine delivered at a later date, the VAT is payable on the wine’s original sale price rather than its current market value.

Prices typically range from between £10 to £15-a-year to store a 12-bottle case of wine. There are bonded warehouses dotted across the country. Some of the biggest names include Arc Wine Reserves in Cambridgeshire, Berry Bros & Rudd in Basingstoke, and Nexus Vinothèque in Wiltshire.

Making investments tax-efficient

If a bottle of wine has a life expectancy of under 50 years then HMRC classifies it as a “wasting asset”, which means it is exempt from capital gains tax (CGT) when sold.

Capital gains tax is tax owed on the profit from selling an asset that has appreciated in value.

The exact HMRC definition of a wasting asset is “an asset with a predictable life not exceeding 50 years at the time when it was acquired”.

When assessing how long the wine’s life expectancy is, its shelf life, the wine’s provenance, condition and vintage will all be taken into account by the taxman.

While port and a few fine wines are exceptions, the vast majority of wine falls into the wasting asset category, and will be exempt.

If the wine is deemed not to be a wasting asset, a seller would still benefit from a CGT exemption on profits up to £6,000.

However, this threshold is set to be slashed to £3,000 in April 2024, meaning profits on even modest sales will attract a 20pc CGT liability once the allowance has been used.

Are you a wine investor? We want to hear from you, email [email protected] and tell us your story, good or bad.