What’s going on here?

The Indian rupee just closed at an all-time low against the US dollar, even with state-run banks selling dollars to prop it up.

What does this mean?

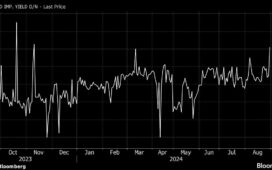

The rupee ended at 83.9625 against the dollar, a hair lower than its previous close of 83.9550. Efforts by state-run banks, probably on behalf of the Reserve Bank of India (RBI), couldn’t stop the currency’s slide to a record low. This drop highlights a broader sense of market unease: India’s BSE Sensex and Nifty 50 indices both fell 0.7%, mimicking declines in European and Japanese markets, which dipped 1% and 0.7% respectively. Investors are jittery about a potential US economic downturn and are starting to unwind carry trades fueled by a soft yen. Meanwhile, other Asian currencies – especially the Indonesian rupiah – edged higher. The dollar index also climbed to 103.1, up slightly against a basket of six major currencies.

Why should I care?

For markets: Volatile vibes weigh on markets.

India’s stock market isn’t the only one feeling the heat. Investor concerns about the US economy’s future have hit global markets too, causing notable drops in European and Japanese indices. The RBI’s moves – like telling banks to avoid large speculative bets and holding policy rates steady – haven’t calmed market nerves. Traders should keep an eye on potential market corrections and shifts toward safer or high-yield assets.

The bigger picture: RBI to the rescue.

The RBI’s steps to bolster the rupee show central banks are ready to intervene in tough times. With India’s foreign exchange reserves at a record $675 billion, the RBI has solid backing for future currency stabilization efforts. Plus, Barclays Bank thinks the RBI might start easing its monetary policy from December 2024. These measures and predictions highlight the central bank’s key role in steering financial markets through uncertainty and volatility.