The adoption of stablecoins in Latin America is being driven by the need for efficient cross-border payment solutions, particularly in countries like Mexico, where they could impact the remittance market.

The cryptocurrency market in Latin America is seeing significant growth, largely fueled by the rise of stablecoins. These digital currencies, which maintain a fixed value relative to a fiat currency such as the U.S. dollar, are gaining traction in the region due to their ability to mitigate volatility and facilitate cross-border transactions.

Stablecoins are a type of cryptocurrency designed to maintain a stable value against a fiat currency. Unlike Bitcoin or Ethereum, whose values can fluctuate dramatically, stablecoins are backed by assets like the dollar, allowing them to maintain a steady price.

There are two main approaches to issuing stablecoins: centralized and decentralized. Centralized stablecoins, such as USDC from Circle and USDT from Tether, are backed by dollar deposits in bank accounts. For every dollar deposited, a corresponding stablecoin is issued, ensuring each coin is supported by a tangible asset, providing stability.

On the other hand, decentralized protocols issue stablecoins based on collateralized cryptocurrencies like Ethereum. In these systems, users lock up a value in cryptocurrencies to receive a percentage of that value in stablecoins, ensuring that there is always sufficient backing for the issued coins.

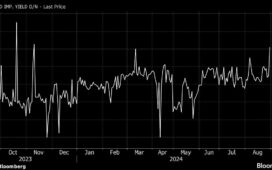

ETH/USD

The demand for stablecoins in Latin America has surged in recent years, with Brazil and Argentina leading the charge. According to a recent report from the analytics platform Kaiko, stablecoins account for 63% of the most traded pairs in the region, surpassing cryptocurrencies like Bitcoin and XRP.

A key factor driving stablecoin adoption in Latin America is the need for efficient and low-cost cross-border payment solutions. Remittances play a crucial role in many Latin American economies, and stablecoins offer a viable alternative to traditional banking systems, reducing transaction costs and increasing the speed and transparency of transfers.

In Mexico, stablecoins could revolutionize the remittance market, one of the largest corridors globally, by making money transfers from abroad faster and cheaper.

However, the collapse of UST, the stablecoin from the Luna project in 2022, serves as a reminder of the risks associated with innovation in the cryptocurrency space. The failure of Luna was a failed experiment with an algorithmic stablecoin that lost its peg to the dollar due to a combination of unsustainable incentives and massive selling pressure.