The United Kingdom’s stock market has recently faced headwinds, with the FTSE 100 and FTSE 250 indices closing lower amid weak trade data from China. This broader market sentiment underscores the importance of identifying resilient small-cap stocks that can thrive even in challenging economic conditions. In this article, we explore Alpha Group International and two other undiscovered gems with strong potential.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

|

Name |

Debt To Equity |

Revenue Growth |

Earnings Growth |

Health Rating |

|---|---|---|---|---|

|

Andrews Sykes Group |

NA |

1.69% |

3.16% |

★★★★★★ |

|

Globaltrans Investment |

15.40% |

2.68% |

16.51% |

★★★★★★ |

|

Impellam Group |

31.12% |

-5.43% |

-6.86% |

★★★★★★ |

|

London Security |

0.31% |

9.47% |

7.41% |

★★★★★★ |

|

M&G Credit Income Investment Trust |

NA |

-0.35% |

1.18% |

★★★★★★ |

|

Rights and Issues Investment Trust |

NA |

-3.68% |

-4.07% |

★★★★★★ |

|

Fix Price Group |

43.59% |

12.53% |

23.49% |

★★★★★☆ |

|

Goodwin |

59.96% |

9.26% |

13.12% |

★★★★★☆ |

|

BBGI Global Infrastructure |

0.02% |

6.58% |

9.90% |

★★★★★☆ |

|

Mountview Estates |

16.64% |

4.50% |

-0.59% |

★★★★☆☆ |

Let’s uncover some gems from our specialized screener.

Simply Wall St Value Rating: ★★★★★★

Overview: Alpha Group International plc offers foreign exchange risk management and alternative banking solutions across the UK, Europe, Canada, and globally, with a market cap of £1.08 billion.

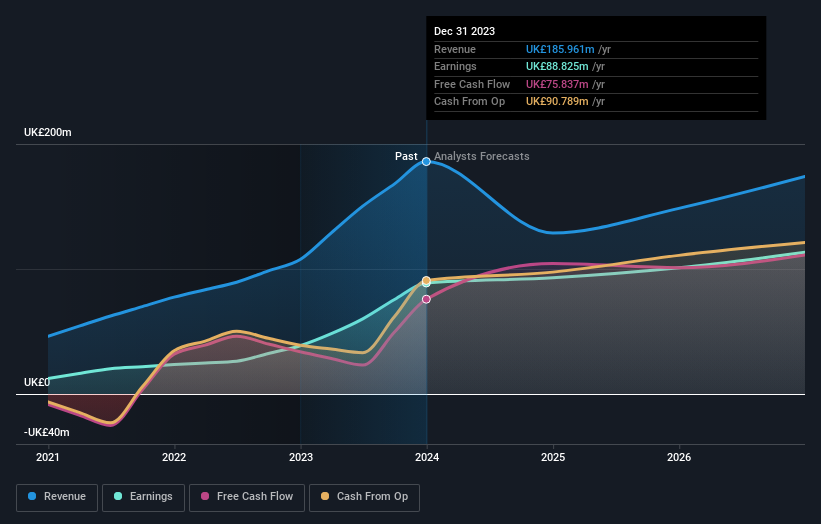

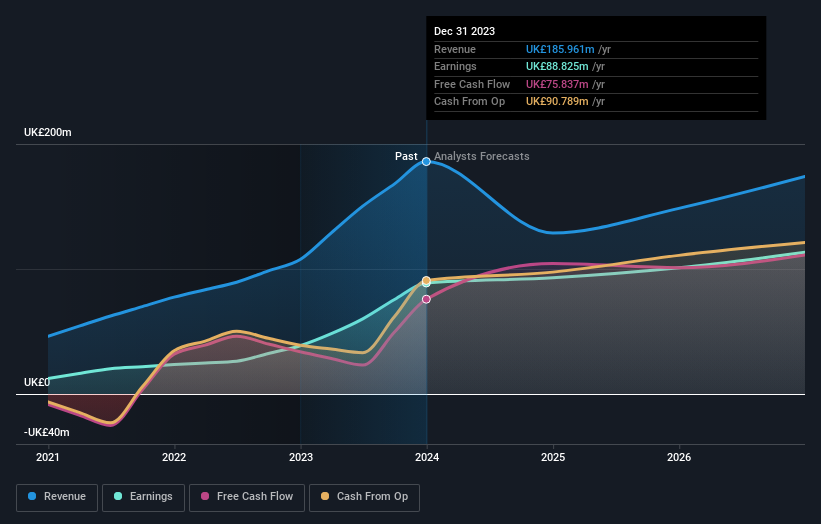

Operations: Alpha Group International plc generates revenue primarily from Alpha Pay (£64.30 million), Institutional services (£61.29 million), and Corporate London excluding Amsterdam (£45.42 million). The company also derives income from its operations in Toronto (£4.23 million) and Amsterdam (£8.70 million), as well as Cobase (£0.19 million).

Alpha Group International, now part of the FTSE 250 and FTSE 350 indices, has seen its earnings grow by an impressive 130% over the past year. This growth rate outpaces the Capital Markets industry average of 0.3%. Trading at a price-to-earnings ratio of 12.2x, it offers good value compared to the UK market’s 16.8x. The company is debt-free and recently commenced a share repurchase program authorized to buy back up to 4.32 million shares, representing about 10% of its issued capital.

Simply Wall St Value Rating: ★★★★★★

Overview: Cairn Homes plc is a holding company that operates as a home and community builder in Ireland with a market cap of £1.03 billion.

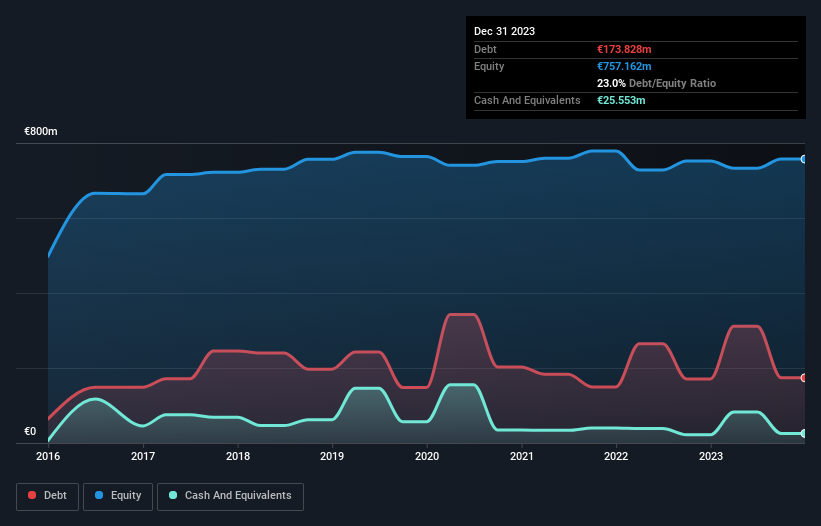

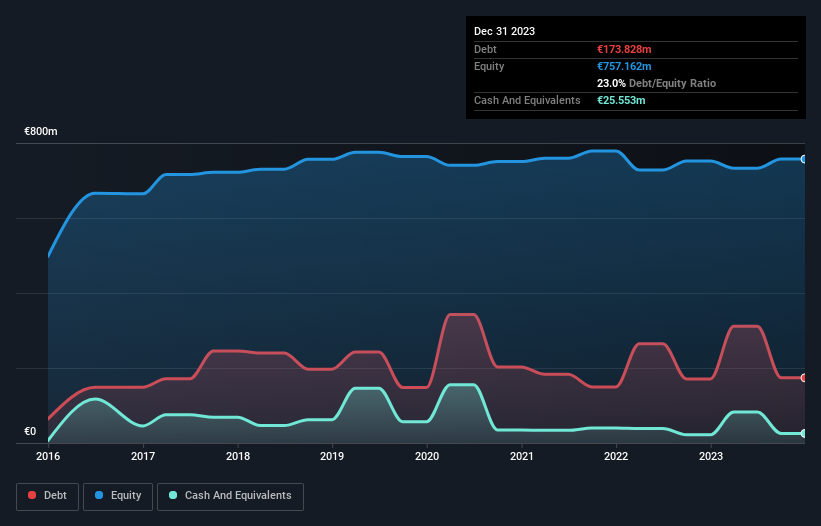

Operations: Cairn Homes generates revenue primarily from building and property development, amounting to €666.81 million. The company’s market cap stands at £1.03 billion.

Cairn Homes, a notable player in the UK market, has demonstrated robust financial health with earnings forecasted to grow 10.91% annually. The company’s net debt to equity ratio stands at a satisfactory 19.6%, reflecting prudent financial management. Over the past year, Cairn’s earnings grew by 5.4%, outpacing the Consumer Durables industry which saw a -14% change. Additionally, interest payments are well covered by EBIT at an impressive 8.4x coverage ratio, indicating sound operational efficiency and strong future prospects for growth and stability in its sector.

Simply Wall St Value Rating: ★★★★☆☆

Overview: Senior plc designs, manufactures, and sells high-technology components and systems for the aerospace, defense, land vehicle, and power and energy markets globally, with a market cap of £696.60 million.

Operations: Senior plc generates revenue primarily from its Aerospace (£651.10 million) and Flexonics (£333 million) segments, with a minor deduction for central costs (-£1.50 million). The company’s market cap stands at £696.60 million.

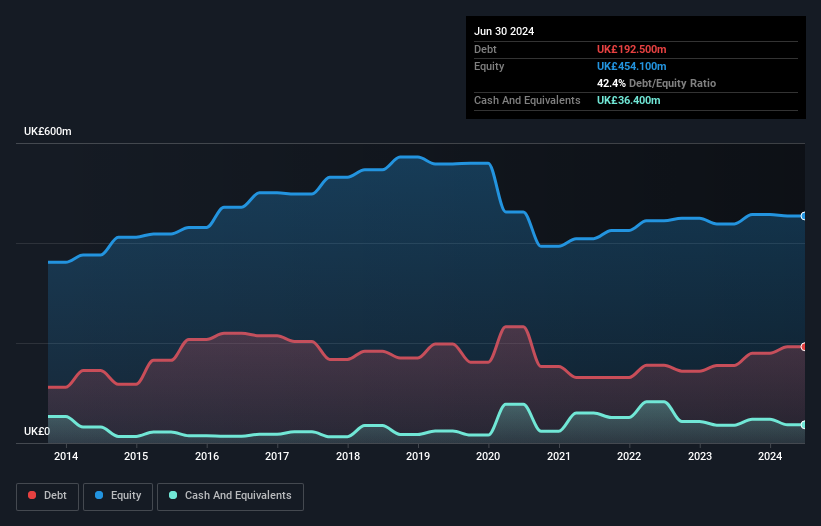

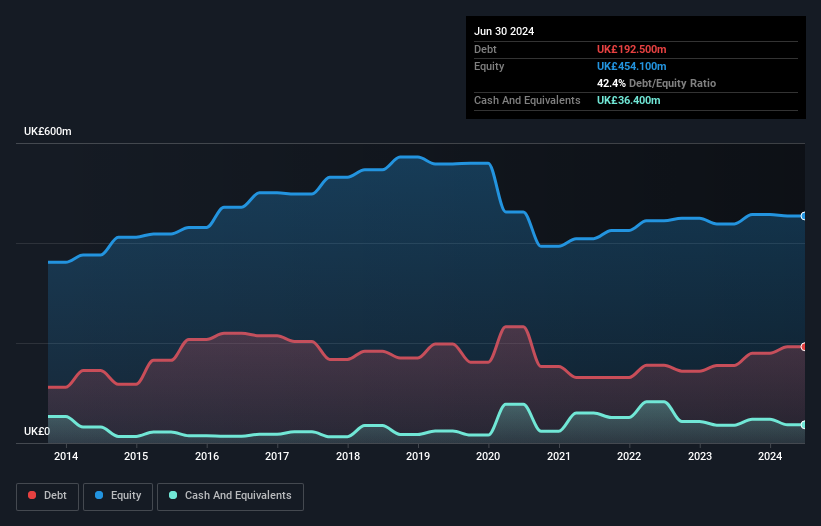

Senior plc, a notable player in the Aerospace & Defense sector, has shown impressive earnings growth of 40.1% over the past year and is trading at 66.9% below its estimated fair value. Despite a debt to equity ratio increase from 35.5% to 42.4% in five years, its net debt to equity ratio remains satisfactory at 34.4%. The company recently secured significant contracts with Deutsche Aircraft and Rolls-Royce, enhancing future revenue prospects while maintaining high-quality earnings performance.

Key Takeaways

Want To Explore Some Alternatives?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include LSE:ALPH LSE:CRN and LSE:SNR.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]