What’s going on here?

Central banks in Latin America are struggling to balance rate cuts with rising inflation and currency weaknesses, leading to market uncertainties.

What does this mean?

Latin American central banks find themselves in a precarious position. Despite attempts to stimulate economies by cutting interest rates, persistent inflation and weak currencies complicate their strategies. Geronimo Mansutti from Tellimer calls this a ‘critical juncture,’ where threats include worsening inflation expectations, global market volatility, and currency instability in the LatAm-5 countries, with Peru being the exception. For instance, Brazil maintained its interest rate at 13.75% in July, but economists predict cuts could start as soon as September. Meanwhile, Chile, Colombia, Peru, and Mexico have all made cautious movements on their interest rates. Yet, fears of a potential US recession and rate hikes by Japan’s central bank add more volatility to the region.

Why should I care?

For markets: Navigating the waters of uncertainty.

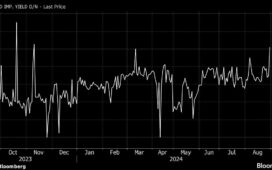

Investors are keeping a close eye on Latin America’s central banks, as their decisions directly affect currency stability and market confidence. Brazil’s real, for example, has underperformed against the US dollar due to fiscal and political concerns. Traders are also pricing in potential rate hikes by the US Federal Reserve, adding to the complexities for Latin American economies.

The bigger picture: Global economic shifts on the horizon.

Alejo Czerwonko from UBS Global Wealth Management notes Latin America’s unique approach to monetary policy, often acting ahead of the US Fed. This proactive stance could set the region apart, but individual challenges remain significant. The mix of internal economic issues and external pressures from major economies could reshape the global market landscape.