What’s going on here?

The US dollar slipped to its lowest this year against the euro on Wednesday, driven by trader anticipation for significant revisions to US payroll data and an upcoming speech by Federal Reserve Chair Jerome Powell.

What does this mean?

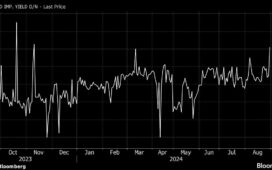

Markets are on edge as they await revisions to US payroll figures, expected later in the day. These numbers could sway market movements, especially with US bond yields hitting their lowest since August 5 after weak monthly job figures spurred recession fears. Additionally, Federal Reserve Chair Jerome Powell is slated to address the Jackson Hole economic symposium by the end of the week. His speech will be scrutinized for hints about future interest rate cuts, particularly given the fluctuating predictions for a rate cut in September. Add to this the reduced yield premium in the US Treasury market, as noted by Pepperstone’s head of research, and it’s clear why the dollar is facing downward pressure.

Why should I care?

For markets: Bracing for impact.

Traders are braced for another bout of volatility. A weak payroll report could once again spike fluctuations across asset classes, reminiscent of the turbulence earlier in the month. The US dollar index has been on a downward slide, hitting a fresh low of 101.34. Notably, the euro climbed to $1.1131, its highest since December, while sterling and the yen also saw significant gains against the dollar. Market participants are highly attentive to these shifts as they navigate through an uncertain economic landscape.

The bigger picture: Ripples in the global economy.

The implications of the softened US dollar are not confined to American shores. Traders are keenly watching Japan’s parliament session on Friday, where Bank of Japan Governor Kazuo Ueda will testify about recent rate hikes. With Australia’s and New Zealand’s currencies touching new highs, global currency markets are vividly reacting to the evolving situation in the US. This interconnectedness underscores the importance of Powell’s upcoming speech and the revised payroll data in shaping not just US economic policy, but global financial trends.