What’s going on here?

Malaysia is catching investor eyes with its robust economic growth, stable government, and a rising currency, making it a standout market in Southeast Asia for 2024.

What does this mean?

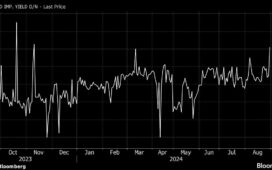

Foreign investment in Malaysia hit record levels, with $1.75 billion flowing into its debt markets in July alone. This surge is powered by the country’s stable financial environment and impressive growth, particularly in the tech sector, where Kuala Lumpur’s stock index, the KLCI, is up over 12% this year. The Ringgit’s more than 5% rise to an 18-month high against the dollar adds to Malaysia’s appeal. Since Prime Minister Anwar Ibrahim took office in 2022, the nation’s political stability and economic vitality have stood out, especially against the backdrop of political unrest in neighboring Thailand and Indonesia.

Why should I care?

For markets: Malaysia’s rise in Southeast Asia.

Malaysia’s financial markets are on a bullish run. The country’s steady economic growth and growing political stability have boosted investments in both debt and equity markets. Beyond the tech sector, the construction, power, and infrastructure industries offer a range of opportunities for investors. With the Ringgit performing well, Malaysian bonds are increasingly attractive, especially as regional economies tweak their interest rates while Malaysia’s central bank holds steady.

The bigger picture: Malaysia’s promising horizon.

Malaysia’s current position hints at its expanding economic influence in Southeast Asia. The country’s political stability and economic reforms create a solid investment environment. The upcoming IPO of 99 Speed Mart Retail Holdings, aiming for a $509 million debut, underscores a thriving equity market. As Malaysia navigates regional political upheavals and strengthens economic policies, its attractive bond yields and stable growth will likely continue to draw investor interest.