Rather than sit on the sidelines, my worries are motivating me to search for businesses that can thrive in spite of an adverse economy.

Last week, I put new money to work by investing in stocks. And I’m sure critics would call me naive for investing at a time like this. But I don’t consider myself naive. To the contrary, if I’m being 100% transparent, I’m worried about the U.S. economy.

For starters, the U.S. national debt recently surpassed $35 trillion. I don’t know where the breaking point is. But the national debt certainly appears to be rising at an unsustainable rate, bringing it ever closer to wherever that breaking point is.

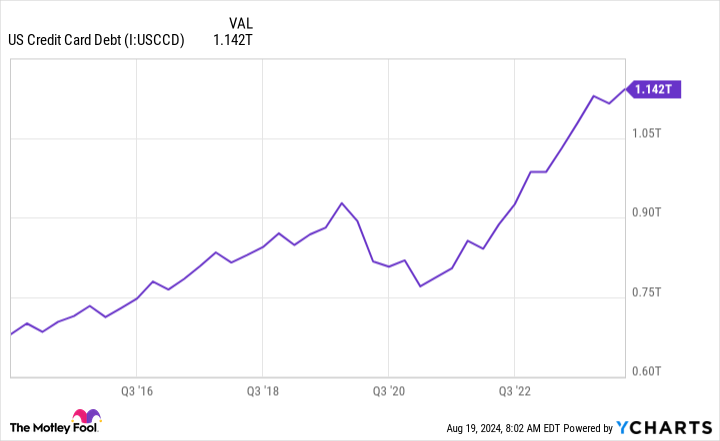

I often hear people complain about how politicians created this problem by failing to balance the budget. But the average U.S. household isn’t much better. Household debt is now at an all-time high of $17.8 trillion, which includes a record $1.1 trillion in credit card debt.

US credit card debt; data by YCharts.

Some advocates for the economy will point to “resilient” consumer spending. But is spending really resilient if debt is skyrocketing? It seems that at some point, perhaps soon, credit will run out. And with cash already largely depleted, consumers will be left without much liquidity.

In short, I wouldn’t be surprised if out-of-control government spending eventually necessitates some hard decisions that set back the economy. And out-of-control household spending could soon lead to a discretionary-spending crash. These are just a couple of things that really worry me about the economy.

Why I invest anyway

I’m worried about the economy, but here’s why I’m an investor anyway: I’ve been worried about the economy for years, but it adapts in unexpected ways. And this usually means that it keeps chugging along, and stocks keep hitting new highs.

More than this, the stock market goes up most years, which is another incentive to have money invested sooner rather than later.

Rather than allow fear to sideline me, I choose to address my fears with the investing decisions I make. In other words, I think an economic recession is possibly right around the corner. Therefore, I only want to be invested in undervalued businesses that are in a position of financial strength for the long term.

And in my view, beverage company Celsius (CELH 0.53%) and discount retailer Five Below (FIVE 2.51%) are two businesses that fit this description.

1. Celsius

As of the second quarter of 2024, Celsius had cash and equivalents of over $900 million and zero debt. Of course, there’s more to investing than finding a business with a strong balance sheet. But in harder economic times, a strong balance sheet is an asset, and it’s one of the reasons I’m comfortable buying Celsius stock right now.

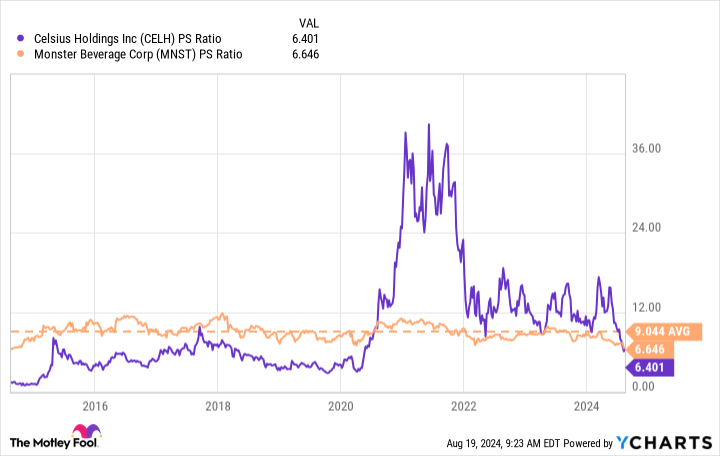

Just as with balance sheets, there’s more to investing than finding a stock that trades at a cheap multiple. But all else being equal, it’s good when a stock is cheap, and I believe Celsius stock is.

A good comparison is Monster Beverage stock. As the chart below shows, Monster stock has traded at an average price-to-sales (P/S) valuation of 9 over the last 10 years, with the valuation rarely deviating far from that average. Therefore, the market will value a quality beverage business at this price. And as the chart below shows, Celsius stock is about 30% cheaper than this, which I think is attractive.

CELH PS ratio; data by YCharts.

Thinking bigger picture, I like Celsius as an investment because it’s growing and its margins are improving. In recent years, Celsius skyrocketed out of obscurity and into the No. 3 position for energy drinks, behind only Red Bull and Monster.

The intriguing thing here is that Red Bull and Monster have a large presence in international markets, whereas Celsius has barely started. Growth could continue for multiple years on international expansion alone.

Moreover, Celsius has a chance to improve its profit margins. In recent years, growth was so fast that management didn’t have time to optimize operations. But now that things have slowed (second-quarter revenue was still up a strong 23%), it can make tweaks that improve profits. For perspective, net profits were up 70% in the first half of 2024 compared to the same period of 2023.

For these reasons and more, I like Celsius stock for the long term.

2. Five Below

Like Celsius, I also like Five Below stock for the long term. It, too, is debt-free, aside from lease agreements. And it’s well capitalized with over $350 million in cash, equivalents, and short-term investments. Moreover, at a P/S of 1, the stock has never been this cheap in its 12-year public history.

Five Below is down more than 60% from the start of 2024. Investors rushed the exits after an abrupt CEO departure and after it missed expectations for the first quarter of 2024. But I think they are extremely overreacting.

For 2024, Five Below expects same-store sales to fall by 3% to 5% — that’s suboptimal, and it’s possible that management will lower those expectations even further when it reports financial results for the second quarter on Aug. 28. But even with this dip in growth, the company expects a full-year net profit of nearly $300 million.

Five Below stores are relatively cheap to open and have a fast payback period of about one year. In coming years, management expects to open more than 1,000 new locations. And considering the unit economics, this should boost both revenue and profits by considerable amounts.

Sales could slow in the near term, but I fully expect Five Below’s profits to soar over the long term. And that’s why I’m happy to add shares of this well-capitalized retailer to my portfolio right now.

In closing, the economy could struggle in the coming months and years. And if that happens, there will be plenty of businesses that have a hard time. But Celsius and Five Below are financially positioned to push through uncertain times and reward shareholders over the long term. And that’s why I recently invested in this duo despite my misgivings over macroeconomic conditions.