Written by Convera’s Market Insights team

Dollar steady as uncertainty reaches all-time high

George Vessey – Lead FX Strategist

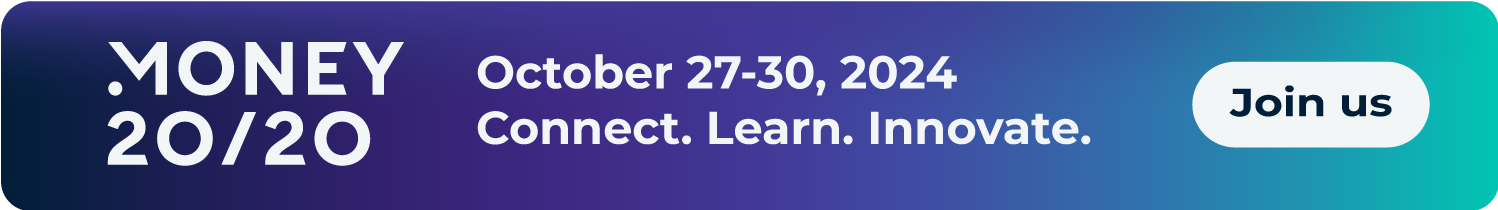

With 10-year US Treasury yields back at August highs, the US dollar’s appeal is strengthening. The 120-day correlation between these two variables has never been so positive for so long, but it is also stretching to near its highest in years. As well as relative growth and yield differentials supporting the dollar, safe haven appeal is also noteworthy.

Foreign investors continue to boost their holdings of US assets in anticipation of more rate cuts driving yields lower in the future. However, amidst the strong US jobs data, those bets have been pared, once again supporting US yields higher and providing a tailwind to the dollar’s rebound over the past week. Some dovish comments from Fed policymakers were largely overlooked, with traders still pricing in just two Fed rate cuts by year-end as opposed to three priced in just a couple of weeks back. Meanwhile, on the macro front, we saw the NFIB Small Business Optimism Index was largely unchanged from last month, but it was the 33rd consecutive month below the 50-year average of 98.

The more striking development was the Uncertainty Index rose 11 points to 103, the highest reading ever recorded, as business prepare for an extremely tight presidential election less than a month away. The dollar might outperform in the build up to the election due to safe haven demand, whilst a clean sweep for either party is likely to spark the most volatility across the FX space in the immediate aftermath.

Pound remains subdued despite rising UK yields

George Vessey – Lead FX Strategist

With oil prices slumping around 4% yesterday, sterling rallied against its G10 commodity-linked peers like the NOK. Although tensions in the Middle East are a tailwind to oil prices, which have surged over 15% in a month, ample and expanding output, coupled with demand worries, are headwinds.

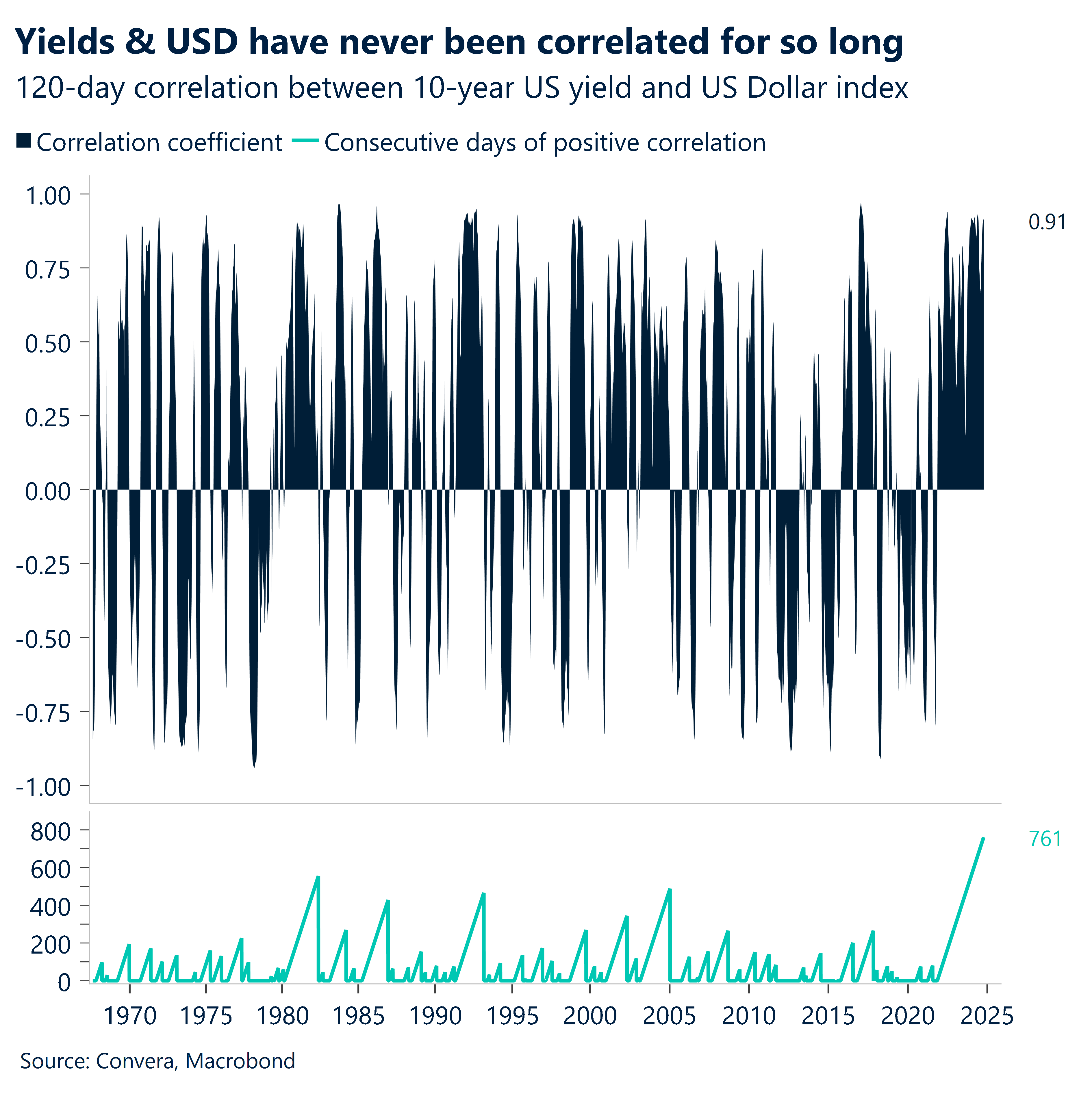

The British pound, along with other the euro, tends to weaken when oil prices rally at a sharp pace. This is due to the UK and many European countries being net-importers of the black gold, hence it weakens their terms of trade. It’s something to keep an eye on going forward if the conflict in the Middle East continues escalating. Another development catching our eye is the uplift in UK bond yields (10-year at a 3-month high above 4%), which hasn’t resulted in a strengthening of the pound as it usually would. The gap between yields on UK bonds and their German equivalents is the biggest in more than a year, amid contrasting expectations for interest-rate cuts and mounting concerns over Britain’s upcoming budget. Yet GBP/EUR remains closer to €1.19, still licking its wounds from its biggest daily sell off in two years last week following Bank of England Governor Bailey’s dovish comments.

Although the moves in global bond markets are more likely down to flip-flopping on the expected pathway for interest rates in the US, it might also be the case that the rise in UK yields reflects mounting speculation the UK government will need to sell more debt to help fill a fiscal hole – hence the lack of positive pound reaction of late.

Negatives pilling up for the euro

Boris Kovacevic – Global Macro Strategist

The euro continued to consolidate just shy of the $1.10 mark after recording its second worst week of the year. Traders are warming up to the idea that the European Central Bank might have to cut interest rates by 25 basis points at two consecutive meetings in October and December. This would push the deposit facility rate to 3%, down from the peak of 4%.

The recent dovish tilt in policy pricing can be seen as a reaction to the continued weakness of the German economy and inflation slide to below 2% in most European countries. The prominent German ECB board member Isabel Schnabel dropped her hawkish stance some weeks ago and shifted her attention to the downside pressures on growth. As the labor market cools, so too will the pressure to ease policy continue to build.

To make matters worse for the euro, investors remain skeptical about Frances prospects of returning to the budget deficit of 3% as laid out in the Maastricht guidelines. The risk premium on holding French government bonds (vs. German ones) remains near its highest level since 2017. All the factors above seem to suggest missing domestic impetus for another leg higher in EUR/USD. This doesn’t mean that an increase is impossible.

The current focus on US developments implies that weaker macro data and more disinflationary signs from across the Atlantic could very well limit the euro’s downside. However, with less than a month to go to the US election, policy uncertainty will remain high. This might suggest less demand to rotate away from the US dollar and range bound movement until the political event is out of the way.

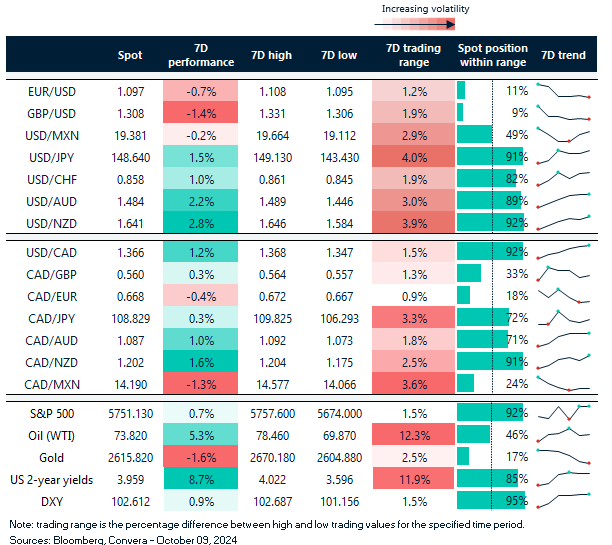

Dollar index holds in top 5% of 7-day range

Table: 7-day currency trends and trading ranges

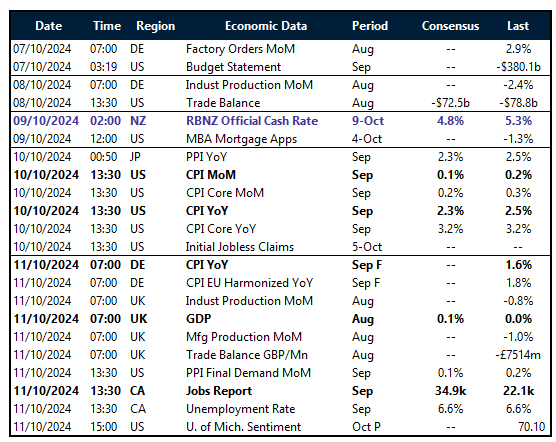

Key global risk events

Calendar: October 07-11

All times are in BST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.