thitivong

Introduction

First of all, we would like to express our condolences to all Israeli citizens affected by the unprecedented act of terror committed by Hamas on October 7, which will have a long-term negative impact on Israeli territory and the entire Middle East region. We hope that sooner or later peace and prosperity will return to all civilians and their affected families in the Israeli territories.

In this article, we will analyze Direxion Daily S&P Oil & Gas Exp. & Prod. Bull 2X Shares ETF (NYSEARCA:GUSH), has caught our attention due to recent developments in the crude oil market. Unfortunately, we have been confronted with news in global financial media about the closure of the Red Sea passage for international ships. This is a very serious event, which could add to inflationary pressures in developed countries as shipping cargo rates will most likely experience a significant increase due to higher insurance costs, longer freight mileage, and potential disruption throughout the entire supply chain. When it comes down to long-term investing, this event will most likely be negligible if we take a look over the next 20 years or more. Nonetheless, high-risk-taking investors could try to monetize using daily leveraged ETFs like GUSH. Furthermore, they could even structure some kind of long call option, or a straddle, or even buy a put option if they are pessimistic about the prospects of the crude oil market.

Red Sea passage closure and impact on global crude markets

Closure of the Red Sea passage due to repeated Houthi attacks will most likely lead to volatility in global crude oil markets. Traders are here left with two highly likely scenarios: 1) the crude oil supply could be disrupted by the longer shipping route via Cape of Good Hope which is roughly 40% longer compared to the commonly used route through the Suez Canal thus leading to higher crude oil prices, or 2) the demand for crude oil could be negatively impacted by a disruption in global trade thus leading to actual deflationary pressure on the crude oil markets (f.i. something similar to what we experienced at the beginning of the COVID-19 lockdowns in March 2020). Both GUSH and its reverse counterpart Direxion Daily S&P Oil & Gas Exp. & Prod. Bear 2X Shares (DRIP) could be used by day-traders to monetize on potential crude oil market volatility or its technical discrepancies over the next couple of months. Our advice is to follow closely all of the global political and economic developments and try to pick the sense of what could be long-term drivers of either crude market supply shock or deflationary pressures of developed economies. Then accordingly traders could either buy the dip or enter the short position at the top of the trend.

Our readers should keep in mind that this ETF follows primarily Oil and Gas producers, which are not directly tied to short-term fluctuations in the crude oil market. For instance, a large oil producer like Shell (SHEL) has most likely signed long-term contracts with let’s say Chinese customers for a certain quantity of crude oil at a predetermined price. Therefore, a short-duration Red Sea passage closure will most likely not have a significant impact on Shell’s profitability or production capacity in the short run.

“The disruption is unlikely to have large effects on crude oil and LNG prices because vessel redirection opportunities imply that production should not be directly affected,” analysts at the investment bank said in a report.

(Source: CNBC)

That is also something that Goldman Sachs (GS) has highlighted in the quote above, as our readers should keep in mind that only roughly 5% of the global oil supply trade ( ≈4.8 million oil barrels per day) goes through the Red Sea passage. Therefore, short-term stock price fluctuations for large oil and gas producers should be less volatile compared to the futures of Brent crude oil. Nonetheless, our readers should keep in mind that any prolonged closure of the Red Sea passage could completely disrupt existing signed contracts. An interesting question could arise: Who will bear the higher cost of shipping, the seller or the buyer? This could trigger enormous disruption throughout the supply chain, as some parties could start to default on their pre-obliged contracts. Imagine a scenario in which a tanker operated by a third-party company that has to deliver crude oil from the Middle East to Europe cannot bear the higher fuel consumption and the total cost of transportation across the Cape of Good Hope. At that point, larger multinational oil producers like Shell or Exxon Mobil (XOM) could start to see operational or financial issues, leading to lower quarterly results.

Finance Yahoo

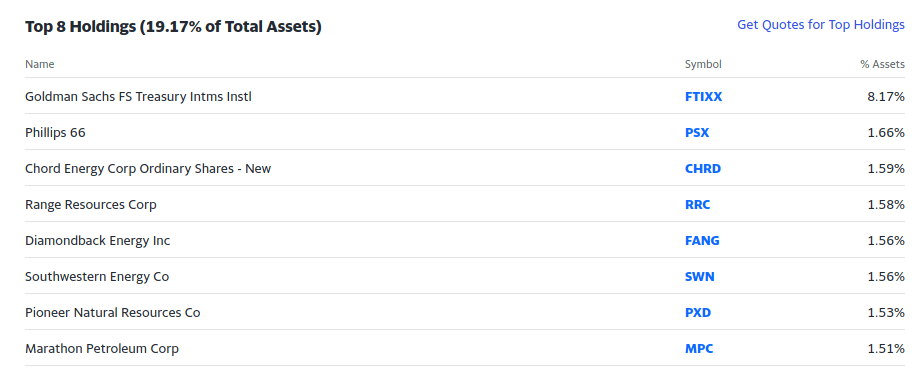

According to the figure above, we can find in the top 8 holdings some of the largest crude oil and gas producers in the US, including Phillips 66 (PSX), Southwestern Energy (SWN), and Pioneer Natural Resources (PXD). Unfortunately, Q4 ’23 and annual 2023 results will be released at the beginning of next year, where companies will also provide more details on how the current disruption in the global supply chain in crude oil impacts their companies.

These are American companies, which most likely have a lower percentage of shipping routes through the Suez Canal compared to Middle Eastern producers who have a higher exposure to supplying crude oil and gas through that route to European and American customers. On the other hand, our readers could maybe try to look up American refineries that are highly dependent on imported crude oil from the Middle East and maybe consider short-term bearish positions if management boards start to announce negative operational and financial results due to blocked Red Sea passage. If the US Army decides to military intervene in Yemen, then Red Sea passage could be blocked for a considerable time in the future. This could fulfill our previously mentioned pessimistic scenarios.

Our advice is that traders in DRIP or GUSH could use that fundamental discrepancy to their advantage. For example, if there is a short-term high rise in the crude oil price, which also impacts previously mentioned companies. Because American Oil and Gas producers are largely involved in different routes like the East Coast to Europe or the West Coast to Asia, any kind of escalation in the Red Sea should not materially impact their business performance. Those traders can maybe look for an opportunity to enter DRIP contracts, in view of shorting the crude oil market, as things deescalate in the Middle East and global supply returns to normal. On the other hand, if investors anticipate a further escalation between the U.S. Army and Yemeni Houthis, then they can count on psychological factors that the stock prices of the largest American Oil and Gas producers will go up due to bullish sentiment on crude oil markets primarily driven by geopolitical issues. However, they should keep in mind these are still two separate markets – futures on Brent Crude and U.S. oil and gas production, and should not be equated as one.

Market Price Performance of an ETF and its Top Holdings

In this article, we will focus only on market price performance for up to 12 months as it is the most relevant for our underlying instrument GUSH.

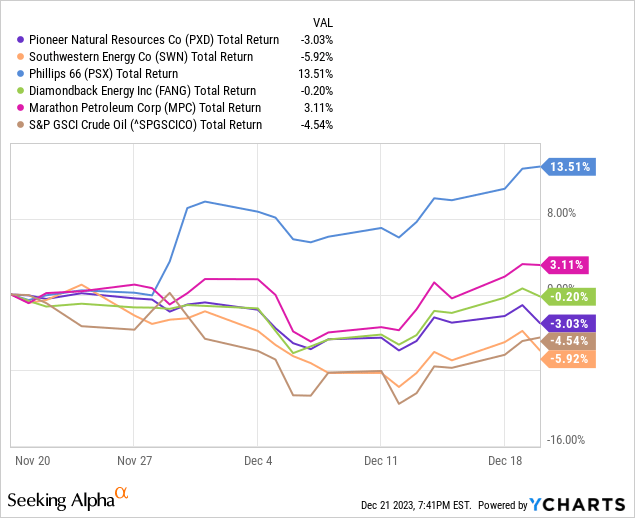

According to the figure above, we can identify that larger Oil and Gas producers like PSX and Marathon Petroleum (MPC) are completely non-correlated to the performance of the S&P Crude Oil index over the last month, while smaller producers like DiamondBack Energy (FANG) or PXD have generated a similar negative total return to the particular oil index in the range of -3% to -6%. This indicates our previous thoughts that the largest oil producers are less likely to be significantly impacted by the closure of the Red Sea passage in the short run.

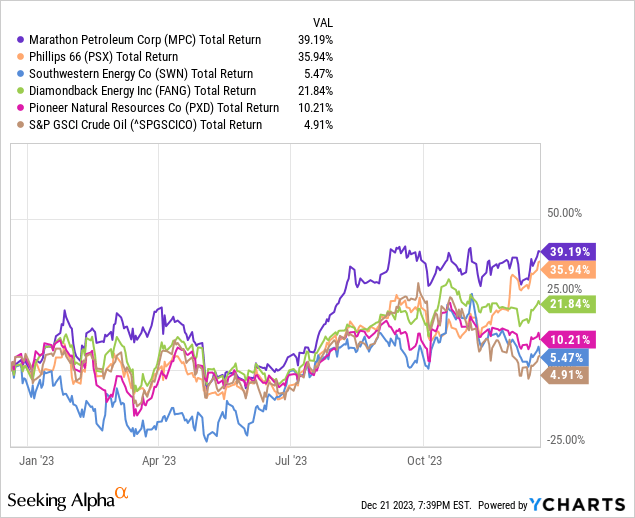

However, if we take a look into the last 12-month performance, then we can easily see that major oil companies have outperformed the performance of the general crude oil market. This performance was primarily driven by positive business sentiment on Wall Street and overall positive macroeconomic trends in developed countries, thus lifting demand for crude oil throughout 2023. In addition, oil companies have reported solid financial and business quarterly results so far in 2023.

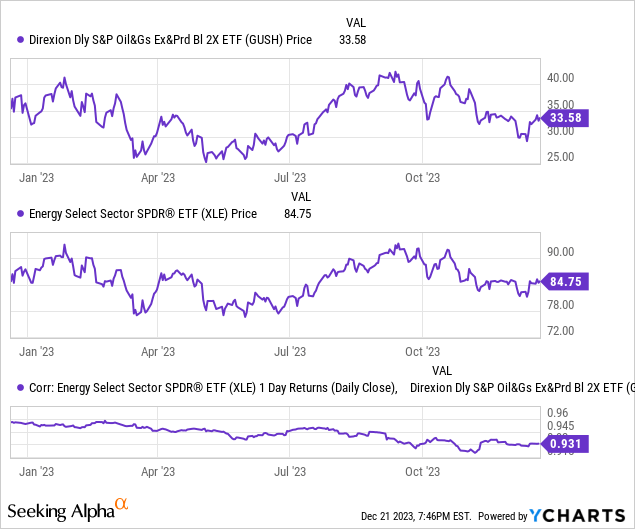

According to the figure above, we have decided to take a look at how GUSH levered ETF compares to the largest ETF investing in the oil industry Energy Select Sector SPDR Fund (XLE). Our correlation analysis indicates there has been a correlation between 90% and 96% which indicates that the performance of GUSH is highly correlated to the overall performance of the largest companies in the oil industry. As we have previously mentioned, our readers should not equate GUSH to the overall performance of the general crude oil market. We know that companies in the oil industry could be affected by other factors, such as the general economic environment, psychological traits on Wall Street (strong pessimism), or changing consumer preferences if they decide to go electric and start to boycott fossil fuel products due to their negative impact on our environment.

Conclusion

In our view, disruption in the global shipping route through the Red Sea should lead to higher oil prices over the coming months, thus leading to an opportunity for short-term traders to monetize on it. However, our readers should keep in mind that using daily leveraged ETFs is a very risky kind of investment, which also leads to higher capital return taxes compared to holding an investment for a prolonged period (over 15 years). In addition, there is still a risk that global demand will be negatively impacted by the global supply crunch due to prolonged shipping routes, thus leading to high losses of going against the downfall trend in the crude oil prices with the GUSH instrument. If our readers are aware of all of those risks and still believe they can correctly predict the global oil market and GUSH’s relation to it, then they can try to monetize it. Just keep in mind that high-risk investing is called so with a reason as it can lead to significant losses in a short time.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.