Key Highlights

- WTI Crude Oil price started a fresh decline from the $78.80 resistance.

- A connecting bearish trend line is forming with resistance at $72.80 on the 4-hour chart.

- Gold could aim for more gains above the $2,670 level.

- Bitcoin could accelerate higher if it settles above $66,500 and $67,000.

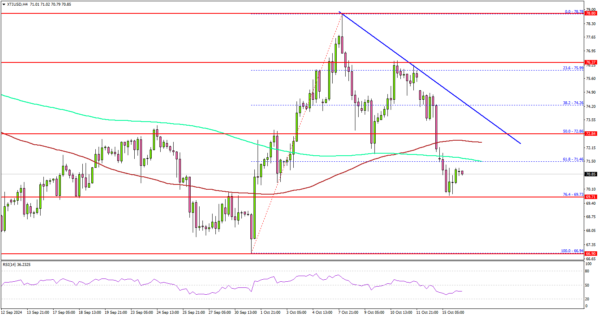

WTI Crude Oil Price Technical Analysis

WTI Crude Oil price rally stalled near the $78.80 resistance zone. The price started a fresh decline and traded below the $75.00 level.

Looking at the 4-hour chart of XTI/USD, the price settled below the $73.20 level, the 100 simple moving average (red, 4-hour), and the 200 simple moving average (green, 4-hour). The bears were able to push the price below the 61.8% Fib retracement level of the upward move from the $66.94 swing low to the $78.78 high.

The bulls are now trying to protect the $69.75 support. It is close to the 76.4% Fib retracement level of the upward move from the $66.94 swing low to the $78.78 high.

On the downside, the first major support sits near the $68.50 zone. A daily close below $68.50 could open the doors for a larger decline. The next major support is $65.50. Any more losses might send oil prices toward $60.00 in the coming days.

On the upside, the price might face resistance near the $72.2 level. The next major resistance is near the $72.80 zone. There is also a connecting bearish trend line forming with resistance at $72.80 on the same chart, above which the price may perhaps accelerate higher.

In the stated case, it could even visit the $76.00 resistance. Any more gains might call for a test of the $78.80 resistance zone in the near term.

Looking at Gold, the price is still showing a lot of positive signs and might aim for more upsides above the $2,670 level.

Economic Releases to Watch Today

- US Import Price Index for Sep 2024 (MoM) – Forecast -0.3%, versus -0.3% previous.

- US Export Price Index for Sep 2024 (MoM) – Forecast -0.4%, versus -0.7% previous.