Thematic funds appear to be here to stay.

Despite recent underperformance, they’ve grown in size, number, and prominence in every major fund market globally over the past five years.

These funds offer investors the opportunity to capitalize on emerging megatrends such as artificial intelligence, aging populations, and alternative energy, while mitigating the concentration risk of individual stock bets. However, these funds often come with higher costs, increased volatility, and unique complexities that require additional due diligence.

Below, we highlight some of the key takeaways from the latest installment of our Global Thematic Fund Landscape.

Thematic Assets Have Tumbled From 2021 Peaks

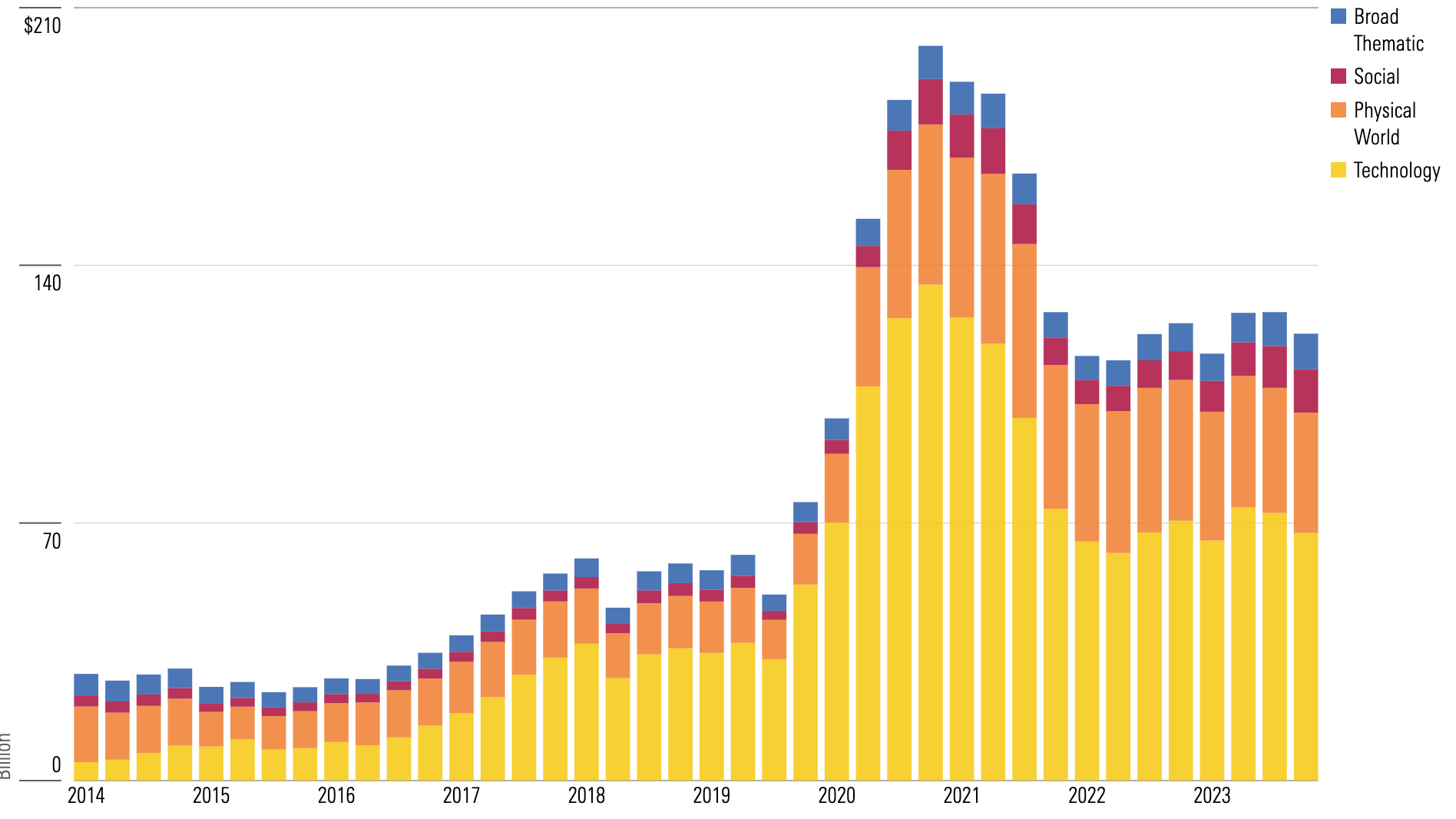

The last few years have been a roller-coaster ride for thematic assets.

As markets rebounded in the wake of the covid-19 turmoil, rock-bottom interest rates and the global rush to digitize provided a stiff tailwind for thematic funds, particularly those with a tech focus.

In the bull market from the end of first-quarter 2020 to the end of 2021, assets in US-domiciled thematic funds surged by more than 3.5 times, topping out at $200 billion in mid-2021. This asset growth was supported by net inflows of $86 billion over the same period.

This was followed, however, by the market crash of 2022, which hit thematic funds particularly hard. In the first half of 2022, thematic assets under management tumbled by almost one third. In the following two years, asset values stabilized despite net outflows of $17.5 billion.

Despite the roller-coaster ride to get there, assets in US-domiciled thematic funds still sat at $121 billion by mid-2024, double the AUM registered in 2019.

Thematic Funds in the US: An ETF Story

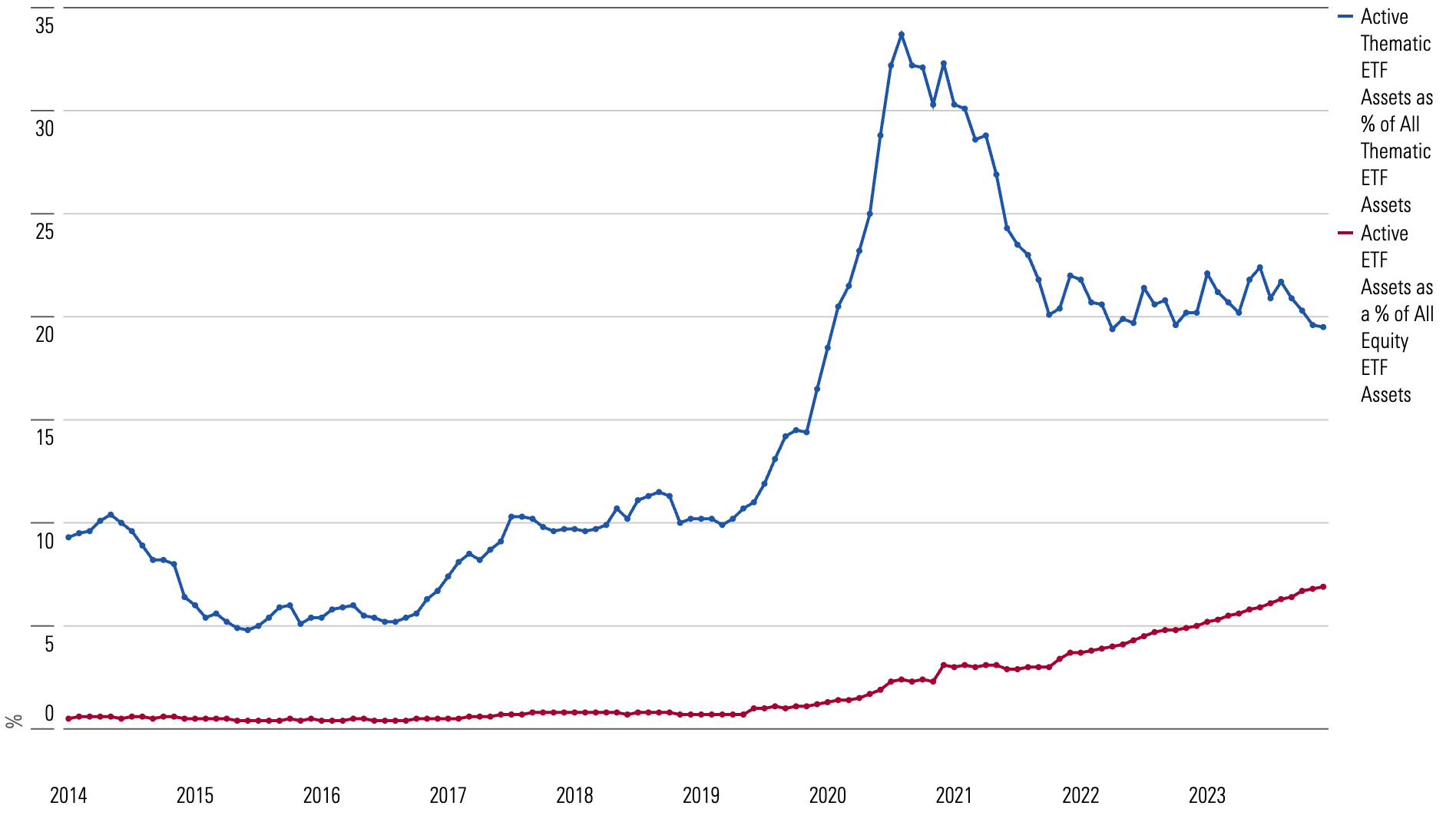

As of June 30, 2024, index funds controlled 70% of US-domiciled thematic fund assets. The evolution of thematic funds is closely tied to the rise of exchange-traded funds. Today, aside from two Calvert index funds (Calvert Global Water CFWAX and Calvert Global Energy Solutions CAEIX), all index-based thematic strategies are available in an ETF wrapper, reflecting the structure’s position as a focal point of passive product development.

ETFs have also become the wrapper of choice for many actively managed strategies. Thematic ETFs have been something of a trailblazer in this regard, with more than 10% of US thematic ETF assets sitting in actively managed strategies as early as 2014. This number spiked to around one third of thematic fund assets in 2021, thanks largely to the wild popularity of the ARK Invest suite of active ETFs, before dropping to around 20% today. As a comparison, despite the steadily growing popularity of active equity ETFs more broadly, they still only represent 7% of all US-domiciled equity ETF assets.

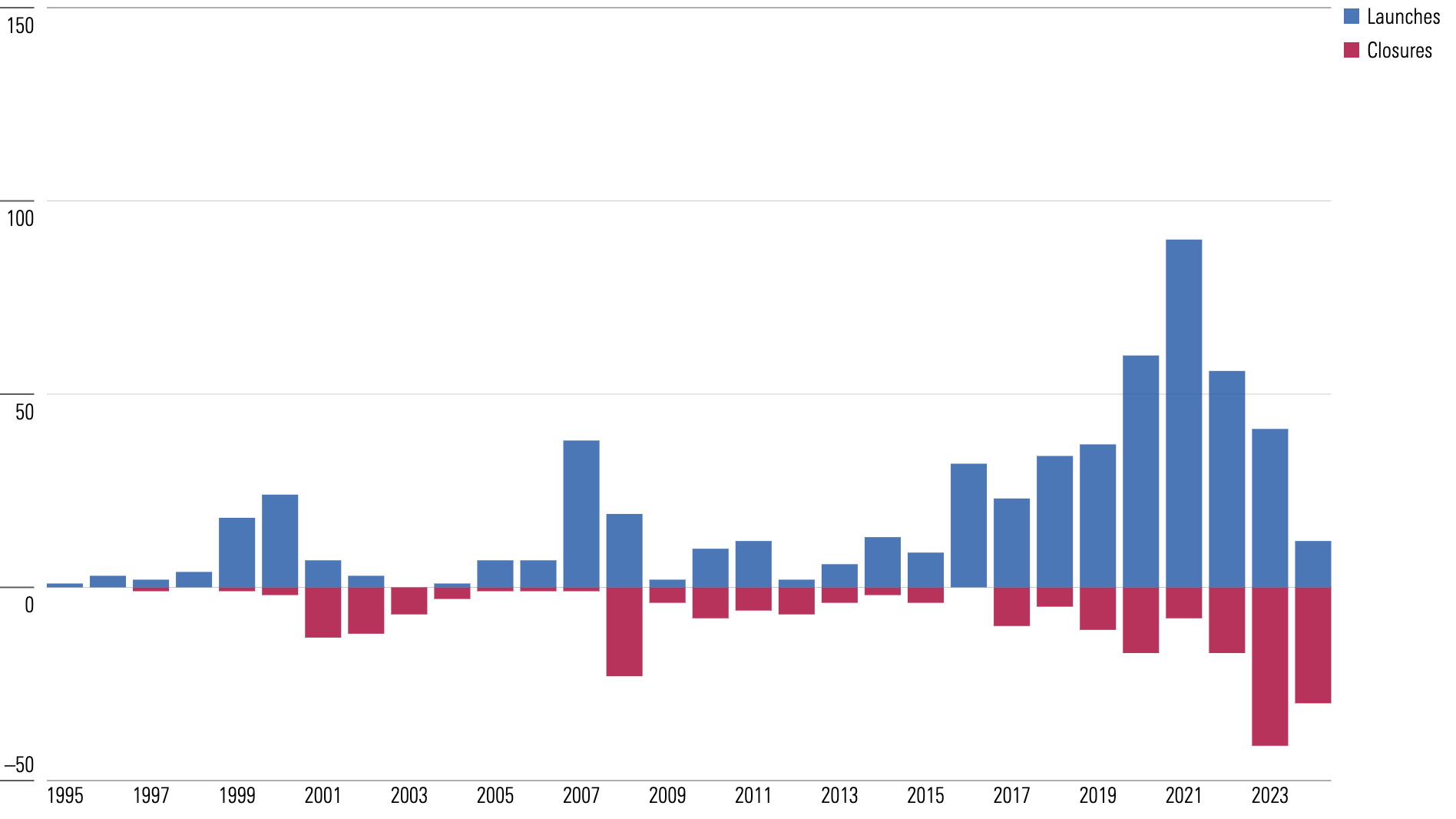

Thematic Fund Closures on Track to Outnumber Launches for the First Time Since 2008

In the US, the rate of new thematic launches has fallen steadily since its peak of 90 launches in 2021—and in the first half of 2024, closures outnumbered launches for the first time since 2008.

Historically, thematic fund launches have been positively correlated with the economy. As illustrated in the exhibit above, new strategies are often introduced in periods of strong market performance, like the new millennium and the mid-2000s, but dry up during downturns. The opposite also is true for closures, which tend to spike in market downturns.

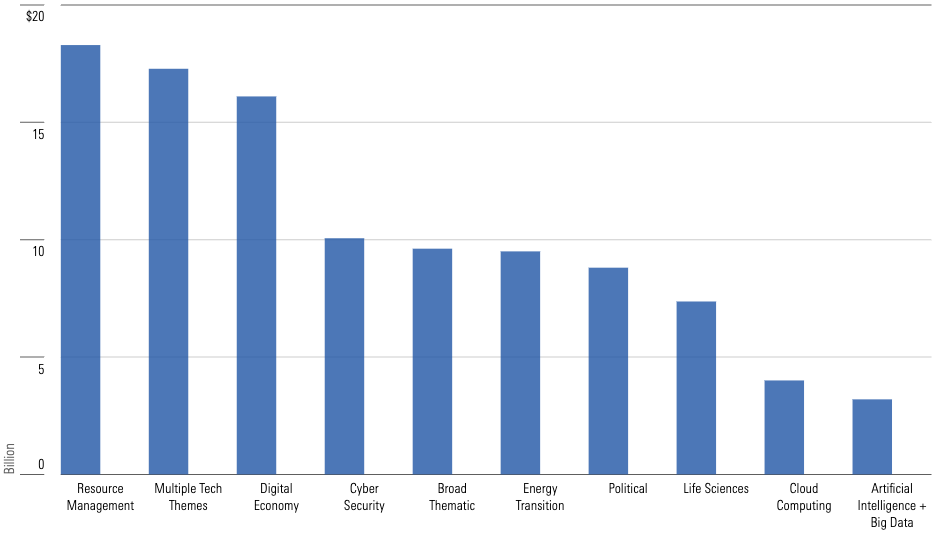

Resource Management Sees the Most Thematic Funds

As of June 30, 2024, resource management was the most popular theme. This grouping includes water funds, which have been a mainstay of thematic investing in the US for almost two decades.

The resource management banner also includes uranium funds, which have benefited from the energy disruption connected with the conflict in Ukraine, as Western governments scrambled to find viable alternatives to Russian natural gas.

Tech-oriented thematic funds remain the largest US broad theme grouping by a wide margin, despite steady net outflows since late 2021. Popular tech themes in the region include digital economy, cybersecurity, and cloud computing, as well as the multiple tech themes, a group that captures the still-prominent ARK Innovation ETF.

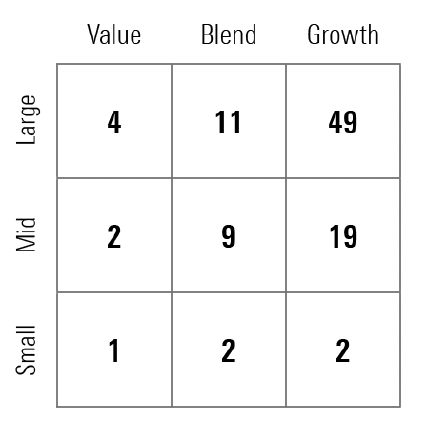

Most Thematic Funds Tilt Toward Growth

As of mid-2024, 66% of US thematic funds landed on the growth side of the Morningstar Style Box, while just 11% fell on the value side.

The US stands out from other regions in the percentage of funds that target the small-cap market segment. Fourteen percent of US thematic funds sit in the small-cap market segment of the style box, while this number sits at 5% globally.

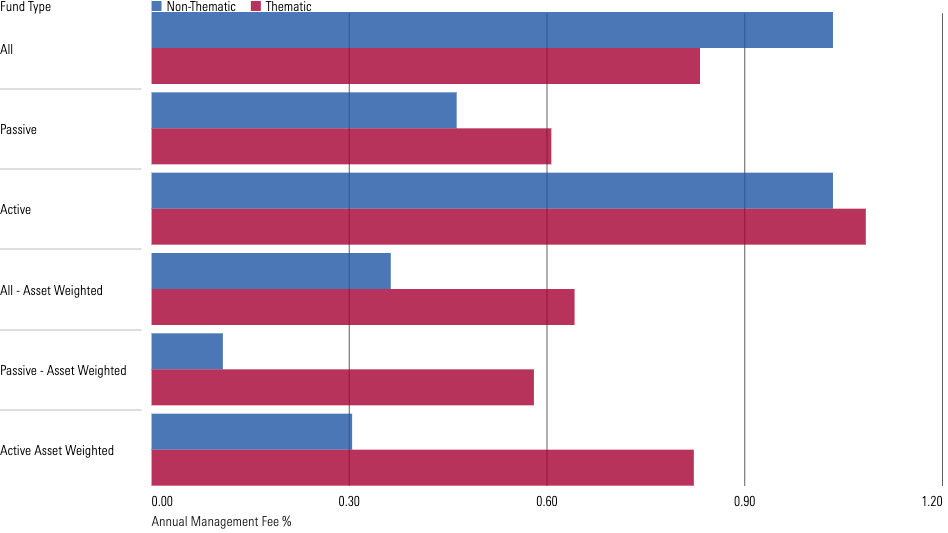

Thematic Funds Charge More

On average, both active and passive US thematic funds levy higher average management fees than their nonthematic counterparts. The difference is particularly striking when we look at asset-weighted fees, which highlight how popular thematic funds charge fees many multiples higher than those of the most popular nonthematic funds.

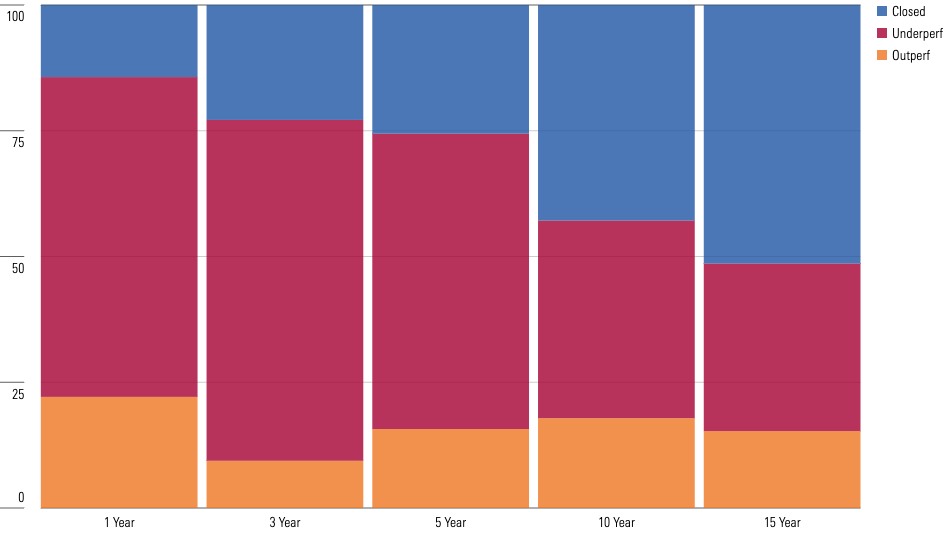

Most Thematic Funds Have Struggled to Outperform

In the year to mid-2024, 22% of thematic funds survived and outperformed global equities.

This figure drops to just 9% of three years, a period that fully captures the headwinds facing thematic funds since early 2022. At the same time, more than two thirds of thematic funds underperformed the Morningstar Global Target Market Exposure Index.

This is a sharp reversal from their stellar showing in 2020, highlighting the volatility that goes hand in hand with thematic investing. Over longer periods, even as closures ramp up, success rates have hovered between 14% and 18%.

Over longer periods, these funds’ high fees contribute to their relatively poor performance versus fee-less broad market indexes. High closure rates also contribute to poor ratios, with 55% of funds failing to survive the 15-year period to mid-2024.

The exhibit above details the difficulty investors face in selecting a thematic fund that will succeed over long periods.