A train to profit town or a graveyard for future returns? Investors in US stocks have been rewarded handsomely in recent years, thanks to the meteoric rise of hyper-scaling giants such as Nvidia, Alphabet and their peers in the so-called “Magnificent Seven”. But, as we begin 2025, is it time to take stock and remove some chips from the table?

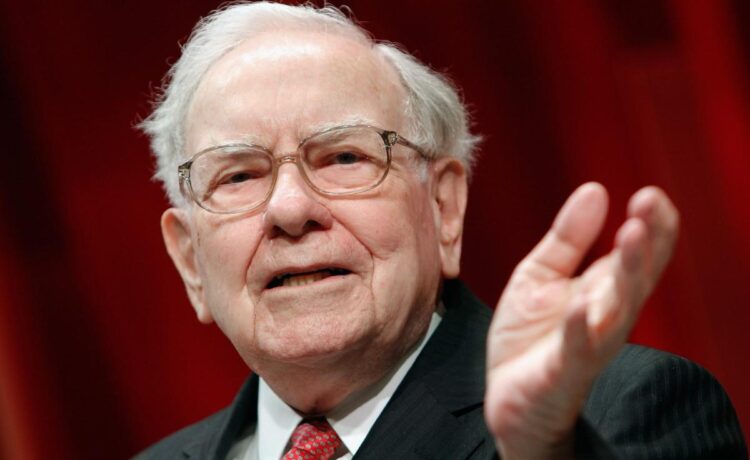

At least one credible market measure says it might be prudent to exercise caution. The Buffett Indicator, a trading signal conceived by legendary investor Warren Buffett, is currently at levels he has previously described as “playing with fire”.

The market gauge, which compares the total market capitalisation of US stocks to the country’s GDP, provides a measure of whether the stock market is overvalued relative to the total economy. With stock prices hitting record highs, concerns are growing as the indicator currently hovers around 200pc – a level last hit before the dotcom crash.

In the last quarter, Buffett’s Berkshire Hathaway was a net seller of stocks, while its cash reserves swelled to an all-time high of $320bn (£262bn) – and Buffett is not alone in signalling potential challenges ahead for runaway US indices.

Analysts at Goldman Sachs recently projected that the S&P 500’s impressive average annual return of 13pc over the past decade could dwindle to just 3pc through the next 10 years. The investment bank attributes this anticipated slowdown to the index’s high degree of concentration.

Goldman also predicts that the equal-weighted version of the S&P 500 could outpace the traditional capitalisation-weighted index by as much as 8 percentage points annually through 2034.

Global fund managers tend to have an objective view of geographic allocation. Among Britain’s best right now is James Thomson, manager of the Rathbones Global Opportunities fund. Despite the recent rally, Thomson is confident the US stock market will continue to set the tone for equities worldwide. He has more than two thirds of the portfolio invested state-side.

Thomson believes the US’s status as the home of innovation, adaptability and repeatable and mission-critical growth has created a unique climate for cultivating stock market performance. And the proof is in the pudding – currently the US has $6 trillion companies; Europe has none.

Ultimately, Thomson says the US leads on tax, business freedom, lower government spending and greater employment flexibility – all driven by its hunger to innovate. The nation also surpasses peers elsewhere, with higher research and development spend and double the venture capital spend as a percentage of GDP.