Some people make it a New Year’s resolution to improve their finances by investing in stocks. It’s a laudable goal, and to get started, it’s crucial to pick stocks that have the tools to perform well for decades to come. Corporations that fit this criteria are a rare breed, but they do exist.

Below, I’ll look at two companies in the healthcare sector: Eli Lilly (NYSE: LLY) and Vertex Pharmaceuticals (NASDAQ: VRTX). For those with $5,000 to invest that’s not being saved for routine expenses or emergencies, purchasing shares of these two companies could be a great move.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. See the 10 stocks »

1. Eli Lilly

Eli Lilly started 2024 on a strong note but struggled during the second half of the year. The drugmaker dealt with several headwinds, including the fact that it didn’t meet investors’ sky-high expectations.

The company’s third-quarter revenue grew by 20% year over year to $11.4 billion, a terrific performance for almost any other pharmaceutical company. However, Eli Lilly missed analyst estimates for the period, sending its stock price down. However, these short-term issues mean little for the company’s long-term prospects.

Over the past few years, Eli Lilly has demonstrated that it’s an innovative company. The drugmaker developed several breakthrough medicines, including tirzepatide, its famous diabetes and weight loss management treatment that was the first dual GLP-1/GIP to earn approval from the U.S. Food and Drug Administration. It also launched Kisunla, one of the few Alzheimer’s disease treatments to get the green light in the last two decades, earning this therapeutic area the label of the “graveyard” of investigational medicines.

These (and other) products should drive top-line growth for Eli Lilly well into the 2030s. The healthcare giant has several exciting late-stage pipeline candidates, too, especially in the weight loss market. Eli Lilly’s long, successful history of dominating the diabetes market is more important than any specific drug or pipeline program.

This doesn’t happen by accident. The company has created and fostered an internal culture of innovation honed by many successes (and failures) over decades. That’s what should allow Eli Lilly to continue producing billion-dollar drugs, excellent financial results, and market-beating performances.

For income-oriented investors, Eli Lilly has a solid dividend program, too. All things considered, the company is an excellent forever stock to invest in — and $5,000 will get you six shares with change left over.

2. Vertex Pharmaceuticals

Vertex Pharmaceuticals is well-known for developing and marketing drugs that treat cystic fibrosis (CF), a rare genetic condition that damages patients’ lungs. It was the first company to create approved medicines that target the underlying causes of CF, rather than just treating some symptoms of the disease. Since the approval of Vertex’s first CF medicine in 2012, no other company has cracked this code, despite plenty of them trying.

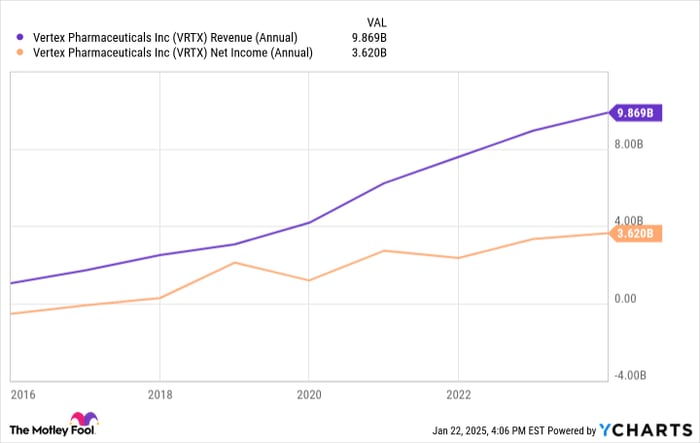

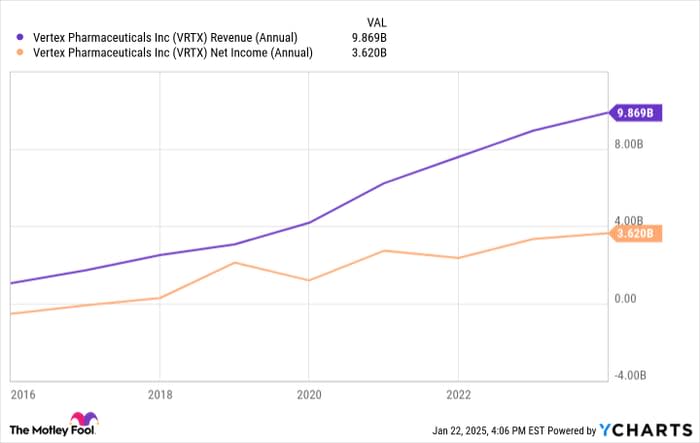

That’s no small feat. It’s no surprise, then, that Vertex’s revenue and earnings have grown rapidly in the past decade.

VRTX Revenue (Annual) data by YCharts.

The question for investors is whether Vertex’s work in CF was an anomaly — a one-off that the company can’t reproduce in other areas — but the evidence suggests otherwise. In 2023, Vertex earned approval for Casgevy, a gene-editing treatment for two rare blood-related conditions with very few treatment options.

Vertex Pharmaceuticals didn’t create Casgevy itself — that was CRISPR Therapeutics‘ accomplishment. However, that should mean little to investors. Penning lucrative deals with smaller drugmakers is a legitimate strategy that larger companies resort to all the time. Further, Vertex has exciting pipeline candidates of its own. It could earn approval for suzetrigine, a treatment for acute pain, by the end of the month.

Its late-stage pipeline features inaxaplin, a potential therapy for APOL-1-mediated kidney disease (there are currently no treatments that target its underlying causes). Vertex’s early-stage type 1 diabetes candidate is also making strides.

Vertex’s lineup will look transformed in five years, and the company should continue performing well beyond that time. It’s another excellent stock to buy and hold for good. At the stock’s current levels, investors can acquire 11 shares of the company with $5,000.

Should you invest $1,000 in Eli Lilly right now?

Before you buy stock in Eli Lilly, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Eli Lilly wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $874,051!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 21, 2025

Prosper Junior Bakiny has positions in Eli Lilly and Vertex Pharmaceuticals. The Motley Fool has positions in and recommends CRISPR Therapeutics and Vertex Pharmaceuticals. The Motley Fool has a disclosure policy.