serts

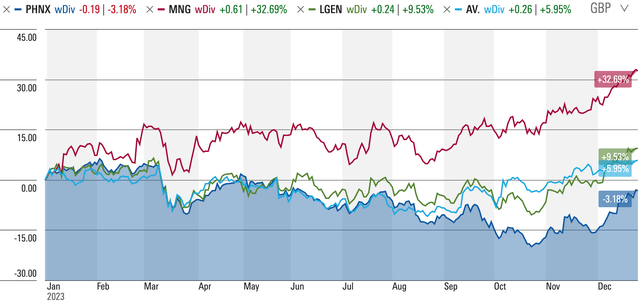

2023 was ultimately a pretty soft year for U.K. life & savings company Phoenix Group (OTCPK:PNXGF), whose shares fell slightly on a total return basis, underperforming British peers with similar business such as Aviva (OTCPK:AVVIY)(OTCPK:AIVAF), Legal & General (OTCPK:LGGNY)(OTCPK:LGGNF) and M&G (OTCPK:MGPUF).

Frustrating as this will have been for Phoenix’s shareholders, recent underperformance leaves it looking interesting, with the stock’s circa 10% dividend yield looking particularly enticing at this point. With the firm also poised to lay on some growth in the years ahead, these shares look like an intriguing pick for value investors, and I open on the name with a Buy rating.

With 12 million customers and around £270 billion in assets under administration (“AUA”), Phoenix is one of the U.K.’s largest life/savings businesses. Broadly speaking, the company’s business can be broken down into two areas: Heritage and Open. Heritage basically means managing existing policyholders who hold products that are no longer marketed to new customers, such as conventional ‘with-profits’ funds. Conversely, and as its name suggests, Open represents businesses that are open to new customers. This captures a wide range of activities, but it includes workplace and retail pensions, individual and bulk annuities, over-50s life insurance, equity release products and more. Heritage accounts for around 45% of AUM, with its various open-book businesses taking up the rest. The split is similar in terms of operating profit: Heritage was around 40% of the £299 million in adjusted operating profit before tax Phoenix posted in H1 (before corporate expenses), with Open at circa 60%.

As suggested, Heritage is basically a melting ice cube type of business. Over time, AUA would steadily decline without new customers as policy maturities and surrenders outweigh the continuing premiums from in-force contracts. Having said that, Phoenix is a consolidator of closed-book businesses from other companies looking to offload their legacy assets, so M&A can offset this natural run-off for some time. Indeed, Heritage AUA has been broadly flat over the past five years at circa £120 billion. Furthermore, the company estimates that U.K. Heritage assets stand at around £435 billion in total, so there is still scope for future M&A to continue this trend.

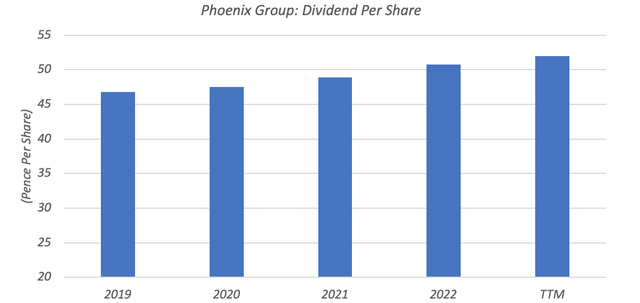

This is partly why Phoenix has been able to pay a modestly growing dividend over the years despite a large part of its business being in run-off. Circa 4% annualized dividend growth might not look all that high, but with its yield historically in the 7%-plus region, it can lead to good total returns for investors.

Data Source: Phoenix Group Holdings

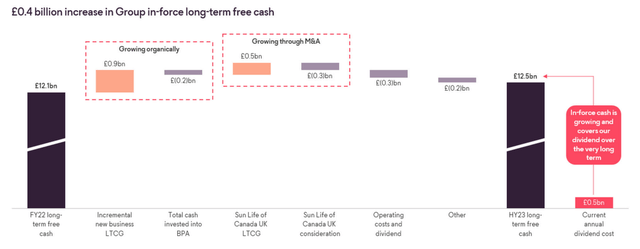

The other aspect to appreciate about Phoenix is that 2024 could represent an inflection point in terms of offsetting Heritage run-off with open new business. In H1, run-offs from Heritage totaled £4.6 billion from the start of the year. While this was only partially offset by £3.1 billion in net flows from open new business, the latter figure represents a 70% year-on-year increase. Management expects net funds flows to be positive in 2024, which would be the first time in the group’s history it achieves this. Furthermore, while net funds flow was negative in H1, M&A and market movements still led to an overall increase in AUA. Group in-force long-term free cash, which basically measures expected future cash generation from current in-force business (less net debt redemption and debt servicing costs) also rose in the period.

Source: Phoenix Group Holdings 1H 2023 Results

While Phoenix is transitioning to a more organic growth-led business model, its stock still offers a dividend yield more befitting of a no-growth company. Management declared an interim dividend of £0.26 per share, an increase of just under 5% year-on-year that brought the trailing-twelve-month payout to £0.52 per share. That maps to a yield of just under 10% given a closing 2023 share price of £5.34.

Although a high yield sometimes signifies a dividend in distress, cash generation looks ample to cover the payout. Phoenix’s operating companies remitted just under £900 million cash to the holding companies in H1, with management expecting the full-year figure to land at the top-end of its £1.3-1.4 billion guidance range. The annual dividend costs around £500 million in cash terms, so even after subtracting annual operating expenses (~£80 million) and interest on debt (~£250 million) there should be plenty left to fund the dividend with cash left to invest in growth and M&A.

Source: Phoenix Group Holdings

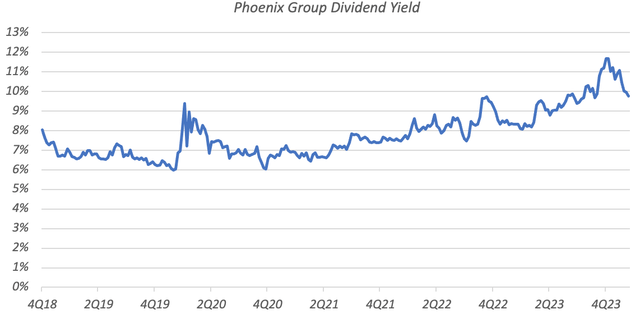

While the dividend looks covered and Phoenix is on track to ramp up organic growth, the stock’s valuation has only become cheaper. Modest dividend growth and 2023’s share price decline has seen its yield expand around 3ppt relative to the 2019-2022 average value of around 7%.

Source: Phoenix Group Holdings & Yahoo Finance, Author Calculations

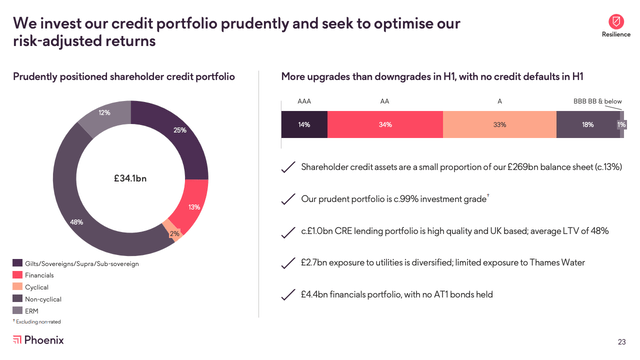

Now, this could well reflect the fact that interest rates and yields have risen sharply in that time, with a higher risk-free rate naturally having a similar impact on high yield stocks like Phoenix. Concerns surrounding the U.K. economy and credit risk in its investment portfolio could also be factor, with a significant portion of its portfolio invested in corporate bonds. On the flip side, rate hikes look done in the U.K. given the Bank of England has been holding steady in recent meetings, while the economy has been muddling through much better than many (including the BoE) expected.

Source: Phoenix Group Holdings 1H 2023 Results Presentation

That lays the ground for a compelling investment proposition here. Even without a tailwind, should the dividend yield gradually fall back down to the 7% area, a 10% base yield and a continuation of ~4% annualized dividend growth would be good for mid-teens annual returns. Risks here obviously include to the investment portfolio I mentioned above, plus insurance risk which would also apply to other life providers (e.g. mortality, lapse rates, annuitant longevity etc.). However, with returns potential already implying a significant margin of safety, Phoenix looks too cheap to ignore at this point, and I open on the stock with a Buy rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.