It’s a new year, and a new presidential administration, making this a good time to break out the crystal ball and try to see just where things are headed. Mary Ann Bartels, market strategist from Sanctuary Wealth, is doing just this – and she sees a potential ‘Golden Age of Investing’ taking shape over the next few years.

Specifically, she believes that the S&P 500 may reach as high as 13,000 by 2030 – which would translate to a gain of 113%. Backing her stance, Bartels says, “We believe this is fundamentally driven by the productivity gains from AI and a strong U.S. economy, aided by maintaining lower corporate taxes, lower interest rates, and the ongoing stimulus from the Biden Administration’s pieces of legislation that allows companies to continue to post strong earnings growth.”

Looking at stock market history, Bartels thinks we are in the “early stages of the boom and that the equity market will not peak until 2029-2030.”

Against this optimistic outlook, some of Wall Street’s top analysts – stock experts rated by TipRanks among the upper 5% of their peers – are running with the bullish view and weighing in on the stocks that investors should buy now. These are Buy-rated shares, and these 5-star analysts see double-digit upside in them. Let’s take a closer look.

Twilio, Inc. (TWLO)

We’ll start with Twilio, a tech and software firm operating in the cloud computing world. Twilio’s platform and tools allow its clients to make the best use of their data and their communications, to move their own customers along the path from sales to marketing to growth. The platform adds intelligence and security to customer service at every level, to drive a real-time, personalized experience through customer engagement. It’s business communications and marketing all in one, solving the problems that come along with our digital economy.

The success of Twilio’s platform can be seen in the numbers it generates. In 2023, the last full year with data available, the company’s software tools facilitated 19.9 billion voice calls, handled 167 billion messages sent or received, sent out 1.9 trillion emails, and verified over 4.8 billion customers. Twilio boasts that more than 300,000 brands trust its platform for customer engagement, including such major names as Shopify, Dell, and AirBnB. Twilio’s stock has seen strong gains recently, and the company has a market cap of almost $23 billion.

The strong recent gains have come on the strength of Twilio’s AI tools. The company has integrated AI tech into its platform in several modes, most prominently in the form of Assistants that allow users to automate platform functions.

A quality product and strong demand are typically the ingredients of a successful company, and Twilio has seen both revenues and earnings trend upwards in recent years. The company’s 3Q24 quarterly report, the last released, showed a top line of $1.13 billion, up 10% year-over-year and beating the forecast by $40 million. The EPS figure, $1.02 by non-GAAP measures, was 16 cents per share better than had been expected.

For 5-star analyst Kash Rangan of Goldman Sachs, key points here are Twilio’s record of recent successes and its ability to continue delivering for investors.

“Following multiple years of growth compression and several strategic actions, we believe Twilio is now hitting an inflection point both in terms of narrative and fundamentals,” Rangan opined. “Twilio’s major cost reduction initiatives and ongoing efficiency measures support strong FCF generation ahead, complemented by our view for an inflecting growth profile. We believe Twilio can observe a positive revision cycle on both top and bottom-line against a conservative initial CY25 guide of +7-8% with usage trends inflecting and growth accelerating to >10% in F2H24 (vs. +7% organic in F1H)… Twilio’s turnaround story is firmly underway with potential for solid upside to Revenue/FCF in CY25 at what we view to be a still compelling entry point of 21x EV/FCF (CY26).”

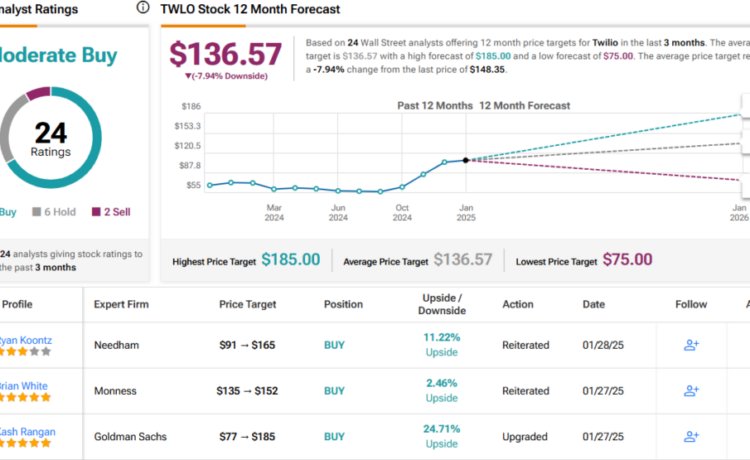

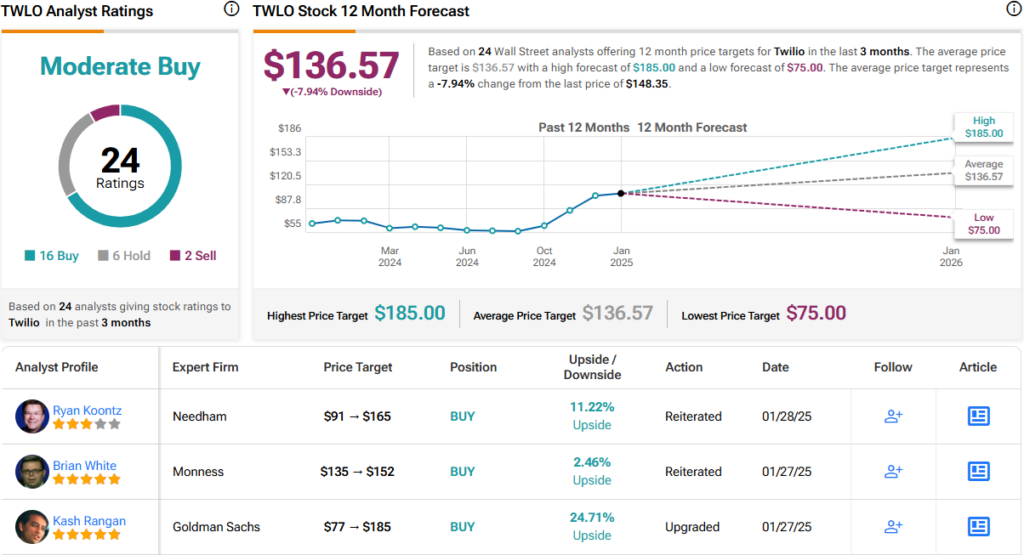

Rangan’s comments back up his Buy rating on TWLO shares, while his $185 price target points toward a gain of 26% on the one-year horizon. (To watch Rangan’s track record, click here)

Overall, Twilio holds a Moderate Buy consensus rating, derived from 24 recent analyst reviews: 16 Buys, 6 Holds, and 2 Sells. That said, at $148.35, the stock has surpassed its average price target of $136.57, implying a potential 8% downside in the near term. It will be interesting to see whether analysts downgrade their ratings or update their targets shortly. (See TWLO stock forecast)

Semtech Corporation (SMTC)

Next on our list is Semtech, one of the smaller semiconductor chip companies – but one with a twist. Semtech specializes in developing chips for use in IoT, mobile devices, and data centers – in short, the company focuses on combining high performance with mobility, backed up by reliable connections to strong data centers. Semtech describes itself as promoting ‘smaller, faster, and smarter electronics,’ meeting the needs of both consumers and businesses.

Towards this end, Semtech has put together a product line to meet the needs of wireless RF, circuit protection, signal integrity, broadcast video, professional AV, cellular IoT solutions, and power management – all applications involved in mobile connectivity. Semtech’s work is deeply connected to some of the fastest-growing areas in the electronics field, and is at the leading edge of mobile connectivity.

No tech company can ignore AI, and Semtech has been making moves to enter that rapidly expanding market. The company has put several AI-capable products on the market, mainly for data center networking.

Semtech cannot compare to the chip industry giants in size – it has a market cap of $5.8 billion – but it has seen both earnings and revenues take an upward trend in recent quarters. The last quarterly report, covering fiscal 3Q25, showed a top line of $236.8 million, up 18% year-over-year and $4.74 million better than had been anticipated. The company’s bottom line figure, a non-GAAP EPS of 26 cents, was 3 cents over expectations. In addition, the company reported record net sales in its data center segment, which were up 58% quarter-over-quarter to reach $43.1 million.

This stock has caught the eye of UBS analyst Timothy Arcuri, who is rated #8 overall by TipRanks. Arcuri first takes note of Semtech’s connection to AI, writing, “Semtech is an analog company making inroads into AI data center networking thanks to a key content win for SMTC’s CopperEdge product in Nvidia’s Blackwell platform, and Nvidia is pushing hard to ramp a similar fiber product (LPO) later this year. Blackwell’s CopperEdge SAM alone is $100MM, while AMD/hyperscalers and an estimated 30MM annual LPO units should be additive to this. Beyond the data center, Semtech’s other analog businesses should see reasonable smartphone units and what should be a strong year of Industrial cyclical recovery.”

Looking ahead, the high-ranked analyst goes on to explain why he believes that SMTC shares are primed for gains: “Street estimates for $76/103MM of F25/F26 Signal Integrity segment growth look low (UBSe $212/220MM), while a recent refinancing is not yet reflected in consensus and a possible portfolio rationalization could be the impetus for the market to reconsider Semtech’s valuation. In all, we think estimates and multiples are on their way up…”

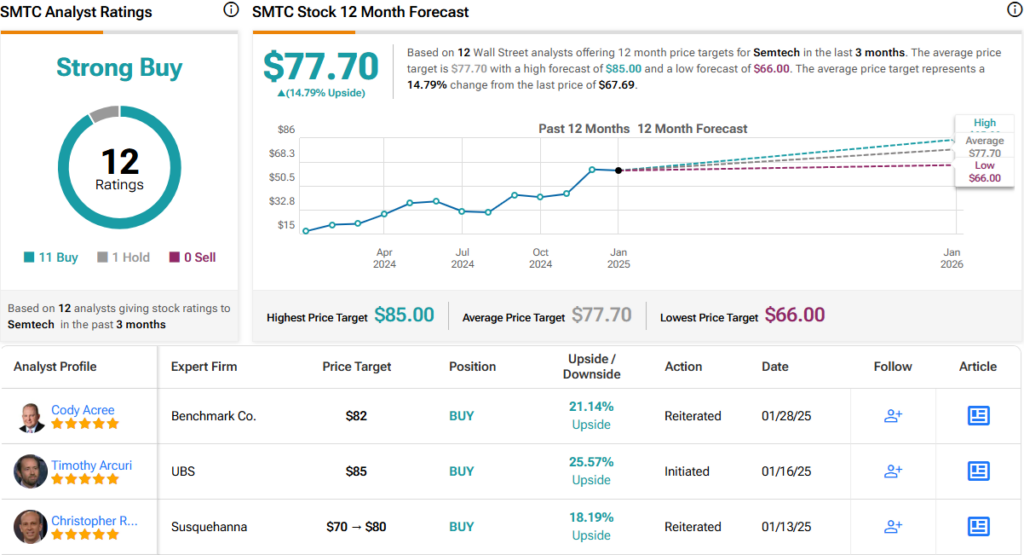

Arcuri puts a Buy rating on Semtech’s stock and complements that with a one-year price target of $85, suggesting a gain of 27.5% for the shares. (To watch Arcuri’s track record, click here)

All in all, among 12 recent analyst reviews, the sentiment heavily favors the bulls, with an 11-to-1 split in favor of Buy over Hold, resulting in a Strong Buy consensus rating. Currently trading at $67.69, the stock carries an average price target of $77.70, suggesting a 15% gain over the coming year. (See SMTC stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Source link