Cboe Global Markets (CBOE) is planning to launch 24-hour trading for U.S. equities on its Cboe EDGX Equities Exchange. This move will be done to meet the growing demand from global investors, particularly those in Asia Pacific markets, who want more access to U.S. markets. By extending trading hours, Cboe hopes to provide investors with more flexibility and opportunities to react to global events and market movements.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks’ Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts’ recommendations with Your Smart Portfolio

According to Oliver Sung, Cboe’s Head of North American Equities, the company has received feedback from market participants worldwide, which highlights the need for extended trading hours. Indeed, investors in countries like Hong Kong, Japan, Korea, Singapore, and Australia are eager to participate in U.S. markets, and 24-hour trading would enable them to do so more easily. This development is part of Cboe’s efforts to improve its services and provide more value to its customers.

In order to offer 24-hour trading, Cboe will seek approval from the Securities and Exchange Commission. Currently, the exchange offers extended trading hours from 4 am to 8 pm ET, Monday through Friday. This follows a similar proposal by the New York Stock Exchange (ICE) in October to extend trading hours to 22 hours for securities such as U.S. stocks, exchange-traded funds, and closed-end funds.

Is CBOE Stock a Buy?

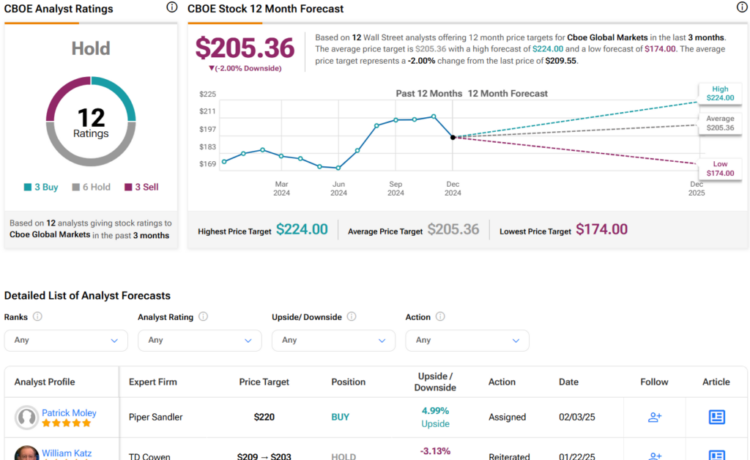

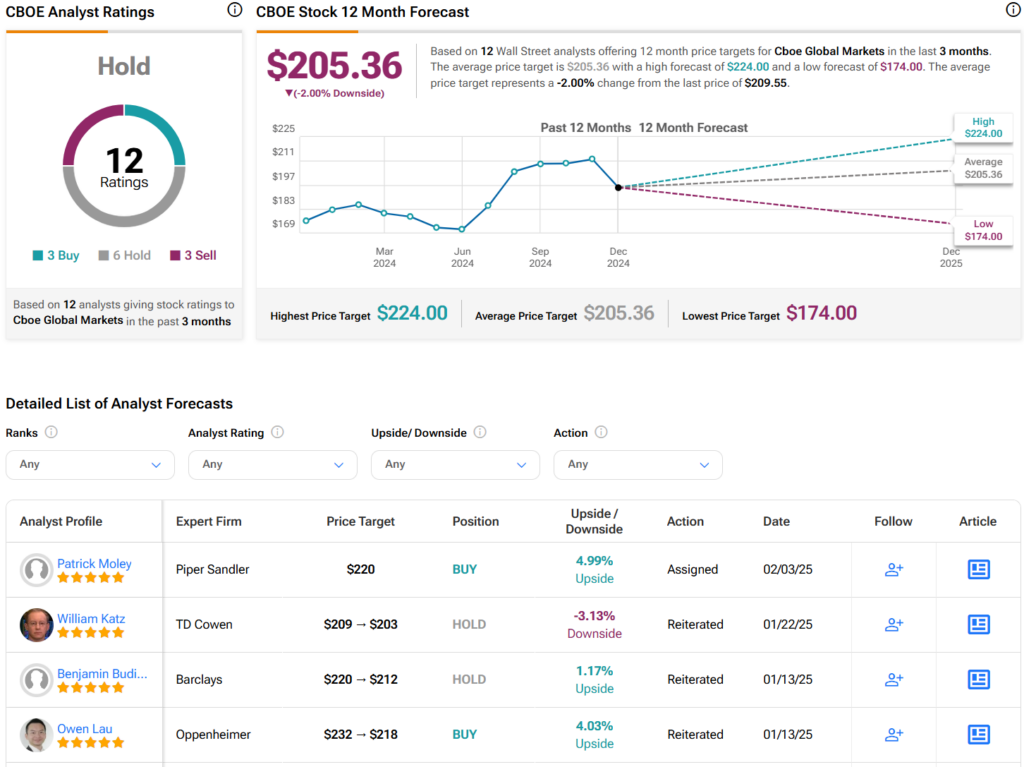

Turning to Wall Street, analysts have a Hold consensus rating on CBOE stock based on three Buys, six Holds, and three Sells assigned in the past three months, as indicated by the graphic below. After a 17% rally in its share price over the past year, the average CBOE price target of $205.36 per share implies 2% downside risk.

Source link