Tom Stevenson is investment director at Fidelity International.

A £100 global market investment made in the week of the first Covid-19 lockdown in March 2020 would now be worth £230.

The start of the pandemic was unsurprisingly accompanied by a stock market slump, and the size of the reward demonstrates the recovery since those lows.

The ‘stay at home’ order turns out to have signalled a rare buying opportunity for investors.

Here are my six key takeaways from investment trends since the pandemic.

Tom Stevenson: Time is a great healer for investors

Lesson one: Contrarian opportunities require courage and timing

During market turmoil, the contrarian approach can offer opportunities to investors – but it’s not for the faint-hearted.

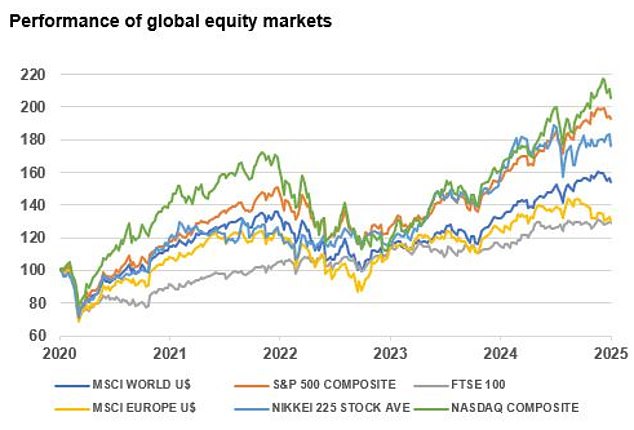

While global shares dropped 33 per cent in early 2020, they more than doubled in value within five years.

To benefit from this, however, would have required perfect timing – which is nearly impossible.

The market rebounded quickly, recovering its January 2020 levels by August that year.

The hardest thing about market timing is less knowing when to get out and more having the courage to get back in again before the moment has passed.

Source: Rebase MSCI World U$ to 100, 20/03/2020-10/01/2025, LSEG Datastream

Lesson two: Time heals market wounds

The pandemic underscored the long-term resilience of the stock market and proved that time is a great healer for investors.

Despite the unprecedented turbulence, a global stock market investment made in January 2020 – which was not even the bottom of the pandemic slump – would now be 54 per cent higher.

The S&P index is up 92 per cent over five years, the Nasdaq is 106 per cent per cent higher and Japan’s Nikkei is up 81 per cent.

Even a poorly timed investment at the pandemic’s onset would have recovered significantly over time.

Source: 14/01/2020-14/01/2025, LSEG Datastream

Lesson three: It’s not easy to pick winners

The pandemic exposed the difficulty of selecting sustainable winners in the stock market.

Early ‘stay-at-home’ favourites like Peloton and Zoom saw significant rises but failed to maintain their momentum.

Peloton, which surged fivefold in 2020, has since plummeted to a third of its January 2020 value. Zoom, meanwhile, has delivered no net returns over the same period.

While these stocks were just flashes in the pan, some beaten-down stocks like British Airways owner IAG have staged comebacks, tripling in value as travel recovered.

Others, like British Land, remain significantly below pre-pandemic levels as remote working reshaped demand for office space.

Source: Rebase to 100, 14/01/2020-14/01/2025, LSEG Datastream

Lesson four: Diversification has been a mixed blessing

The next lesson from Covid is that diversification can help – a bit.

Diversification has offered mixed results in recent years as the traditional way of balancing a portfolio with a mixture of bonds and equities failed during the pandemic. Bonds often moved in tandem with shares, diluting returns.

Geographic diversification, however, proved more helpful. For example, the FTSE 100’s gains in 2022 cushioned the blow of Wall Street’s losses.

Source: Rebase to 100, S&P 500 Composite, FTSE 100, Bloomberg Global Aggregate USD. 14/01/2020-14/01/2025, LSEG Datastream

Lesson five: Steady investing can smooth the ride

The past five years have shown the value of regular investing during times of volatility.

If you had invested £1,200 as a lump sum five years ago, it would have grown by 15 per cent in the first year.

But if you had spread that investment across 12 equal monthly instalments during the pandemic’s early days, you’d have achieved a 21 per cent return.

This approach doesn’t maximise returns in rising markets but can shield investors from severe market drops, keeping them in a position for future recovery.

Source: MSCI World U$, 13/01/2020 – 13/01/2021, LSEG Datastream

Lesson six: Stay on course to achieve long-term financial goals

The years since the pandemic started have been a rollercoaster for investors, demonstrating the importance of patience, diversification, and disciplined investing.

While predicting market movements is impossible, and past performance is not a reliable indicator of future returns, staying invested and maintaining a long-term perspective can help you navigate the uncertainties ahead.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading fees

Trading 212

Trading 212

Free dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.