Gold price eased on Wednesday after hitting a series of new record highs in past 24 hours

The latest bullish acceleration was sparked on as growing concerns about the negative impact of a trade war between US and China after two world’s largest economies imposed tariffs on each other.

Investors fear that Trump’s tariffs could spark stronger rise in inflation that would result in slowdown in still fragile economic growth and raise threats of global recession.

Today’s dip was shallow so far, as sentiment remains firmly bullish, making traders fear of taking any stronger action in profit-taking.

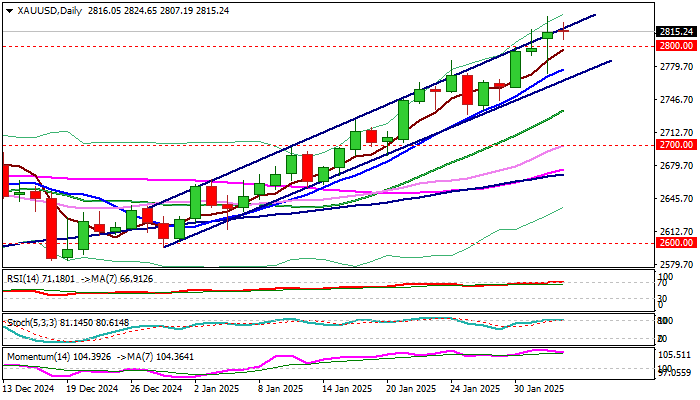

However, overbought conditions on 4-hr, daily and weekly chart warn that the price may take some time for consolidation before attacking next targets at $2886/$2900 (Fibo 138.2% projection / round-figure).

Initial supports at $2850/40 (Broken Fibo projection / today’s low) should ideally contain, with bullish bias above broken bull-channel trendline ($2823)

Increased safe haven demand is likely to persist in current circumstances and add to bullish near-term outlook.

Res: 2886; 2900; 2946; 2983

Sup: 2860; 2850; 2840; 2823