Bulk-buying, bargain-hunting shoppers propelled Costco Wholesale (NASDAQ: COST) to a record-breaking 2024 for sales and earnings. The discount retailer is benefiting from a resilient economic backdrop while capitalizing on an ongoing e-commerce expansion. Its latest update highlighted further growth momentum to kick off 2025.

With the stock up 47% over the past year and currently trading at an all-time high, can the rally keep going? Let’s discuss what to do with shares of Costco Wholesale.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

The case to buy or hold Costco stock

With 139 million cardholders worldwide, Costco’s members-only store concept remains massively popular. Its loyal customer base is attracted to low prices on a variety of items, from everyday essentials to jewelry, electronics, and furniture. Access to exclusive deals, including discounted gasoline, travel services, and an in-store pharmacy, means that for many people, the annual membership fee is a no-brainer.

Costco’s ability to pull in new members and keep them within its retail ecosystem highlights the power of its operating model and the attraction of the stock as a possible investment.

Image source: Getty Images.

The recent trends have been impressive. Costco recently reported its January results (for the period ended Feb. 2), with net sales up 9.2% year over year and total company comparable store sales increasing by 9.8% during the month, excluding the impact of changes in gasoline prices and foreign exchange.

Perhaps the bigger story has been Costco’s success at building out its e-commerce business, with segment comparable sales 13.6% higher than the same month last year. This dynamic is important as it represents a new growth driver, allowing Costco to leverage its extensive logistics infrastructure with a more diversified merchandise mix to reach a wider consumer market online.

According to Wall Street estimates, Costco is on track to generate a solid 7% revenue increase this year and in 2026. The runway includes the hike to the U.S. and Canada membership pricing announced last year, lifting the top line and profitability margins as the plans renew at a modestly higher rate. Costco intends to open 20 new warehouses in the remainder of fiscal 2025 as a tailwind for new memberships. The forecast for earnings per share (EPS) is even stronger, climbing at around a 10% annual rate for the next two years.

Investors convinced that Costco is well-positioned to continue its path of steady, profitable growth as it expands internationally have plenty of reasons to buy the stock.

|

Metric |

2025 Estimate |

2026 Estimate |

|---|---|---|

|

Revenue (in billions) |

$272.8 |

$291.9 |

|

Revenue growth (YOY) |

7.2% |

7% |

|

Earnings per share (EPS) |

$18.18 |

$19.98 |

|

EPS growth (YOY) |

9.8% |

9.9% |

Data source: Yahoo Finance. YOY = year over year.

The case to sell Costco stock

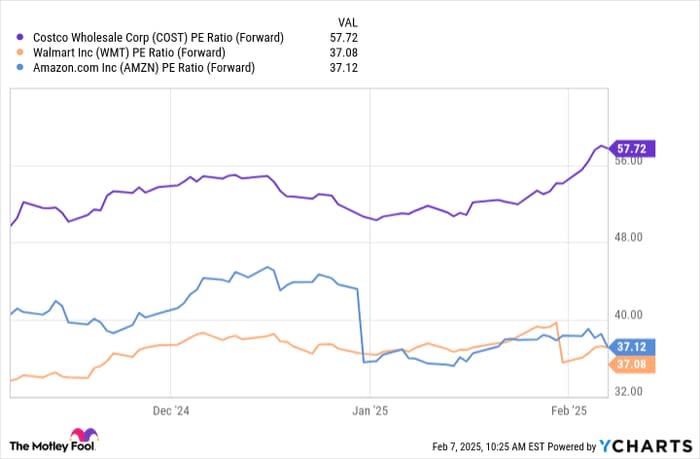

There’s a lot to like about Costco, with all indications that its outlook is as strong as ever, supported by solid fundamentals. On the other hand, the apparent optimism toward the company’s retail dominance has translated directly into an objectively expensive valuation. Shares of Costco are trading at 58 times its consensus 2025 EPS estimate, a level well above peers like Walmart and Amazon, each with a forward P/E ratio closer to 37.

The market appears to be assigning Costco an earnings premium based precisely on its membership-based model and consistent execution history. While this metric alone doesn’t mean the stock needs to sell off anytime soon, the concern is that it could at least limit the upside in the share price against already high expectations. All this is in an environment that faces other uncertainties with Costco being exposed to broader macroeconomic conditions. While details have not been confirmed, proposed trade tariffs by the Trump administration have the potential to generate some supply chain disruptions or inflationary cost pressures as an operating headwind.

Investors who believe Costco will be challenged to achieve its financial targets and see room for membership performance metrics to slow going forward could consider selling or at least avoiding the stock.

COST PE Ratio (Forward) data by YCharts

Decision time

I believe shares of Costco are just too pricey to buy today with conviction. There are likely enough strong points for shareholders to continue holding, but investors sitting on the sidelines may find more compelling opportunities elsewhere in the stock market. Nevertheless, this is one stock to keep on your radar for the possibility of a market correction that might offer a chance to acquire shares at a lower and more attractive price.

Should you invest $1,000 in Costco Wholesale right now?

Before you buy stock in Costco Wholesale, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Costco Wholesale wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $795,728!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 7, 2025

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Dan Victor has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Costco Wholesale, and Walmart. The Motley Fool has a disclosure policy.