My outlook for the silver market is bullish, largely driven by the Federal Reserve’s intent to stimulate the economy through monetary policy adjustments in 2024.

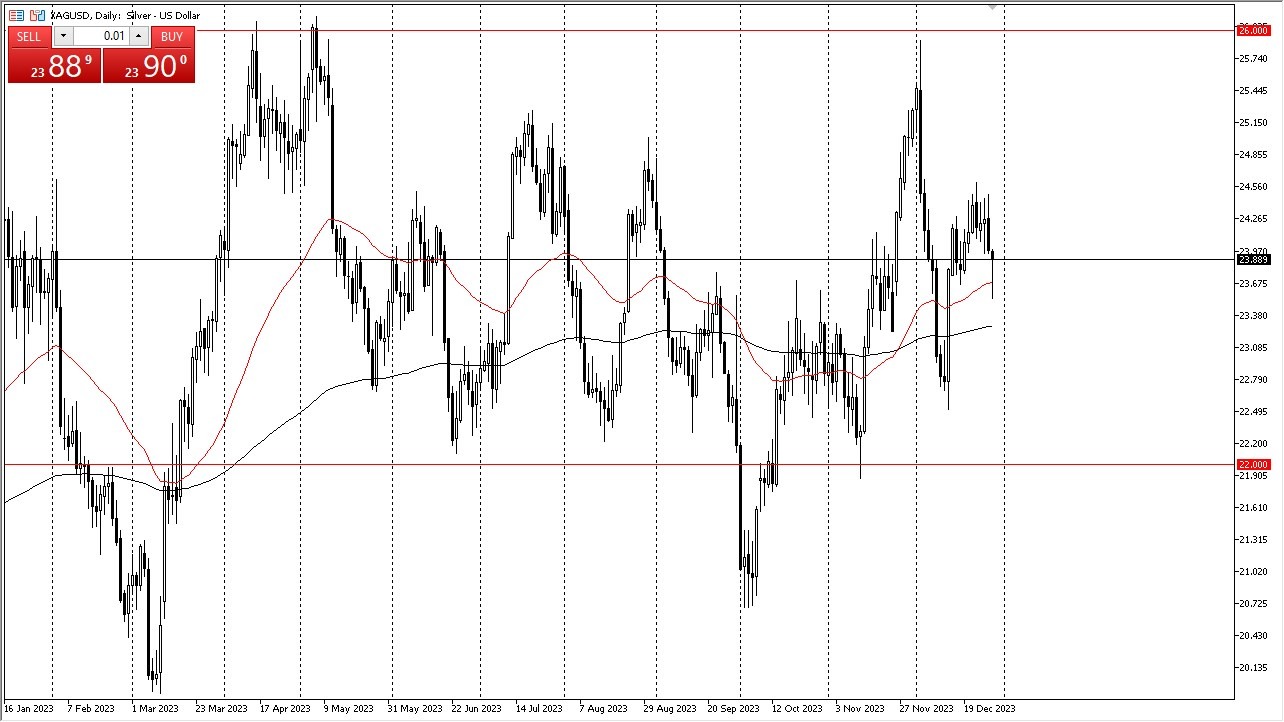

- A slight pullback occurred on Friday in the silver markets. Nevertheless, the 50-day Exponential Moving Average appears to be exerting a stabilizing influence on the market.

- We currently find ourselves within a region that has previously served as both support and resistance, which is characteristic of the prevailing choppiness in the markets.

- This behavior aligns with the current time of year and the backdrop of significant volatility witnessed over recent months.

Forex Brokers We Recommend in Your Region

It is important to acknowledge that the market’s current choppiness can be attributed to a lack of liquidity, a factor that commonly affects market dynamics during this period. Consequently, the price action on Friday should not be overly emphasized. Instead, it is more indicative of the market’s ongoing effort to establish a trading range.

Given this context, I find the notion of purchasing on dips appealing, but I would prefer to witness a rebound before expressing enthusiasm. The well-established negative correlation between silver and US interest rates underscores the importance of monitoring the 10-year yield in the United States. A potential drop in US rates could spark heightened interest in silver.

Silver holds a unique position among metals, as it is not solely classified as a precious metal but also as an industrial one. Unlike gold, silver’s demand is influenced by factors beyond its status as a store of value. Strong economic data, for instance, can stimulate demand for silver, particularly within industries such as electronics and green technology.

My outlook for the silver market is bullish, largely driven by the Federal Reserve’s intent to stimulate the economy through monetary policy adjustments in 2024. However, it is essential to acknowledge the existence of a formidable resistance level at $26. At present, the 200-day EMA, located just below the 50-day EMA, appears to define the lower boundary of the overarching trend. A breakdown below this level would necessitate a reevaluation of longer-term expectations for the market.

In the end, the silver market experienced a modest pullback on Friday, with the 50-day EMA playing a stabilizing role. Prevailing market choppiness is largely attributed to a lack of liquidity, a common feature during this period. Consequently, the price action should be viewed as part of the ongoing effort to establish a trading range. Purchasing on dips is a plausible strategy, contingent upon observing a rebound. The correlation with US interest rates remains a pivotal factor, and economic data can influence silver demand, particularly in industrial applications. A bullish outlook for silver is driven by the Federal Reserve’s accommodative monetary policy in 2024, while a notable resistance level is observed at $26.

Ready to trade our Forex daily analysis and predictions? Here’s a list of regulated forex brokers to choose from.

Ready to trade our Forex daily analysis and predictions? Here’s a list of regulated forex brokers to choose from.