Investing in an exchange-traded fund (ETF) can be a good move for long-term investors to consider today. It’s an easy way to just have a balanced position in the overall market.

However, there’s one problem these days. If you invest in an ETF which simply mirrors the S&P 500, you’ll often find that it isn’t all that balanced. The most valuable, and potentially most expensive stocks, including the “Magnificent Seven,” make up a big chunk of many funds.

To reduce your risk and exposure to any individual stock, you may want to consider investing in a fund which includes the stocks within the S&P 500 index but that doesn’t weight them based on market capitalization. This can be a safer way to invest.

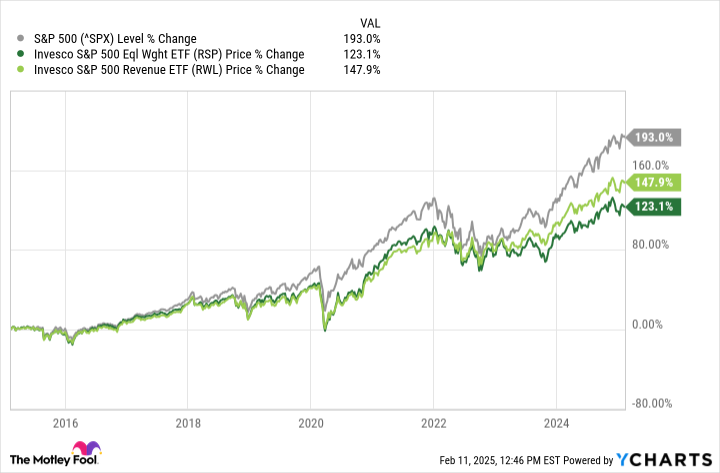

Two options you may want to consider are the Invesco S&P 500 Equal Weight ETF (RSP 0.07%) and the Invesco S&P 500 Revenue ETF (RWL -0.03%). While these two funds have underperformed the index over the past decade, here’s why they can be great investments to hold today.

Invesco S&P 500 Equal Weight ETF

As its name suggests, the Equal Weight ETF gives all S&P 500 stocks an equal weighting in its portfolio when the fund does its quarterly rebalancing. And that’s evident when you look at the makeup of the fund, with Palantir Technologies being its largest holding today but still only accounting for 0.33% of the entire fund’s weight.

The fund charges an expense ratio of 0.2% and provides investors with a balanced position in the S&P 500. And tech stocks, which can be especially volatile, make up only 14% of all of the ETF’s holdings. The downside for investors is that all this diversification can lead to much more muted gains, especially when the market is performing well. And that’s why it’s not all that surprising that it hasn’t outperformed the index, which has benefited from top growth and tech stocks amassing significant gains in recent years.

The Invesco S&P 500 Equal Weight fund is more appropriate for risk-averse investors who want exposure to the index as a whole but want to avoid the downside risk that may come with relying heavily on a handful of expensive stocks.

Invesco S&P 500 Revenue ETF

Another ETF for investors to consider is the Invesco S&P 500 Revenue ETF, which weights its position in stocks based on their revenue. Its expense ratio is higher at 0.39% but in return, investors get a weighting that isn’t equal across the board and isn’t based on market cap.

This kind of weighting allows big companies to account for more significant allocations within the fund than with the Equal Weight ETF. The top three holdings here are Walmart, Amazon, and UnitedHealth Group. Collectively, those investments make up 10% of the fund’s total weight.

Within this fund, tech stocks have an even lower representation, accounting for just over 10% of overall holdings. It puts into perspective just how much of a premium investors often pay for tech stocks based on revenue. They aren’t even one of the top three sectors in this ETF. Instead, the top sectors in the fund are healthcare (19%) followed by financials (16%) and consumer staples (13%).

For investors who want diversification but perhaps some weighting based on size, the Invesco S&P 500 Revenue ETF can be a suitable option to consider. While its expenses are a bit higher, this can give investors potentially a better mix of long-term growth and safety.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Palantir Technologies, and Walmart. The Motley Fool recommends UnitedHealth Group. The Motley Fool has a disclosure policy.