The EUR/USD pair demonstrated resilience in early European trading hours on Thursday, recovering ground to hover near 1.0425 as the US Dollar’s strength began to wane. This modest recovery comes amid a complex backdrop of geopolitical tensions and policy developments that continue to influence currency markets.

Market dynamics and policy concerns

The pair’s recovery faces potential headwinds from multiple directions, most notably from US President Donald Trump’s recent trade policy announcements. Trump’s declaration of possible 25% tariffs on car imports, scheduled for implementation as early as April 2, has introduced fresh uncertainty into the market.

The scope of these protectionist measures extends beyond the automotive sector, with similar duties being considered for pharmaceutical and semiconductor imports, adding another layer of complexity to the currency pair’s trajectory.

The European side of the equation presents its own challenges, with ECB policymaker Fabio Panetta’s recent comments highlighting persistent weakness in the Eurozone economy. This economic fragility could potentially limit the Euro’s ability to maintain sustained gains against its major counterparts. Meanwhile, the Federal Reserve’s minutes from the January policy meeting are drawing attention, though market expectations for any immediate rate adjustments remain muted.

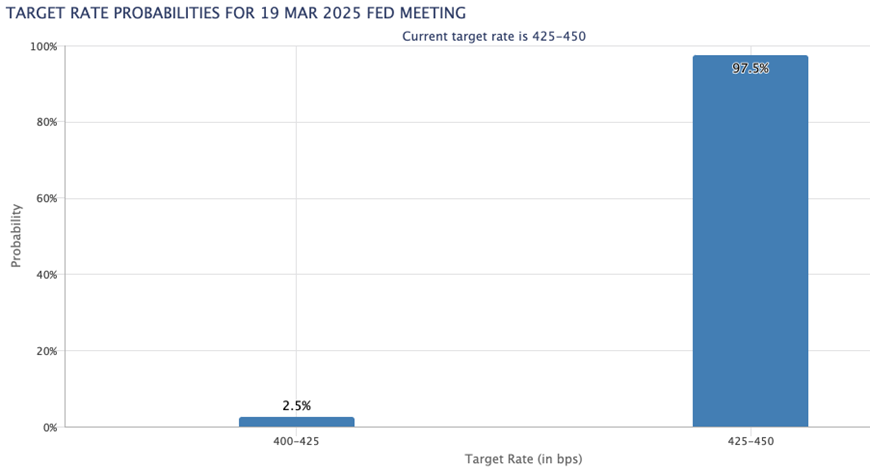

According to the CME FedWatch Tool, the probability of a March rate cut is virtually non-existent.

Source: CME Group

Market sentiment appears cautiously optimistic, with US stock index futures showing modest gains. This positive risk sentiment, coupled with a slight dip in US Treasury yields, could provide some support for the EUR/USD pair in the near term. The German yields have shown notable strength, maintaining their upward trajectory and suggesting potential for further gains. However, the overall market movement may remain constrained within a range, influenced by the interplay of these various factors and the broader risk environment.

Technical outlook

At the time of writing, the pair is showing some resilience with recovery signs in plain sight. However prices remain below the moving average, with RSI holding flat at the midline. A sign of declining momentum, which might stall the pair’s recovery. Key levels to watch will be resistance levels 1.0486 and 1.0506, with downside support levels at 1.0432 and 1.0350.

Source: Deriv MT5