Insiders say regulation introduces structured investment obligation for Islamic insurers

Infographic: TBS

“>

Infographic: TBS

The Insurance Development and Regulatory Authority (IDRA) has mandated that Islamic insurance companies invest in government securities, a requirement that previously applied only to conventional insurers while Shariah-based Islamic insurers were exempt.

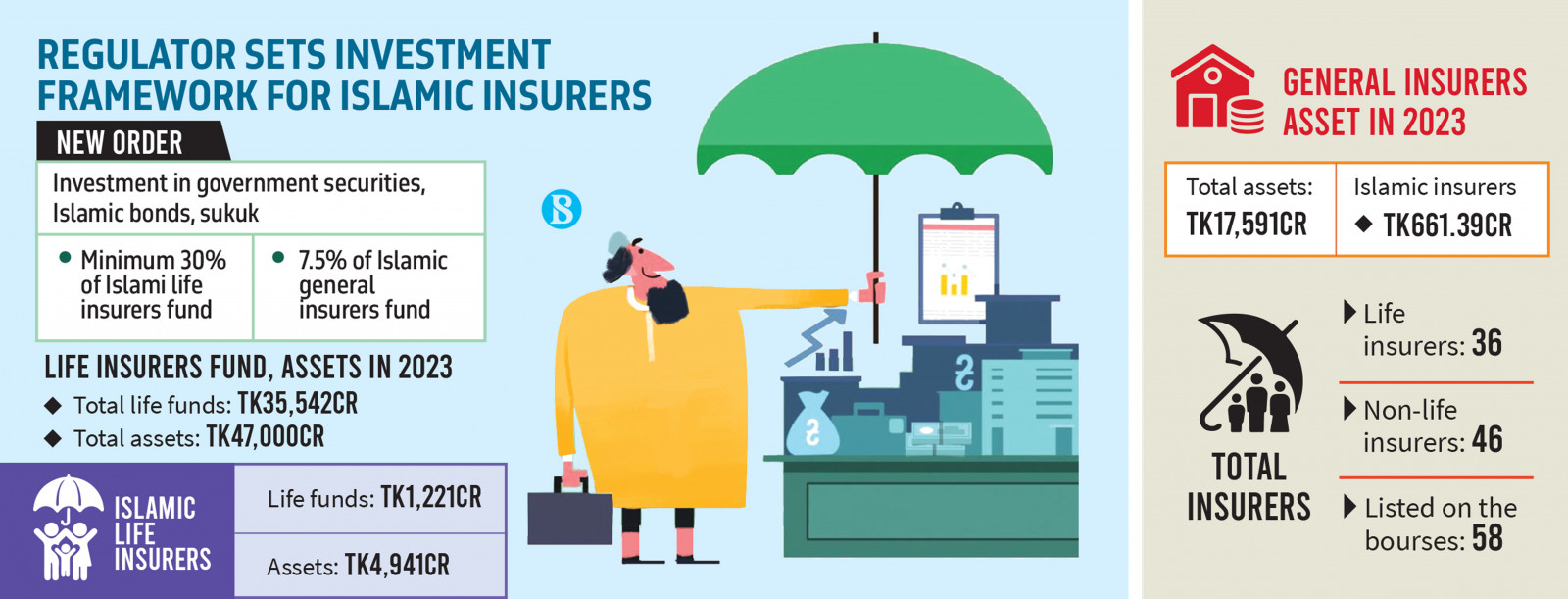

Under the new directive, Islamic life insurance companies must allocate at least 30% of their funds to government Islamic bonds (Sukuk) or securities, while Islamic general insurance companies are required to invest a minimum of 7.5%.

To implement this directive, IDRA issued a letter to Islamic insurance companies on 19 February, signed by the regulator’s Director Abdul Majid.

A senior IDRA official noted that the government is prioritising sukuk issuance to finance its projects, catering to investors seeking Shariah-compliant financial instruments.

“In line with this focus, the IDRA has released a circular detailing the investment framework for Islamic life insurers, aimed at fostering greater discipline and stability within the sector,” the official added.

Industry insiders said the regulation introduces a structured investment obligation for Islamic insurers. Previously, they followed general life insurance investment policies and often opted for more lucrative opportunities, yielding higher returns.

However, they said with mandatory investment in government securities, their flexibility will be restricted, making it difficult to achieve the same level of high returns as before, and profits could decline.

SM Nuruzzaman, chief executive officer of Zenith Islamic Life Insurance, believes the decision will bring positive changes to the life insurance sector.

However, he acknowledged that it may lead to lower profits for some companies. “The regulatory requirement will now compel companies to comply with specified investment tools.”

He further stated that previously, the absence of such mandatory directives allowed Islamic insurance companies to bypass strict adherence to life insurance investment guidelines.

SM Zialul Hoque, the chief executive officer of Chartered Life Insurance, said while life insurance companies had clear investment policies, Islamic insurers did not always follow them properly.

He added that the new directive puts some pressure on these companies to ensure compliance with investment regulations.

Policies for life insurers

Bangladesh’s 2019 investment regulations for life insurance companies provide guidelines to ensure financial stability and responsible asset management.

Under these rules, insurers must allocate at least 15% of their assets to government-backed infrastructure bonds or other bonds, all of which must have a minimum “AA” rating from an approved rating agency in Bangladesh.

Additionally, insurers can invest up to 5% of their funds in debentures or securities issued by city corporations, with government approval. Up to 10% can be invested in debentures approved by the securities regulator.

Investment in listed company shares is limited to 10% of paid-up capital, with total equity exposure not exceeding 25% of assets. Investments in “Z” category stocks, as designated by BSEC, are strictly prohibited.

Insurers are also permitted to invest up to 20% of their funds in immovable properties within city corporations or municipalities, provided they are free of legal disputes.

A maximum of 60% of funds can be deposited in scheduled banks, with no more than 10% in any single bank, and only in banks rated “A” or higher.

Other investment opportunities include up to 20% in regulator-approved mutual funds, 10% in government-designated financial institutions, and 10% in subsidiary companies, all requiring regulatory approval.

Finally, up to 5% can be invested in other approved asset classes with regulatory consent.

Insurance industry size

According to the IDRA, as of 2023, Bangladesh has 82 insurance companies, including 36 life insurers and 46 non-life insurers. The total life funds of 35 life insurers amount to Tk35,542 crore, with total assets of Tk47,000 crore. Non-life insurers hold assets worth Tk17,591 crore.

Among them are 16 Islamic insurance companies, consisting of 12 life insurers and four general insurers. Islamic life insurers have funds of Tk1,221 crore and assets totaling Tk4,941 crore, while Islamic general insurers hold assets of Tk661.39 crore.

The four Islamic general insurance companies are Islami Commercial Insurance, Islami Insurance Bangladesh, Northern Islami Insurance, and Takaful Islami Insurance.

The 12 Islamic life insurance companies are Alpha Islami Life, Fareast Islami Life, Mercantile Islami Life, Bengal Islami Life, Padma Islami Life, Prime Islami Life, Protective Islami Life, Sonali Life, Trust Islami Life, Zenith Islami Life, NRB Islamic Life, and Akij Takaful Life Insurance.