(Bloomberg) — China’s strategy of defending its currency by choking local liquidity is sending ripples throughout the financial system, squeezing banks and fueling losses at bond funds.

Most Read from Bloomberg

The People’s Bank of China has drained cash through open market operations most days this month, supporting the yuan by making it more scarce. But that has had unintended consequences: Banks have hoarded cash rather than lend it to rivals, while debt funds have suffered losses as investors sell bonds to raise money. China’s 10-year bond yield hit its highest level since December on Monday.

The latest sign of a cash crunch at Chinese banks is a sharp drop in their lending through repurchase contracts, or repo. The country’s biggest banks cut their lending in the repo market by around two-thirds in mid-February compared with the daily average last year, according to people familiar with the matter.

“If banks’ cash-borrowing pressure keeps building and the costs further climb, it may limit their ability to issue loans and support the economy,” Yang Yewei, an analyst at local brokerage Guosheng Securities, wrote in a note. “We doubt tightness in funding can be sustained for a long period.”

The PBOC didn’t immediately reply to a fax seeking comment.

The cash crunch has come at a bad time for Chinese banks. Their deposits from other non-bank financial institutions declined about a quarter from November’s level in just two months, after regulators moved late last year to limit the rates they can pay on interbank deposits. Slumping savings rates have also put pressure on deposits.

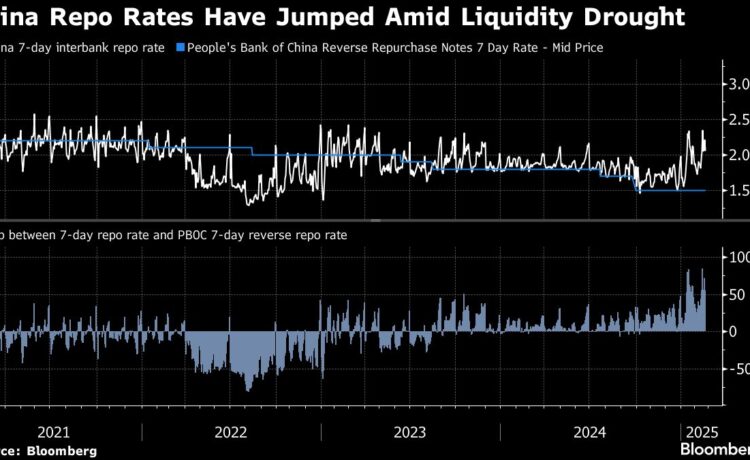

The seven-day interbank repo rate has stayed well above the PBOC’s own reverse repo rate, a key anchor for the market. The spread exceeded half a percentage point every day last week, according to Bloomberg-compiled data.

Bond Funds Suffering

Meanwhile, more than half of the Chinese funds that invest in the bond market were sitting on year-to-date losses by mid-February, according to the China Securities Journal, a state-owned publication.

These funds have been hit hard by the liquidity squeeze, which has weighed on debt prices as investors sell bonds to free up cash. Their woes have been exacerbated by a resurgence of interest in the stock market, fueled by optimism over Chinese AI start-up DeepSeek and signs of Beijing’s renewed support for the private sector.