Join Our Telegram channel to stay up to date on breaking news coverage

The cryptocurrency market has entered a period of correction, impacting numerous altcoins. The global crypto market cap is $2.85 trillion, reflecting an intraday decline of 2.54%. However, trading activity remains strong, with the total market volume reaching $159.51 billion, a 2.13% increase in the same timeframe.

Some analysts describe this phase as a “purge,” as market corrections trigger the liquidation of excessive leveraged positions. While multiple factors could drive this downturn, it may also be part of a natural market cycle. This dip presents an opportunity for investors to accumulate assets at lower prices. Despite current volatility, certain altcoins are well-positioned to thrive in emerging market trends. This article explores some of the top cryptocurrencies to invest in now.

Top Cryptocurrencies to Invest in Now

Stacks is valued at $0.87, reflecting a 9% rise over the past 24 hours. Meanwhile, IoTeX has teamed up with Piggycell to bring blockchain technology into real-world infrastructure. Despite the overall downturn in the cryptocurrency market, Solaxy has garnered significant attention, securing $23.7 million through its ICO.

1. Stacks (STX)

Stacks is a Bitcoin layer designed to enable smart contracts and decentralized applications while keeping Bitcoin the main asset. Unlike traditional systems, Stacks allows transactions to be finalized on the Bitcoin blockchain, ensuring security while improving processing speed.

The Nakamoto release, activated on October 29, 2024, introduced faster transactions with finality matching Bitcoin’s security standards. This update paved the way for sBTC, a Bitcoin-backed programmable asset.

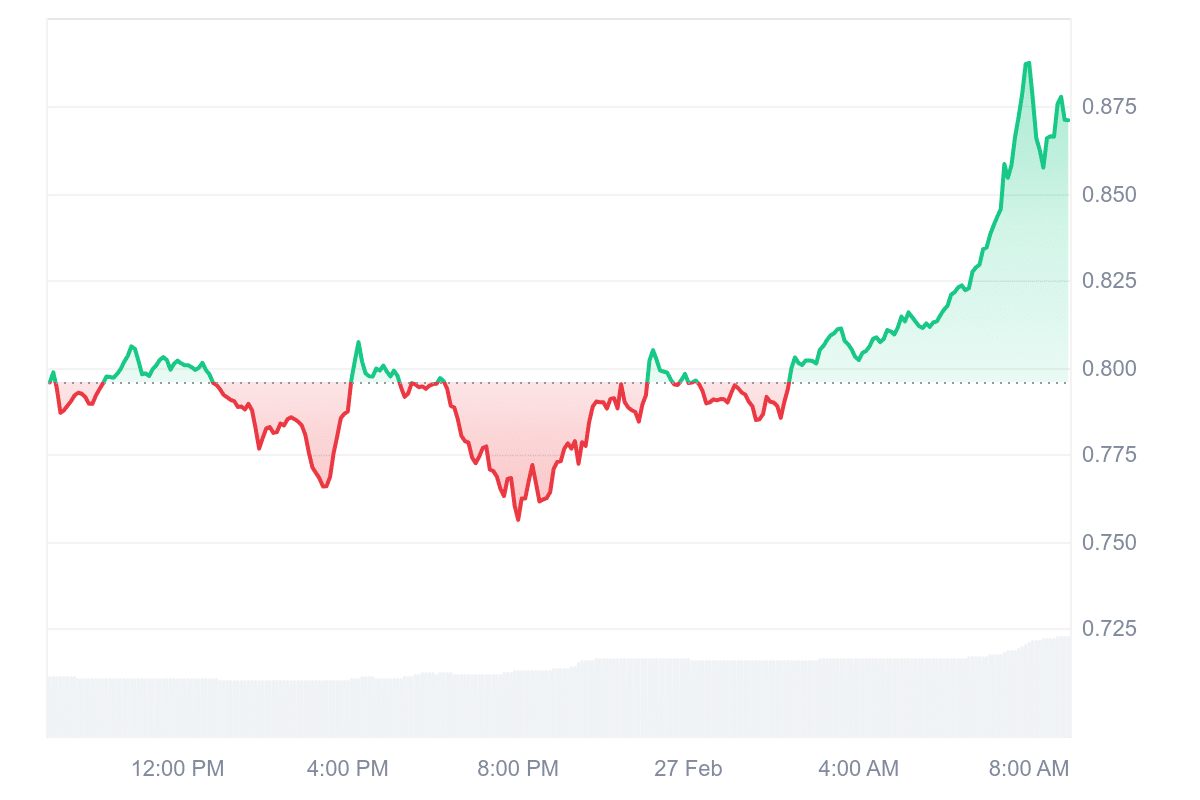

Meanwhile, Stacks (STX) is trading at $0.87, showing a 9% increase in the last 24 hours. It is performing near its recent peak, with a 24-hour volume-to-market cap ratio of 0.1310, reflecting its liquidity.

This development highlights Stacks’ efforts to enhance Bitcoin’s functionality while maintaining its security. By supporting smart contracts and enabling faster transactions, Stacks continues to evolve as a key player in the Bitcoin ecosystem.

2. Flow (FLOW)

Flow is a blockchain that separates consensus from computation, allowing it to process transactions efficiently while maintaining security. Consensus determines the order of transactions, while computation executes them. This division improves speed compared to traditional blockchains. Flow operates on a Proof of Stake mechanism and uses a multi-role architecture to balance scalability, efficiency, and cost.

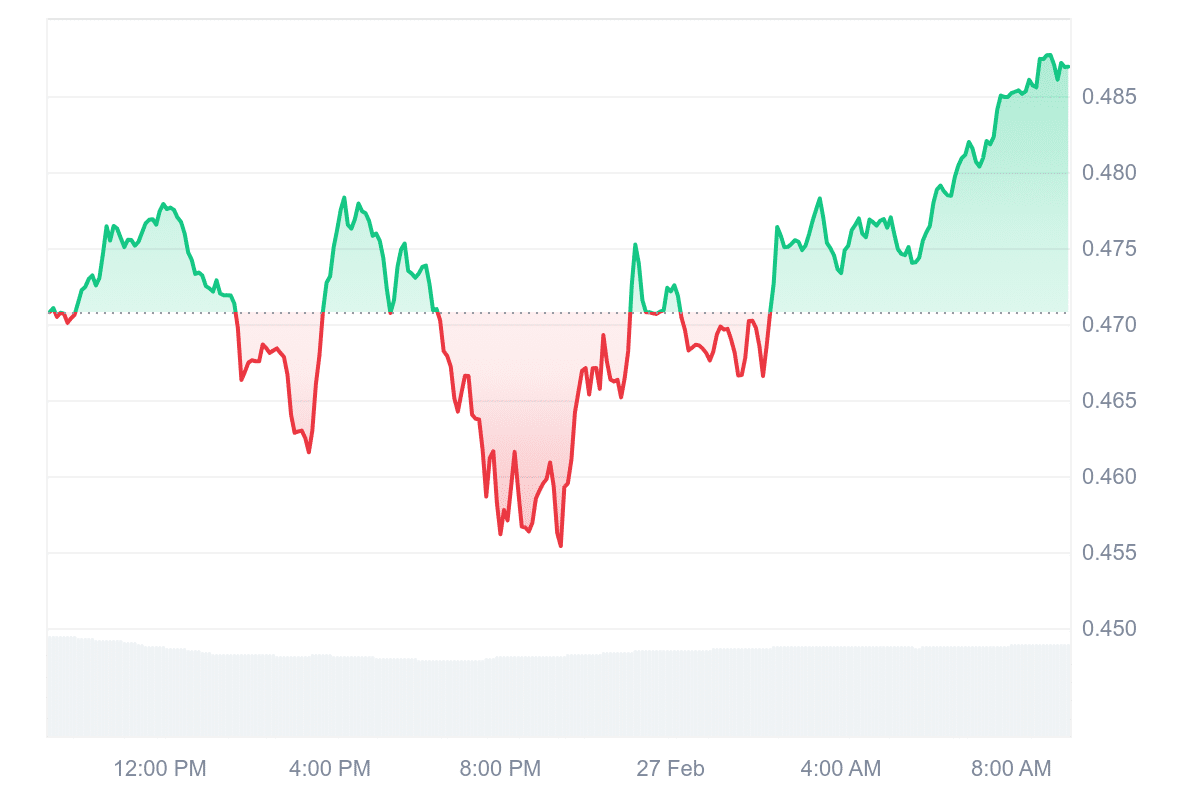

Currently, FlOW’s price is $0.48, reflecting a 3.43% increase in the past 24 hours. The market cap is $762.84 million, with a 24-hour trading volume of $38.22 million, indicating high liquidity. The token recorded an all-time high of $46.16 in April 2021, while the lowest price was $0.3921 in September 2023.

Technical indicators suggest that Flow is in a neutral zone. The 14-day Relative Strength Index (RSI) is 40.27, implying neither overbought nor oversold conditions. This indicates the price may move sideways in the short term. The 24-hour volume-to-market cap ratio of 0.0753 further supports liquidity in the market.

Analysts predict the token could reach $0.50 by next month. Flow’s unique design aims to solve scalability issues in blockchain networks, making it an option for developers and users seeking efficiency.

3. Gravity (G)

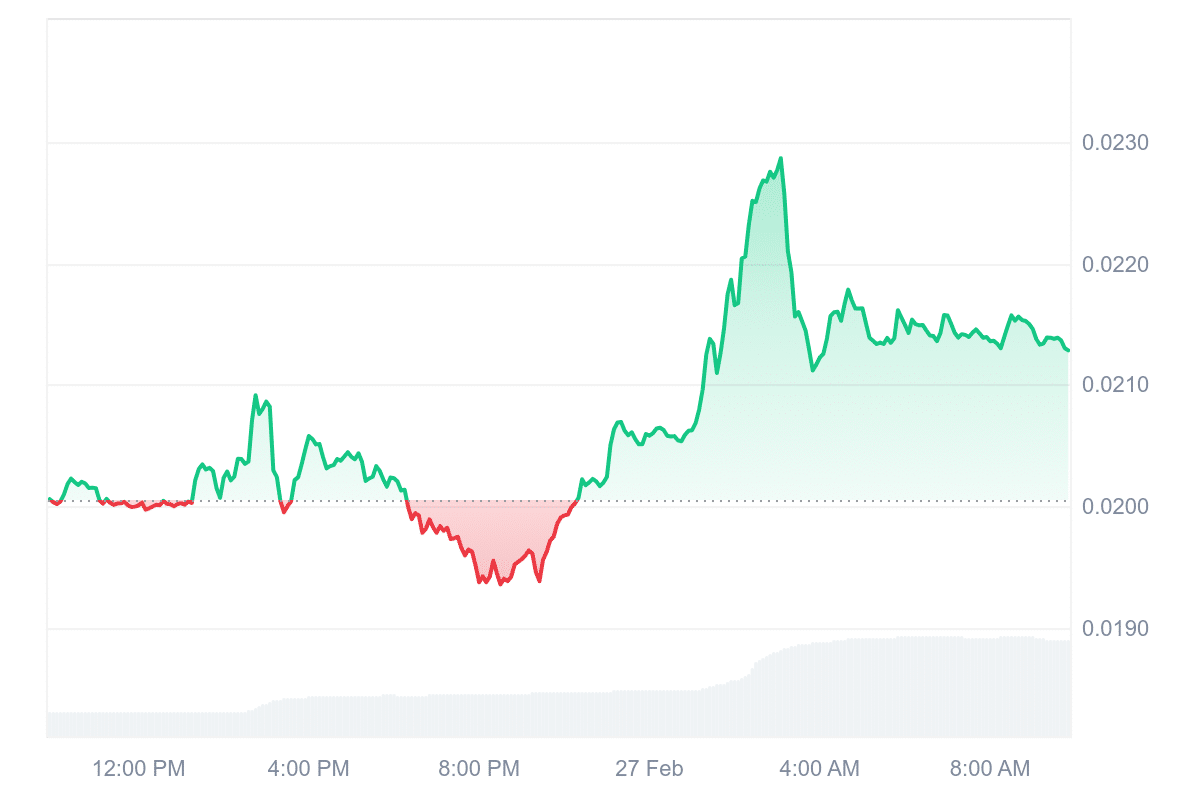

Gravity has recorded significant growth recently, showing resilience in the market. The Gravity token, G, is valued at $0.021, reflecting a 6.27% increase in the last 24 hours and a 12.79% gain over the past week. The market capitalization is $186.66 million, with a daily trading volume of $69.48 million, surging by 278.61%.

This increase suggests growing trading activity. The token’s 24-hour volume-to-market-cap ratio of 0.7539 indicates strong liquidity. The 30-day volatility remains below 30%, currently at 14%, signaling relatively stable price movements.

Meanwhile, Gravity is a Layer 1 blockchain designed for easy use and broad adoption. It incorporates advanced technologies like Zero-Knowledge Proofs, which enhance privacy, and a staking-based system that helps secure the network. One of its key features is simplifying Web3 identity management, allowing users to interact with decentralized applications without dealing with complex technical processes.

The network’s utility token, G, serves multiple functions. It acts as the gas token for transactions, secures the blockchain through staking, and participates in governance decisions. Additionally, it incentivizes participation and facilitates payments within the Gravity and Galxe ecosystems.

4. IoTeX (IOTX)

IoTeX has partnered with Piggycell to integrate blockchain technology into real-world infrastructure. This collaboration will bring IoTeX’s DePIN solutions to Piggycell’s charging network, which includes 13,000 hubs and 100,000 batteries across South Korea. By incorporating DePINscan and ioID, Piggycell aims to improve transparency, security, and operational efficiency.

IoTeX operates as a modular platform, connecting smart devices and real-world data to blockchains. Its solutions facilitate secure data sharing and decentralized applications, positioning the project within the growing $28.2 billion DePIN ecosystem.

Following this announcement, the IOTX token gained 6.35% in 24 hours. Its market liquidity remains stable, with a 24-hour volume-to-market cap ratio of 0.1655. The Relative Strength Index (RSI) at 42.59 suggests neutral momentum, indicating potential sideways trading. Volatility stands at 20%, suggesting moderate price fluctuations.

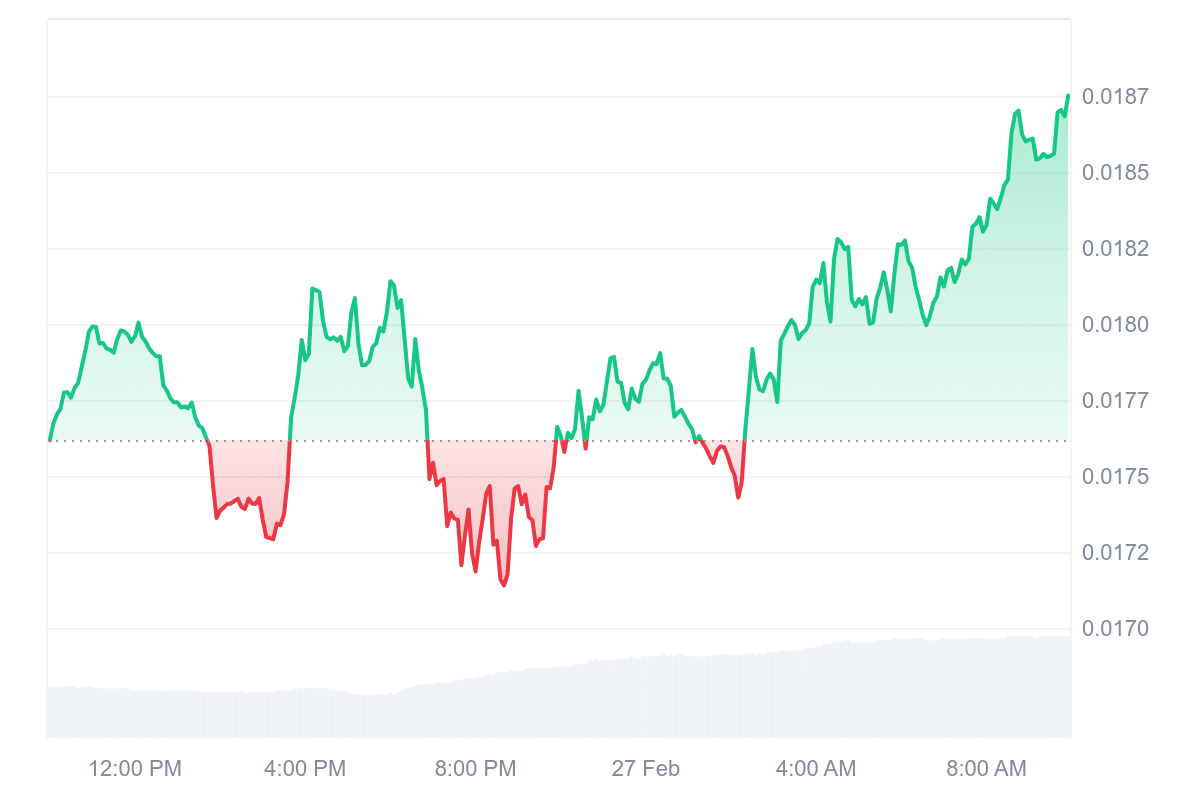

Analysts predict a 15.93% price increase for IOTX in March, with estimates ranging between $0.018992 and $0.027437. The projected average price is $0.02178, with an expected return on investment (ROI) of 46.05%. These projections follow a positive market trend in February.

5. Solaxy (SOLX)

Solaxy (SOLX) has gained attention despite the broader cryptocurrency market downturn, raising $23.7 million through its initial coin offering (ICO). This project introduces a layer-2 scaling solution for Solana, aiming to improve transaction speeds and reduce costs.

Layer-2 solutions handle transactions off-chain before finalizing them on the main blockchain. This approach helps reduce congestion, a common issue during high-traffic events like meme coin launches. Solaxy seeks to make the Solana network more efficient by processing transactions separately.

The SOLX token is currently priced at $0.001648, with less than 48 hours until the next price increase. The project has allocated 10% of its total token supply for liquidity and 15% for marketing, which suggests efforts to maintain token stability and attract new users. Solaxy has also partnered with Best Wallet to simplify in-app purchases. This collaboration could make it easier for users to buy and manage SOLX tokens.

Meanwhile, Solaxy’s latest development update highlights progress in bridging, a crucial component for liquidity movement. Asset transfers between Solana’s main network (L1) and Solaxy’s rollup environment have undergone testing through Hyperlane integration.

The team has also enabled deposit and withdrawal functions, allowing liquidity to flow in and out of the platform. Their next steps include stabilizing the production deployment and broadening asset support beyond Solana’s native token (SOL).

Solaxy‘s focus remains on refining its infrastructure to support smoother transactions. Bridging solutions are essential in layer-2 systems, as they allow users to transfer assets efficiently between networks. The project’s ability to facilitate seamless asset movement is a key factor in its adoption.

Read More

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage