- The Kenya shilling remained stable against major international and regional currencies in the week ending February 27, 2025, trading at KSh 129.31 per US dollar, a slight change from KSh 129.45 on February 20

- CBK reported minor fluctuations in the exchange rates of other major currencies, with the Sterling Pound averaging KSh 163.81 and the Euro at KSh 135.79 during the same period

- Uganda shilling traded at KSh 28.39, the Tanzanian shilling at KSh 20.05, the Rwandese Franc at KSh 10.80, and the Burundian Franc at KSh 22.87

- Kenya’s foreign exchange reserves dropped to USD 9.057 billion as of February 27, marking a four-week low from USD 9.219 billion recorded in early February

Elijah Ntongai, a journalist at TUKO.co.ke, has more than four years of financial, business, and technology research and reporting expertise, providing insights into Kenyan and global trends.

Nairobi – The Kenya shilling remained largely stable against major international and regional currencies in the week ending February 27, 2025, despite a decline in foreign exchange reserves to a four-week low.

Source: UGC

According to data from the Central Bank of Kenya (CBK), the shilling exchanged at KSh 129.31 per US dollar on February 27, showing minimal movement from KSh 129.45 on February 20.

“The Kenya Shilling remained stable against major international and regional currencies during the week ending February 27. It exchanged at KSh 129.31 per US dollar on February 27, compared to KSh 129.45 per US dollar on February 20,” read the latest CBK bulletin.

The Kenyan currency also posted slight fluctuations against other major currencies, with the Sterling Pound averaging KSh 163.81 and the Euro at KSh 135.79 during the same period.

Regional currency exchange rates showed similar trends, with the Uganda shilling trading at an average of KSh 28.39, while the Tanzanian shilling stood at KSh 20.05. Meanwhile, the Rwandese Franc maintained a rate of KSh 10.80, and the Burundian Franc averaged KSh 22.87.

Foreign exchange reserves drop

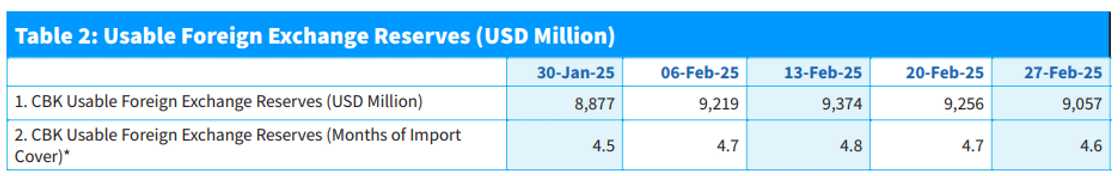

CBK also reported that Kenya’s foreign exchange reserves dropped to USD 9.057 billion as of February 27, down from previous levels of USD 9.219 billion that was reported on the first week of February.

This marks a four-week low but the reserves remain above the CBK’s statutory requirement of maintaining at least four months of import cover. The reserves currently provide 4.6 months of import cover, ensuring sufficient backing for external obligations.

Source: UGC

The CBK is expected to continue monitoring exchange rate movements closely to ensure stability in the forex market.

Kenya secures KSh 194b Eurobond

In other news, Kenya successfully issued a new US$1.5 billion (KSh 194 billion) Eurobond at a 9.5% coupon rate, slightly lower than the 9.75% rate of the February 2024 issuance, reflecting improved investor confidence.

The bond, which will be repaid in three equal installments in 2034, 2035, and 2036, attracted strong demand, with an order book exceeding US$5 billion (KSh 647.4 billion).

The government issued the bond alongside a buyback offer for the US$900 million (KSh 116 billion) Eurobond maturing in 2027 to extend its debt maturity profile and reduce fiscal pressure.

Proceeds from the new Eurobond will be used to refinance existing external debt, ensuring a smoother debt repayment schedule.

Source: TUKO.co.ke