The tech-laden Nasdaq Composite index is having a forgettable 2025 so far as it recently entered correction territory following remarkable gains in 2023 and 2024 thanks to catalysts such as artificial intelligence (AI).

Investors have apparently been booking profits in high-flying tech stocks amid economic uncertainty arising out of the tariff-induced trade war, a decline in consumer confidence in February, and a tepid February jobs report. These factors have sent the Nasdaq Composite down by more than 13% from its most recent high on Dec. 16, 2024.

A stock market correction can open up some great buying opportunities

A stock market correction refers to a drop of 10% to 20% in a major index. So, the Nasdaq is firmly in correction territory as of this writing, and some of the top names in this sector have also taken a beating. It remains to be seen how long this correction is going to last and if a bigger drop is on the way. However, investors should note that such corrections can create opportunities to buy top stocks on the cheap.

I think it’s worth looking right now — during the current Nasdaq correction — at Nvidia (NASDAQ: NVDA), which is trading at an attractive valuation, growing at a nice clip, and is the leading player in its industry. Buying Nvidia at its current valuation could turn out to be a smart long-term move considering the massive markets it serves.

Nvidia is cheaper now than it was after its 2022 plunge

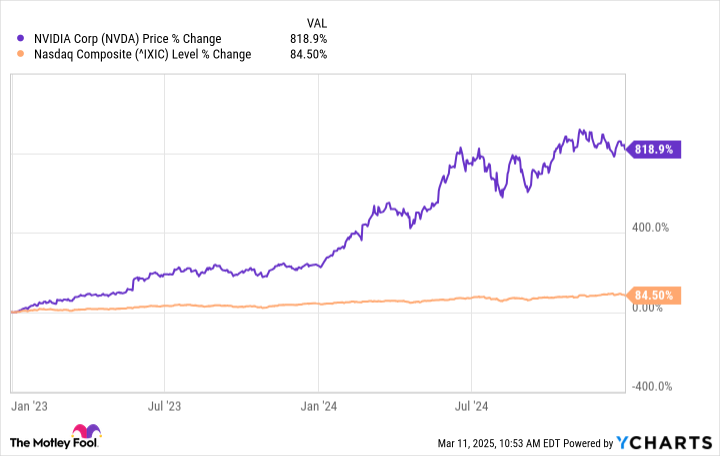

Nvidia stock was hammered big time during the Nasdaq sell-off of 2022, losing 50% of its value that year. However, investors who were savvy enough to buy this semiconductor bellwether that year were rewarded with outstanding gains over the next couple of years. Specifically, Nvidia stock shot a remarkable 820% over 2023 and 2024, fueled by terrific growth in its revenue and earnings.

It crushed the Nasdaq’s 84% gains during this period by emerging as the leader in AI data center chips. But what’s worth noting here is that Nvidia is now cheaper than it was at the end of 2022. Nvidia is now trading at 24 times forward earnings estimates, well below its forward earnings multiple of 34 at the end of 2022.

Nvidia is now growing at a much faster pace than it was two years ago. The chip designer ended fiscal 2023 (which ended in Janary 2023) with flat revenue growth and a 25% drop in adjusted earnings. For comparison, Nvidia’s fiscal 2025 revenue was up by 114% and its adjusted earnings jumped 130%.

So, Nvidia looks like a much safer stock to buy right now as compared to 2022 thanks to its remarkably strong growth and cheaper valuation.

The chip giant’s remarkable growth is here to stay

Nvidia is serving multiple end markets that should ideally allow it to remain a top growth stock for a long time to come. For instance, the market for AI chips is expected to exceed $500 billion in annual revenue by 2033 thanks to the growing application of this technology in autonomous vehicles, edge computing devices, and other areas.

Nvidia reportedly commands 92% of the AI chip market. This is precisely why its data center revenue could keep growing at a commendable pace even if the company were to lose some ground in this market. And there seems to be a solid chance that Nvidia will keep its dominant position in the AI chip market thanks to its pace of technological advancements.

The company says it sold $11 billion worth of its latest generation of Blackwell AI processors that went on sale in the previous quarter. That was close to the $12.6 billion revenue that rival AMD generated last year in the data center business. As such, it won’t be surprising to see Nvidia cornering a major chunk of the $500 billion revenue opportunity in AI chips in the coming years.

And Nvidia’s long-term opportunity isn’t limited to just AI hardware. The company’s professional visualization and automotive businesses also have massive growth opportunities. For example, Nvidia is expecting its automotive revenue to triple in the current fiscal year to around $5 billion following a 55% increase in the previous fiscal year.

Nvidia’s huge partner ecosystem in the automotive space — which includes auto majors such as Hyundai and Toyota, along with original equipment manufacturers (OEMs) and ride-sharing companies such as Uber — puts it in a nice position to capitalize on secular growth trends in the automotive industry. These companies are tapping Nvidia’s hardware and software ecosystem to build autonomous vehicles and robotaxis.

Additionally, Nvidia’s enterprise software revenue doubled last year thanks to growing demand for its AI solutions. There is a huge addressable opportunity in this market as well which could complement the company’s growth in other segments.

As such, it won’t be surprising to see Nvidia coming out strongly from the ongoing correction and delivering healthy gains to investors in the long run. It’s unlikely that any one stock will set you up for life, but buying this tech stock right now could turn out to be a smart move for investors looking to add a fast-growing company to their portfolios that they can hold for a long, long time.

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Nvidia, and Uber Technologies. The Motley Fool has a disclosure policy.

The Motley Fool is a USA TODAY content partner offering financial news, analysis and commentary designed to help people take control of their financial lives. Its content is produced independently of USA TODAY.

Don’t miss this second chance at a potentially lucrative opportunity

Offer from the Motley Fool: Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia:if you invested $1,000 when we doubled down in 2009,you’d have $277,401!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,128!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $467,393!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of March 10, 2025