By Rahul Rao

IndusInd bank’s latest set of issues in the form of an “accounting discrepancy” has tanked the stock.

While there are no reasons to believe depositors need to be worried at this point, from an investor’s perspective, the optics of the latest episode are concerning.

The stock price has reacted just as much, falling by 27% in a single day on 11th March 2025.

What just happened?

The latest surprise comes in the form of an accounting discrepancy in forex hedges NOT on the asset side or the loan book.

IndusInd Bank’s NRI Deposit Bet: A success, until it wasn’t

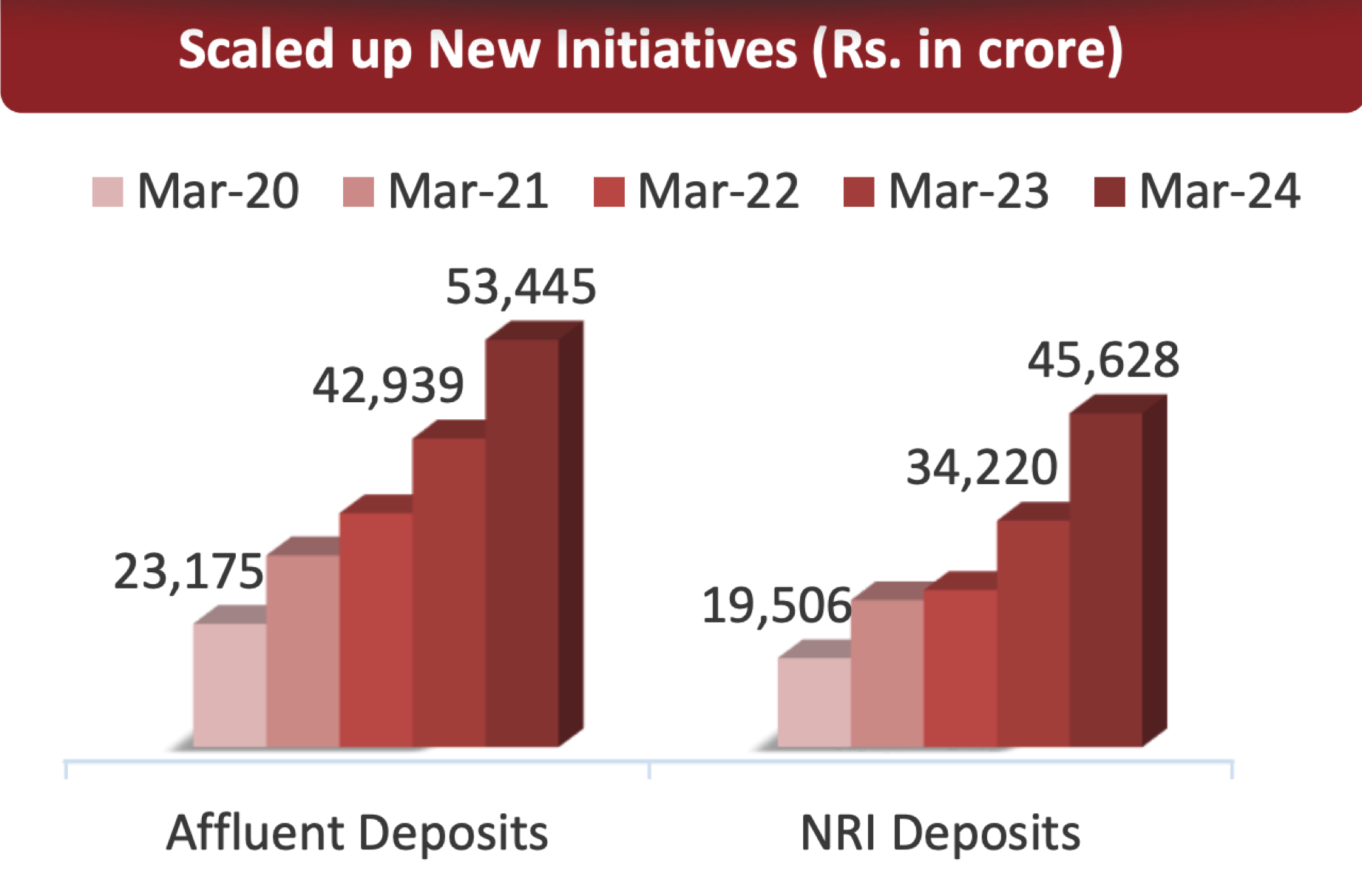

According to Krishan Appala, a fund manager at Capitalmind – In the recent years, IndusInd Bank aggressively pursued NRI deposits, offering attractive interest rates to lure in foreign currency inflows. By Q3 FY25, the bank had accumulated ₹58,600 crore in NRI deposits—about 14.3% of its Total deposits of 4.09 Lac Cr.

On the surface, this seemed like a smart strategy. NRI deposits are a stable, long-term source of funds, and for a bank looking to expand, they provide liquidity without the volatility of corporate or wholesale deposits. But behind the scenes, something more complex was happening. A series of internal hedging manoeuvres—designed to manage foreign exchange risk—worked well, until an accounting mismatch flipped the bank’s playbook upside down.

This wasn’t about fraud. It wasn’t even about bad loans. It was about a simple yet costly accounting discrepancy that forced IndusInd to take a ₹1,500 crore hit to its Q4 FY24 profits, about 2.3% of its Total net worth.

How did this happen?

The mechanics of the trade

Let’s say an NRI deposits $1 million into an NRE account for five years. Since NRE accounts are held in INR, the bank converts the dollars into rupees at the prevailing rate—let’s assume ₹86 per USD. That gives the bank ₹8.6 crore, which it can now lend out or deploy in its business.

The challenge? At the end of five years, when the NRI wants their money back, the bank must return the deposit in dollars. If the exchange rate changes, which it almost certainly will, IndusInd could be caught in a bind—what if the rupee depreciates significantly and it now takes ₹100 to buy a single dollar? That’s a problem.

Banks don’t leave such risks unmanaged. This is where hedging comes in.

How the risk was managed

The ALM Desk handles risk by transferring the $1 million liability to the Trading Desk through an “internal (derivative) trade”.

ALM Desk receives ₹8.6 crore to use as they wish.

Trading Desk takes on the dollar obligation, agreeing to return ₹8.6 crore in five years.

But this doesn’t remove the risk—it just shifts it – internally.

The Trading Desk, now holding large dollar liabilities, hedges them externally by entering a currency swap, a derivative contract used to hedge currency risk, with a global bank. This locks in an exchange rate, protecting against fluctuations.

Ideally, these internal and external hedges should cancel each other out.

Except, they didn’t.

The reason they did NOT was because these “Internal trades” are done only for “trades that had little liquidity”. For Example, a 3-5 year Yen deposit or a 8-10 year dollar deposit.

The issue arose because the “external leg” was marked to market (MTM) i.e – valued daily at fair values, while the “internal trade” used swap cost accounting or swap valuation. These two legs vary during the contract period but converge on maturity.

However, if the bank was to pay back foreign borrowings/deposits in the interim, the hedge or protection, may not be perfect, leading to a gain or loss on the trade. The discrepancy was identified when foreign currency borrowings were repaid and internal trades were unwound.

In IndusInd bank’s case, according to an article in Business Standard, “losses were shown as receivables, which were included in the “intangible assets” On the Balance sheet i.e. – the bank needed to provide for these losses but did not.

Was the disclosure of the issue nudged the RBI?

While Sumant Kathpalia – CEO, IndusInd Bank stated In an analyst call on 10th March, “we could have delayed the LODR disclosure and saying, let us find out and validate the accounts and then we will cover them. I don’t think that is the right way. I think we should be upfront in what we have and we want to disclose to the market”

On the other hand, it could be argued that RBI nudged IndusInd Bank to disclose these losses. For one, the disclosure came on 10th March, Just three days after the bank disclosed that RBI extended the CEO’s tenure by only one year as opposed to three years which was originally requested.

Secondly, the new guidelines on Classification, valuation and operations of Investment portfolio of commercial banks (2023), triggered an “internal review” that bought this issue to light.

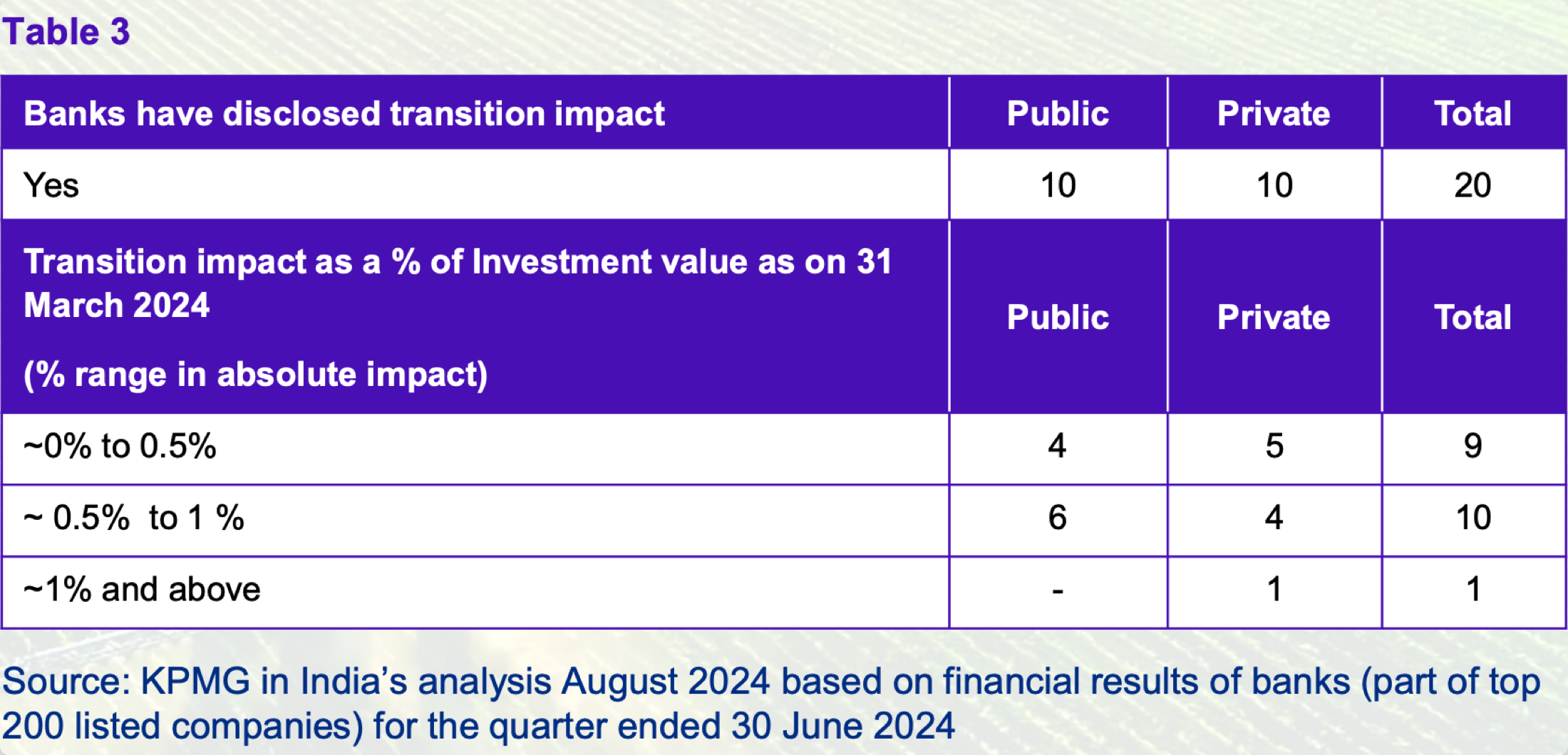

These new guidelines came into effect from 1st April 2024 and according to a KPMG note, most banks communicated the impact of the transition within a quarter i.e. – June 2024.

IndusInd Bank did not.

It eventually disclosed issues with the derivative positions, also a new requirement as per new guidelines, on 10th March 2025.

Is it intent?

Knowing what we know right now, there is no reason to believe depositors should be worried. Investors, on the other hand, have a lot of questions.

Is it simply a case of negative news, stacked back to back that is worrying stakeholders?

If it’s the forex positions that led to such losses, why are they isolated to IndusInd bank alone?

Will the final quantum of losses, post “external agency review” be significantly larger?

Why did the RBI refuse to extend CEO’s term by three years as requested?

We feel repeated operational glitches – such as the one where the bank “accidently” disbursed MFI loans to 84,000 and now the latest episode on unaccounted for forex losses, highlight shortcomings and dent public trust, the very currency a bank ultimately banks upon.

Disclaimer:

Note: We have relied on data from www.Screener.in and www.tijorifinance.com throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educational purposes only.

Rahul Rao has been Investing since 2014. He has helped conduct financial literacy programs for over 1,50,000 investors. He helped start a family office for a 50-year-old conglomerate and worked at an AIF, focusing on small and mid-cap opportunities. He evaluates stocks using an evidence-based, first-principles approach as opposed to comforting narratives.

Disclosure: The writer or his dependents do NOT hold shares in the securities discussed in the article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.