ARTnews Top 200 collectors Jeff Bezos, Bernard Arnault, and Alice Walton lost billions on March 7 and March 10 after stock market sell-offs motivated by investor concerns about the new Trump tariffs and a potential global recession.

By the end of the trading day Friday, the major U.S. indices had fallen by more than 2 percent for the week and the S&P 500 fell 3.1 percent, the largest drop since September, according to NPR. On March 10, The Wall Street Journal reported the Nasdaq Composite fell 4 percent.

More from Robb Report

As of end of day Monday, 24 of the 30 Top 200 collectors that are also currently on Bloomberg’s Billionaires Index, saw major losses, according to data analysis by ARTnews. For 11 of those 30 billionaire art collectors, the two days of losses from the stock market lowered their total net worth by 3 percent or more.

Alice Walton—the founder of the Crystal Bridges Museum of American Art, chairman of the Art Bridges Foundation, and heiress to the Walmart fortune—had the largest two-day loss at more than $6.5 billion, and the largest reduction in her net worth, 7 percent, down to $107 billion.

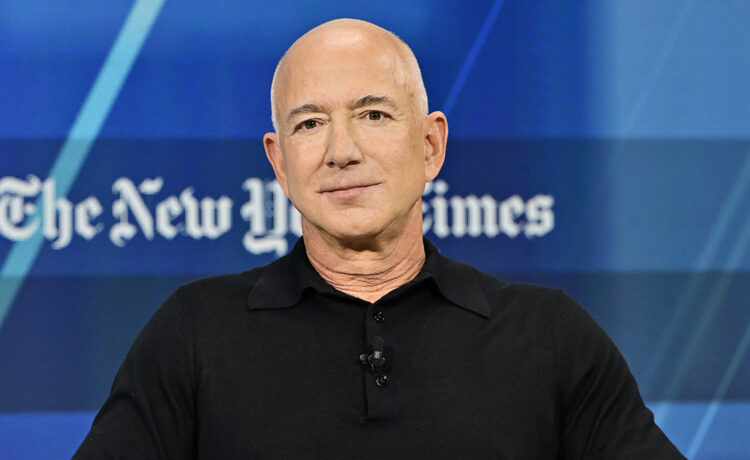

During the same two-day period, there were also 10-figure declines in the net worths of Amazon founder Jeff Bezos (-$5.83 billion), LVMH owner Bernard Arnault (-$5.3 billion) Uniqlo CEO Tadashi Yanai (-$1.7 billion), and SAP co-founder Hasso Plattner (-$1.5 billion).

The stock market declines also resulted in losses exceeding $500 million for Chanel chairperson Alain Wertheimer, HCL Enterprise chairperson Shiv Nadar, KKR co-founder Henry Kravis, and former KKR CEO George Roberts.

The eight billionaire Top 200 collectors whose year-to-date losses exceeded $1 billion when the markets closed on March 10 were Bezos (-$22.5 billion), Nadar (-$7.5 billion), Reliance Industries chair Mukesh Ambani (-$3.86 billion), Yanai (-$3.75 billion), Roberts (-$3.3 billion), Kravis (-$3 billion), Walton (-$2 billion), and former Apollo Global Management CEO Leon Black (-$1.54 billion).

While all 30 billionaires on the 2024 Top 200 list still have total net worths exceeding $7 billion, the stock market losses could add to concerns of an already challenging art market due to this year’s fires in Los Angeles and ongoing geopolitical conflicts, as well as the impact of the new tariffs the Trump administration has implemented against imports from China, Hong Kong, Canada, and Mexico.