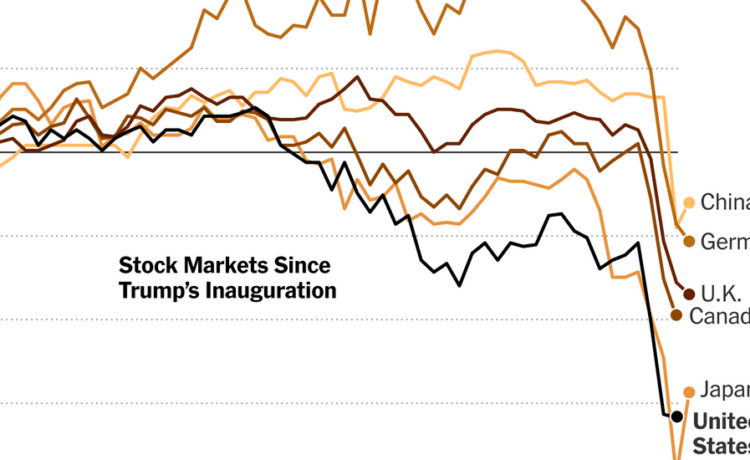

Even more unusual is that last week’s sell-off stemmed directly from presidential policy.

“If they’re maintained, the tariff hikes announced April 2 represent a self-inflicted economic catastrophe for the United States,” Preston Caldwell, a senior U.S. economist for Morningstar Research Services, said in a blog post on Friday.

Chief executives have begun warning consumers that they should expect prices to increase on some groceries, clothes and other products. Consumers have said they intend to rein in spending on big-ticket items. Some auto companies have already announced production pauses overseas, as well as job losses domestically. Bank economists have raised the odds that a recession will hit the United States over the next 12 months.

On Monday, Larry Fink, the chief executive of the asset management giant BlackRock, said, “Most CEOs I talk to would say we are probably in a recession right now.”

Speaking at the Economic Club of New York, he said some industries, like airlines, are already faring poorly. But, Mr. Fink said, inflationary pressures mean the Federal Reserve is unlikely to cut interest rates any time soon, despite some investor expectations that it will have to do so to bail out a struggling economy.

Scott Bessent, the Treasury secretary, said on Sunday on the NBC program “Meet The Press” that he saw “no reason” to expect a recession.

But analysts are worried.

“We remain very cautious,” said Stuart Kaiser, an equity analyst at Citi. Even with last week’s drop, he said, markets may have further to fall because earnings and economic growth expectations remain “well above levels consistent with announced tariff levels.”

Tony Romm contributed reporting.