-

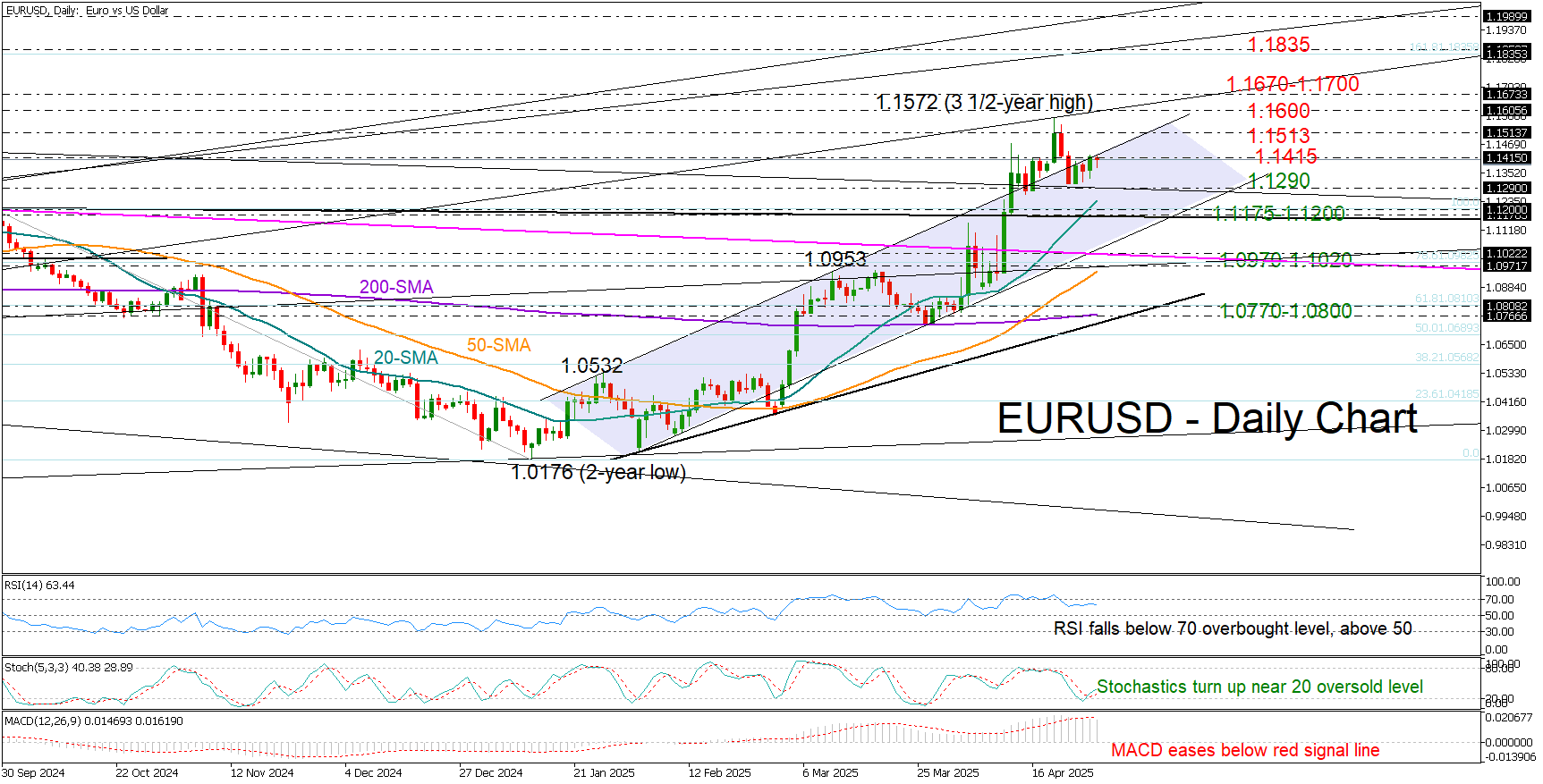

EURUSD remains range-bound; struggles to close above 1.1415.

-

Technical signals have weakened, but some optimism persists.

EURUSD opened the week with moderate gains, as bullish momentum lacked sufficient follow-through to push the price above the upper boundary of the bullish channel near 1.1415.

With the RSI turning lower after peaking in overbought territory and the MACD slipping below its red signal line, the outlook for a decisive rally in the coming sessions appears limited. Still, hopes for another bullish move have not entirely faded, as the stochastic oscillator has just posted a positive crossover near its 20-level oversold area.

A slew of US data, including nonfarm payrolls, along with Eurozone CPI inflation figures, are scheduled for release and could influence market direction.

Sellers may remain on the sidelines as long as the pair trades above the 1.1290–1.1300 support zone. The 20-day simple moving average (SMA) is also approaching this area, while slightly lower, the 1.1175–1.1200 territory may help absorb downside pressure, potentially delaying a drop into the 1.0970–1.1020 region. A continuation below the 50-day SMA could intensify selling, possibly leading to further declines toward the 200-day SMA and a tentative support trendline, both located around the 1.0765–1.0800 area.

On the upside, if the pair breaks above 1.1415, resistance may emerge near the 1.1513 barrier. A successful move beyond this level could lead to a critical test of the former support-turned-resistance line from June 2024, situated around 1.1600. An advance through the 1.1670–1.1700 resistance zone could unlock additional upside momentum toward the next hurdle at 1.1835.

In summary, EURUSD is maintaining a neutral stance in the very short term. A decisive move above 1.1415 or below 1.1290 is needed to clarify the next directional bias.