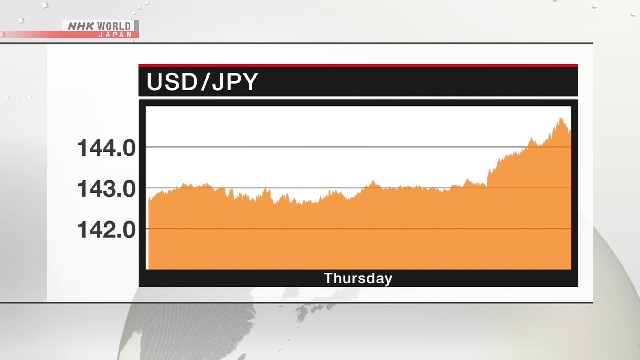

A decision on Thursday by the Bank of Japan to maintain its current monetary policy triggered a fall in the Japanese currency against the dollar in Tokyo.

Investors shared the view that the timing of the next hike in interest rates will come later than expected.

The yen briefly weakened to the upper 144 level.

Analysts say the central bank’s downgraded outlook for Japan’s economic growth and inflation prompted investors to sell the yen on speculation that the BOJ will find it difficult to raise rates this year.

Tokyo’s benchmark Nikkei 225 stock index rose on the weaker yen. It closed on Thursday at 36,452, up 1.1 percent.

Some investors bought shares of export-related companies on expectations that the yen’s depreciation will have a positive impact on their performance.

The benchmark index extended its winning streak to six trading days.