(Bloomberg) — Solid results from US banking titans provided a ray of light amid a retreat for global stocks as central bank officials pushed back against bets on aggressive interest rate cuts.

Most Read from Bloomberg

Futures on the S&P 500 pared most of a decline of as much as 0.7% after Goldman Sachs Group Inc. and Morgan Stanley posted earnings that beat analysts’ estimates in key business areas. Shares of both lenders rose more than 1% in premarket trading.

By contrast, banks in Europe led a decline that pushed the benchmark Stoxx Europe 600 index to a five-month low after JPMorgan Chase & Co. analysts said lending revenue will be capped by the peak in interest rates. The MSCI Asia Pacific Index lost 1.5%, the most in three months. Two-year Treasury yields rose seven basis points to 4.22%, while an index of the dollar climbed 0.6% to a one-month high.

Market positioning for aggressive rate cuts in the US and Europe is being tested by hawkish comments from policy makers, including the European Central Bank’s Francois Villeroy de Galhau who said that it’s too early to declare victory on inflation. Traders are awaiting Federal Reserve Governor Christopher Waller’s speech later Tuesday for cues on the timing of a Fed rate cut, with money markets seeing a two-in-three chance of a reduction in March.

“Central banks pushing back on rate cuts is not helping risky assets,” said Mohit Kumar, chief European economist at Jefferies International. “The market has gone a bit ahead of itself.”

European stocks pared losses after the ECB’s monthly survey showed consumer expectations for euro-zone inflation fell to the lowest in more than 1 1/2 years in November. Money markets held interest-rate cut wagers broadly steady after the ECB data, pricing the first quarter-point reduction by April followed by almost five more by year-end.

ECB Governing Council member Robert Holzmann indicated on Monday that cuts this year were not assured given lingering inflation and geopolitical risks. His sentiments echoed prior comments from ECB President Christine Lagarde warning that it’s too early to talk about trimming borrowing costs. A raft of ECB speakers are on the WEF roster for Wednesday.

READ: A Pessimist’s Guide to Global Economic Risks in 2024

Economic data in the UK, meanwhile, supported the case for Bank of England rate cuts in the coming months, with wage growth cooling at one of the fastest paces on record. The pound weakened as much as 0.8% against the dollar and gilt yields edged lower.

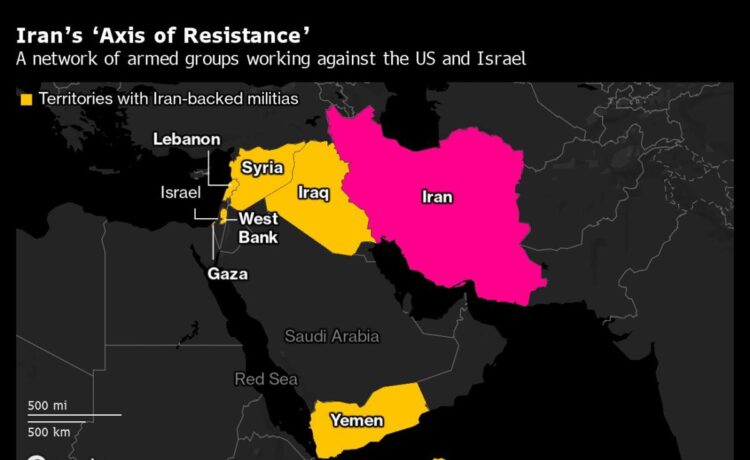

Elsewhere, oil prices were steady as continued Houthi attacks on ships in the Red Sea that are keeping tensions high in the Middle East were offset by a shaky global economic outlook and gains in the dollar. Global benchmark Brent held above $78 a barrel, while West Texas Intermediate traded around $73.

Some key events in markets this week:

-

US Empire Manufacturing, Tuesday

-

Federal Reserve Governor Christopher Waller speaks, Tuesday

-

China GDP, property prices, retail sales and industrial production, Wednesday

-

Eurozone CPI, Wednesday

-

UK CPI, Wednesday

-

US retail sales, industrial production, business inventories, Wednesday

-

Federal Reserve issues Beige Book survey, Wednesday

-

European Central Bank President Christine Lagarde speaks at Davos, Wednesday

-

New York Fed President John Williams speaks, Wednesday

-

Australia unemployment, Thursday

-

Japan industrial production, Thursday

-

European Central Bank publishes account of December policy meeting, Thursday

-

US housing starts, initial jobless claims, Thursday

-

Atlanta Fed President Raphael Bostic speaks, Thursday

-

Japan CPI, Friday

-

US existing home sales, University of Michigan consumer sentiment, Friday

-

US Congress faces deadline to pass spending agreement before part of federal government shuts down, Friday

-

San Francisco Fed President Mary Daly speaks, Friday

Here are some of the main moves in markets:

Stocks

-

S&P 500 futures fell 0.3% as of 7:59 a.m. New York time

-

Nasdaq 100 futures fell 0.3%

-

Futures on the Dow Jones Industrial Average fell 0.2%

-

The Stoxx Europe 600 fell 0.3%

-

The MSCI World index fell 0.4%

Currencies

-

The Bloomberg Dollar Spot Index rose 0.6%

-

The euro fell 0.6% to $1.0886

-

The British pound fell 0.6% to $1.2647

-

The Japanese yen fell 0.7% to 146.68 per dollar

Cryptocurrencies

-

Bitcoin rose 1% to $43,118.49

-

Ether rose 1% to $2,544.76

Bonds

-

The yield on 10-year Treasuries advanced six basis points to 4.00%

-

Germany’s 10-year yield was little changed at 2.24%

-

Britain’s 10-year yield declined one basis point to 3.78%

Commodities

-

West Texas Intermediate crude rose 0.5% to $73.02 a barrel

-

Spot gold fell 0.9% to $2,038.36 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Divya Patil, Lynn Thomasson and Jan-Patrick Barnert.

(A previous version corrected headline, first paragraph to say dollar is headed for a one-month high.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.