The UK retained its position as the second most attractive destination in Europe for Foreign Direct Investment (FDI) in 2024, despite a sharp drop in project volume, according to the EY 2025 UK Attractiveness Survey.

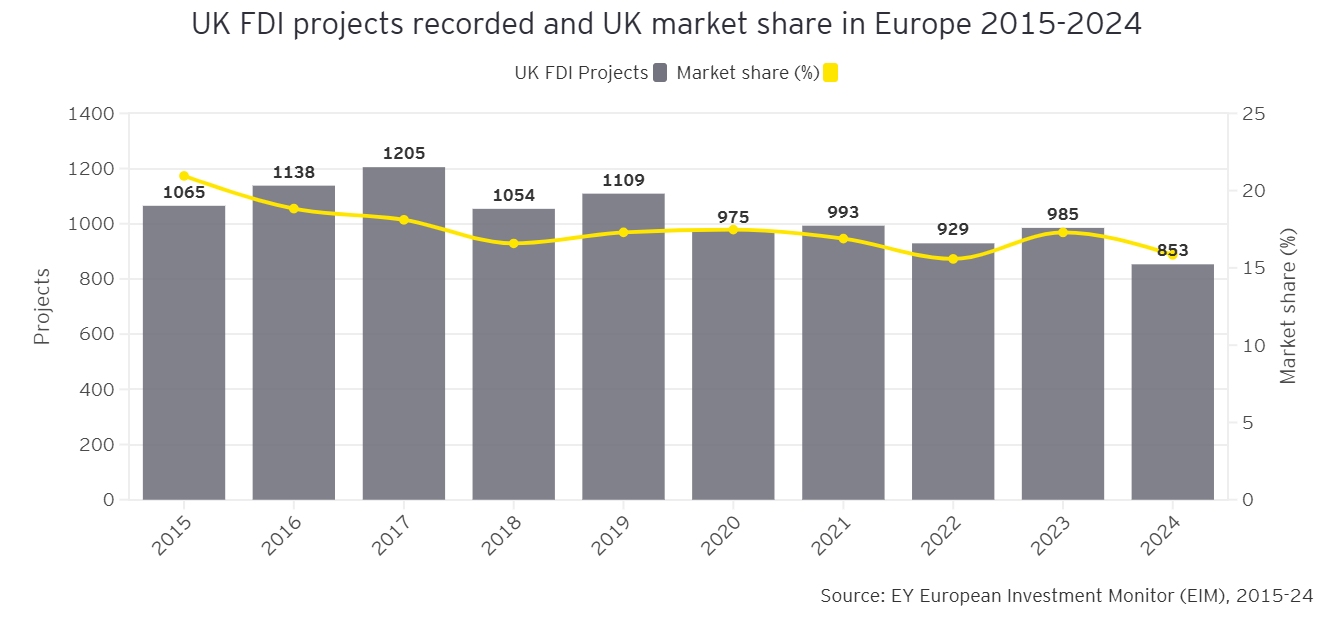

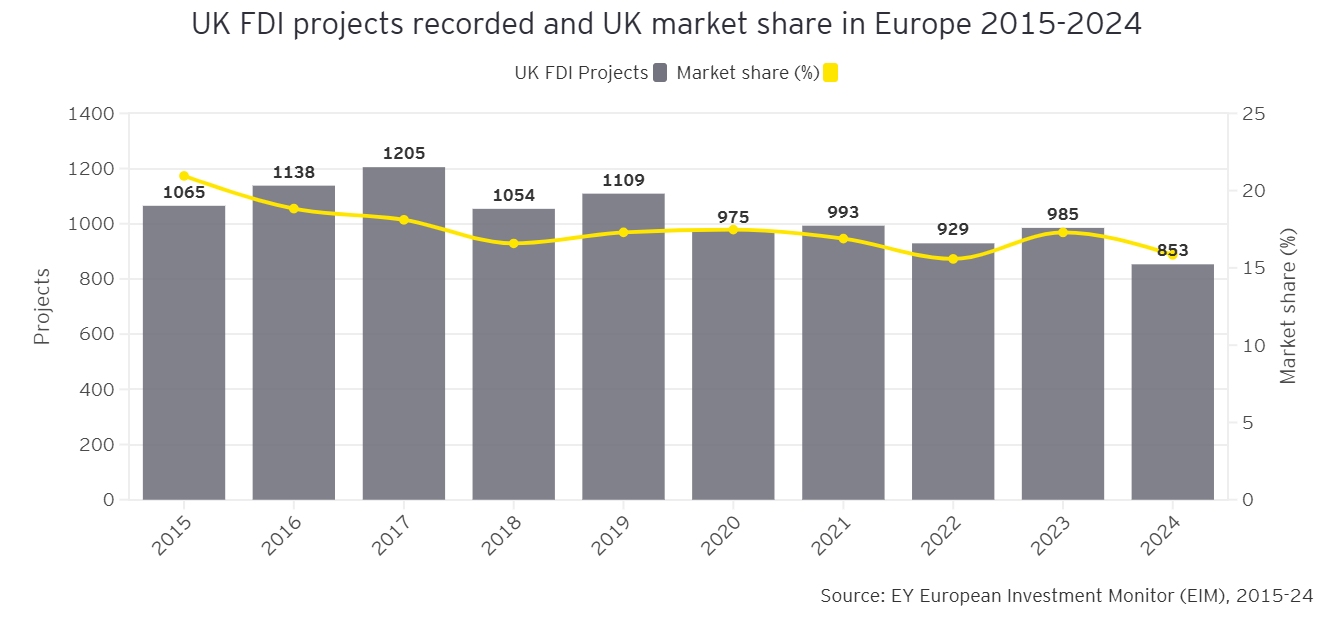

The country secured 853 FDI projects last year, down 13% from 2023. It followed France, which recorded 1,025 projects (a 14% drop), and ranked ahead of Germany, where projects declined by 17% to 608.

Greater London remained Europe’s top region for inward investment by volume, attracting 265 FDI projects. But that too marked a notable decrease — down 31% on the previous year.

The UK’s overall share of FDI in Europe slipped to 15.8% in 2024, from 17.3% the year before. Total European project numbers fell by 5% to a nine-year low of 5,383.

“While it’s encouraging to see that the UK remains one of Europe’s top investment destinations, it wasn’t immune to the decline in FDI volume that affected other large European countries last year,” said Anna Anthony, EY UK & Ireland Regional Managing Partner.

Economic headwinds and global competition weigh on FDI across Europe

The report points to Europe-wide challenges — from subdued economic growth and rising energy prices to intensifying global competition — as key reasons for the overall decline.

France grappled with political uncertainty and elevated labour costs. Germany experienced a downturn in its manufacturing sector. The UK, like its peers, saw investors grow cautious during a year of major domestic elections and rising operational costs.

In contrast, Spain, Poland, and Italy saw project numbers grow, albeit from a smaller base.

“Economic growth across Europe has been relatively modest in recent years, which appears to be driving investors towards more competitive global destinations such as Asia and the US,” said Peter Arnold, EY UK Chief Economist.

Quality over quantity: UK focus shifts to high-value sectors

Despite the headline fall in project volume, the UK saw improvements in the strategic value of investments it attracted. The number of R&D projects rose by 32% and manufacturing projects by 22%, the highest since 2016. Both sectors are recognised as priorities in the UK’s Industrial Strategy.

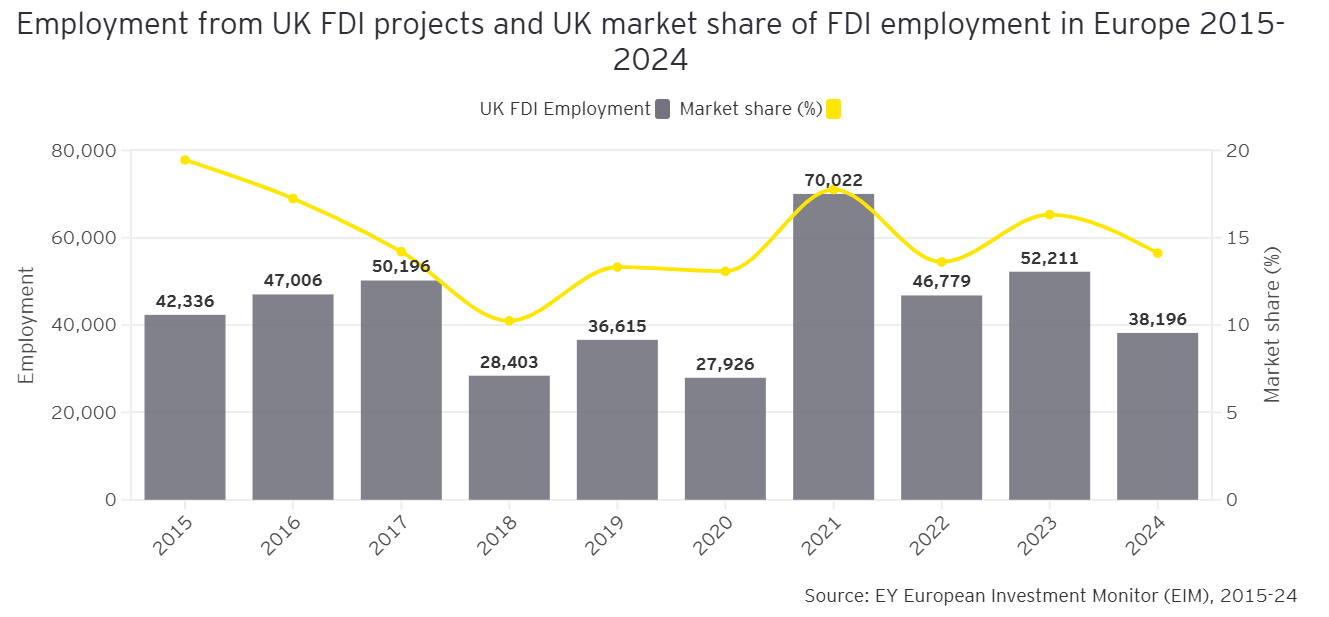

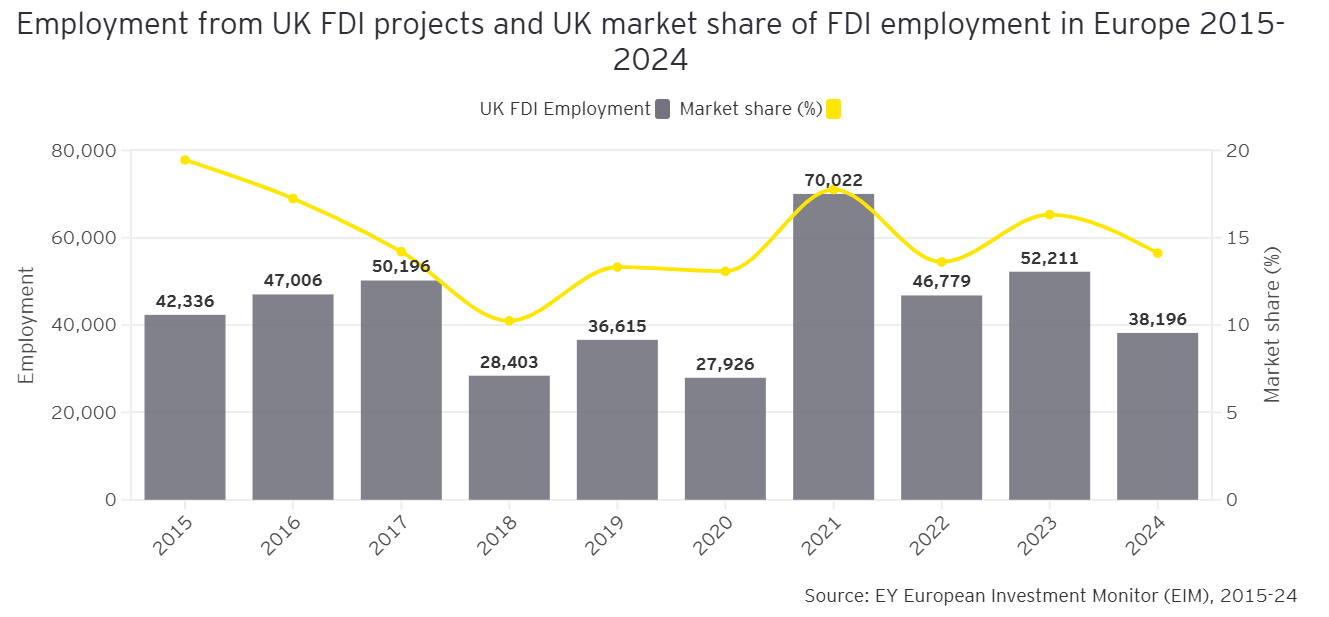

The UK also led Europe in FDI-related job creation, with 38,196 new roles — ahead of Spain (34,603) and France (29,000).

Meanwhile, ‘new’ investment projects — rather than reinvestments or extensions — accounted for 63% of the UK’s total, the highest proportion in Europe.

Tech remains strong, but sector sees sharp decline

The UK maintained its lead in software and IT services, securing 161 tech FDI projects. However, this represented a steep 37% drop from the previous year, and its share of Europe’s tech FDI declined from 27% to 20%.

Other notable sectors for UK FDI in 2024 included:

- Transport manufacturing and aerospace: 75 projects

- Business and professional services: 74 projects

- Pharmaceuticals and health: 33 projects each

- Retail, tourism and culture: 31 combined projects

India emerges as key growth partner amid drop in US-led investment

The United States remained the UK’s largest source of investment, accounting for 24% of all FDI projects — but US-originating projects fell by 7% year-on-year.

India, by contrast, contributed 8% of UK FDI projects, with a notable share in the tech sector. The UK captured half of all Indian FDI into Europe last year.

Australia and Singapore also ranked as disproportionately strong contributors to UK investment compared with their European-wide figures. The UK accounted for:

- 59% of Australian FDI into Europe

- 32% of Singapore FDI

- 18% of Canadian FDI

“The UK tends to attract FDI from a more diverse range of countries outside Europe, supported heavily by Commonwealth nations,” Arnold added.

“Strengthening economic ties with high-growth partners worldwide may enable the Government to maintain a resilient investment pipeline for the UK.”