SBI Mutual Fund has been one of the top-searched keywords on Google Trends this week, following the launch of its new index fund, SBI Nifty200 Quality 30 Index Fund.

The sudden spike in Google search suggests that investors actively seek more information about the fund house’s latest offering and overall portfolio.

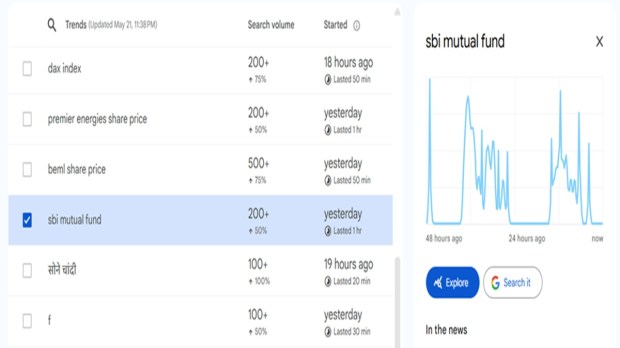

As per Google Trends data, search activity around “SBI Mutual Fund” surged notably after the announcement. Market observers are of the view that this online interest reflects growing investor curiosity for knowing passive investing options focused on quality stocks.

(Source: Google Trends)

SBI Mutual Fund, India’s largest AMC with over Rs 11 lakh crore in AUM and more than 125 schemes, recently launched the SBI Nifty200 Quality 30 Index Fund — an open-ended scheme tracking the Nifty200 Quality 30 Index.

Industry experts say that such spikes on Google Trends often mirror market sentiment or signal shifting retail interest, especially during the launch of new fund offers (NFOs).

The current NFO is open for subscription and will close on May 29.

Also read: HDFC mutual funds: 5 top-performing SIP plans with up to 21% annualised returns in 10 years

The investment objective of the scheme is to provide returns that correspond to the total returns of the securities as represented by the underlying index, subject to tracking error.

“The Nifty200 Quality 30 Index is designed to track the performance of the top 30 companies within the Nifty200 index, selected based on stringent quality metrics such as financial health, profitability, and sustainable growth. I believe the SBI Nifty200 Quality 30 Index Fund can be a valuable addition for investors, enabling them to invest in quality companies passively for long-term wealth creation,” said Nand Kishore, MD & CEO, SBI Funds Management.

The new SBI mutual fund scheme looks to primarily invest a minimum of 95% and a maximum of 100% of its assets in stocks comprising the Nifty200 Quality 30 and up to 5% in Government securities (like G-Secs, SDLs, and treasury bills), including triparty repo and units of liquid mutual fund.

The minimum application amount during the NFO has been kept at Rs 5,000 and in multiples of Re 1 thereafter with additional purchases of Rs 1,000 and in multiples of Re 1 thereafter. Investments in the new fund can also be done through daily, weekly, monthly, quarterly, semi-annual, and annual SIP.