JHVEPhoto

One of the top themes for investment in 2024 is Artificial Intelligence (“AI”), and if you are looking to invest in AI, now is the time to invest in Marvell Technology (NASDAQ:MRVL). This company should benefit tremendously from the proliferation of AI. However, the problem is that a few other areas of its business have encountered short-term issues, which showed up the last time the company reported earnings on November 30, 2023. Investors were disappointed in its near-term revenue forecasts and lackluster profitability. Still, despite the short-term hiccup in revenue growth and profitability, the potential long-term opportunity justifies a buy.

This article discusses why some areas of its business have encountered issues and why those issues should only be short-term. I will also discuss the company’s opportunity in AI, its competitive environment, a few risks, the valuation, and why long-term growth investors should consider buying.

The company has several different business lines

Marvell had its initial public offering on June 27, 2000, and it is a survivor of the dotcom era. The company’s initial business was manufacturing chips for Seagate Technology (STX) disk drives. Between 2000 and 2010, the company diversified into many different businesses, including networking chips, wireless communication chips, power management chips, and consumer electronics. From 2010 until today, the company has shifted its focus toward data centers and cloud computing while divesting some non-core areas like its Wi-Fi Connectivity business. Today, the company has five end markets: Data Center, Enterprise Networking, Carrier Infrastructure, Consumer, and Automotive/Industrial. Marvell can sometimes confuse some investors because some of the company’s products have use cases in different end markets. For instance, the company makes many optical products across the Data Center and Carrier Infrastructure end markets. So, when management spits out the name of a particular chip or product, unless they specify which end market the product goes into, non-tech investors can get quickly confused about what the product does and its use case.

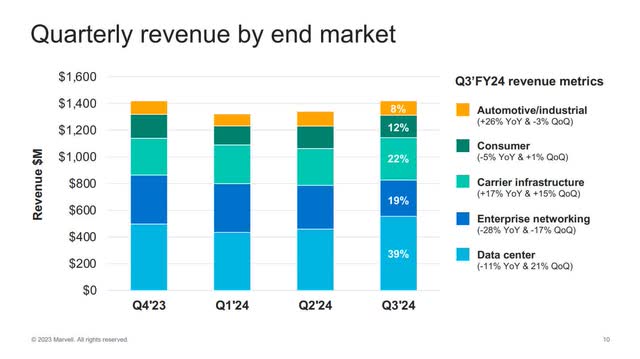

The image below shows how each segment contributed to total revenue and the growth rate in the third quarter of fiscal year (“FY”) 2024 results.

Marvell Third Quarter FY 2024 Earnings Presentation.

What investors didn’t seem to like about the results is that management didn’t give great guidance for several of its most important end markets. The company’s Carrier Infrastructure end market, the second-largest business at 22% of revenue, grew above guidance in the third quarter due to initial 5G deployments producing above-market wireless growth. The unwelcome news is that management projected the first wave of 5G rollouts would end in the fourth quarter of FY 2024, implying demand for its components would begin to slow. In addition, the macro environment has negatively impacted Telco carriers spending plans. Chief Executive Officer (“CEO”) Matt Murphy said on the earnings call:

We have been forecasting for some time that this wave of above-market wireless growth for Marvell would start to decline by the fourth quarter as the initial wave of 5G rollout completion. Additionally, demand is continuing to soften as carriers are managing CapEx [Capital Expenditures] in a difficult macroeconomic environment. As a result, following an extended multiyear period of strong growth, we are expecting a period of digestion. In addition, we expect revenue from the wired portion of our carrier end markets to continue to decline, reflecting weakening demand. As a result, for the fourth quarter, we expect revenue from our overall carrier end market to decline in the mid-40% range on a sequential basis.

Source: Third Quarter FY 2024 Earnings Call.

The Carrier business can be lumpy and cyclical. Although neither Marvell nor investors can pinpoint an exact date that this end market will rebound, revenue growth should return over the long term. As data traffic expands, carriers will eventually ramp up investments in additional capacity in the wireless and wired end markets. CEO Murphy said during the earnings call that the company already had two design wins, one wireless and one wired, that should provide incremental growth once the end market bounces back. On the wireless side, the design win is for a specialized chip that goes into a base station. This equipment is the component that sends and receives a wireless signal, and cell phone companies often locate these base stations in a cell tower. On the wired side, the design win is for 800 Gigabit Digital Signal Processors, specialized chips used in optical modules for real-time processing of high-bandwidth digital signals, mainly audio and video. Customers can use these chips to connect high-bandwidth data centers. This Marvell product is an industry first and is an example of the company differentiating itself from competitors through its expertise in optical modules.

The company’s third-largest end market, Enterprise Networking, at 19%, declined 28% over the prior year’s comparable quarter and 17% sequentially. Even worse, management sees continued weak end-market demand ahead and a continued inventory correction among OEMs (original equipment manufacturers), resulting in reduced purchases of Marvell components. CEO Murphy communicated this inventory correction is a normal part of the cycle, albeit taking longer than initially anticipated. He also said macroeconomic factors have worsened the decline and that the company may have to deal with the inventory correction issue for the next few quarters. Management projects Enterprise Networking’s fourth-quarter revenue to drop mid-single-digit percentage sequentially.

Although things look bleak in the short term for Enterprise Networking and Carrier Infrastructure, which make up 41% of the company’s business collectively, CEO Matt Murphy optimistically talked about both businesses’ upside on the third quarter’s earnings:

The last thing I would say, though, on carrier and enterprise is that these are — this is a cyclical downturn on these and the kind of design win strength we’ve had in the design position we had is such that [when] these…recover, and they will come back to a normalized run rate over time. And when that happens, that will be a tailwind to EPS [earning-per-share] and a tailwind to revenue growth as that kind of think of it as the base business of Marvell returns to growth.

Source: Marvell Third Quarter FY 2024 Earnings Call.

I emphasized that the CEO thinks of Carrier Infrastructure and Enterprise Networking as the base business because sometimes, in earnings calls or other communications, he will refer to the “base business” without specifying the end markets.

Marvell’s automotive and industrial end markets revenue growth declined 3% sequentially and grew 26% year-over-year in the third quarter of FY 2024. The company projects a 20% sequential decline in this end market, with the industrial market responsible for the decline. The industrial segment’s orders can be lumpy from quarter to quarter.

Revenue for the Consumer end market in the third quarter declined 5% over the prior year’s comparable quarter while growing 1% sequentially. The company projects that fourth-quarter Consumer revenue will drop in the mid-teens on a percentage basis sequentially. Some consumer devices like smartphones, Wi-Fi routers, and smart home products may rely on wireless connectivity solutions that use Marvell’s Wi-Fi chips and technologies. This end market is Marvell’s least important business and one that it has deemphasized over time.

Marvell’s largest end market at 39% of total revenue, the Data Center, consists of products directed toward enterprise on-prem, data center storage, the cloud, and AI. In the third quarter, the enterprise on-prem business declined sequentially amid weakening demand. Data center storage is another disappointing area displaying slack demand with no end in sight. However, the excellent news is that AI, the most significant part of Data Center revenue, and cloud adoption are picking up steam. CEO Murphy said during the third-quarter earnings call:

In our last earnings call, we provided a forecast for AI revenue to cross a $200 million quarterly run rate exiting this year. Since then, demand has continued to grow, and we now expect our AI revenue in the fourth quarter to come in significantly above our forecast. In addition to strong growth from AI, we also expect revenue from standard cloud infrastructure to grow sequentially in the fourth quarter. For the enterprise on-premise portion of our data center end market, we expect revenue to decline sequentially in the fourth quarter.

Source: Marvell Third Quarter FY 2024 Earnings Call.

Marvell’s initial business of manufacturing disk drive chips was something management recognized a while ago as unsustainable in the long term, and the company’s move toward diversification appears to be paying off in these challenging times. Management’s diversification efforts into the data center, networking, and wireless have played out favorably recently. When the data center was having a rough time in 2023, superior wireless infrastructure growth helped support the company, and now that wireless has gone down, the data center has picked up the slack.

The company’s diversification has also put it in a great position to capitalize on a powerful secular trend of storage, networking, computing, security, and optical interconnects converging onto single devices or tightly coupled solutions. Cloud computing, AI, and high-performance computing generate massive amounts of data, requiring these types of devices that can handle the resulting increased bandwidth and lower latency network needs. Only a select few companies have the competency to custom-make converged solutions for the data infrastructure market, and Marvell is one of them.

Over the long term, Marvell believes data infrastructure has the best growth potential within the semiconductor industry. Suppose you think that data infrastructure is the most lucrative area to invest in; Marvell should be on your radar screen of investments to research.

Marvell benefits from AI in several ways

Marvell has several products that support AI infrastructure in the Data Center end market. Some products that the CEO mentioned on the company’s third-quarter earnings call are:

- PAM4 optical modules: AI, especially generative AI, requires fast data transmission between servers and storage systems. These modules help reduce latency within AI systems. The lower the latency, the quicker applications like Bard, ChatGPT, or any other AI can produce answers to a query. Marvell was the first company to release a PAM4 device in March 2023. It is an upgrade over the previous NRZ (non-return-to-zero) technology; PAM4 can transmit more data per unit than NRZ, reducing power consumption.

- Teralynx Ethernet switches: This component is another AI-enabling technology that provides high-performance connectivity between servers, storage, and AI processing units for cloud data centers.

- Data center interconnect(“DCI”) products: Marvell’s top product in this category is the 800G ZR/ZR+ optical modules, first introduced in August 2023. The company designed this product to connect data centers up to 1,200km apart. DCI enables more rapid data transfers between data centers, reducing latency in AI workloads.

The AI opportunity in the data center is massive and rapidly growing. In Marvell’s first quarter FY 2024 earnings call, CEO Murphy highlighted that the AI opportunity was $200 million in revenue at the end of FY 2023, and he expected an AI revenue compound annual growth rate of 100% between FY 2023 and FY 2025. In other words, the company forecasts AI revenue of $800 million by the end of 2025, which is enormous growth. That estimate doesn’t include the AI opportunity for storage and networking. CEO Murphy said:

In the future, we expect generative AI implementations involving video and images to provide a tailwind to overall storage and exabyte growth, both in HDD and Flash. However, it is difficult to accurately allocate revenue from our storage business specifically to AI. So, the AI revenue forecast I just discussed does not include any storage contributions. In addition, we expect the increase in network traffic from AI will also provide a tailwind for our broader networking portfolio over time, which we have not yet captured in our AI revenue forecast. We’ve seen rapid shifts in our cloud customers plan to spending on AI infrastructures becoming a much bigger portion of their CapEx [capital expenditures]. We believe that Marvell is one of a scarce few semiconductor companies positioned to enable this trend and is uniquely able to participate in all three aspects of AI systems, networking, compute, and storage.

Source: Marvell First Quarter FY 2024 Earnings Call.

Another area where Marvell can benefit is the emerging edge computing market. The company manufactures custom application-specific integrated circuits (ASICs) for customers in several end markets. This article from September 2020 states:

Marvell today announced that the company’s ASICs offering is well-positioned to enable the next generation of AI accelerator solutions for the data center and automotive markets. Marvell’s custom ASIC offering is differentiated for AI and machine learning applications with leading density and performance SRAMs [Static random-access memory], the highest performance SerDes [Serializer/deserializer] and a full spectrum of pre-qualified high-bandwidth memory interfaces.

Source: Marvell news release.

One of the most significant use cases for ASICS is for AI inference, where a trained AI model makes a prediction or performs a task after a user provides it with new data. If you listen to companies like Cloudflare (NET), there is a massive opportunity for companies that enable AI inference in locations as close to the user as possible. Moving computing assets close to the end users is also known as edge computing. Marvell can potentially grow in this area by providing customers with inference chips designed for local use and optimized for specific AI workloads. During the third quarter earnings call, one analyst asked the company how large the ASICs opportunity could become for Marvell. CEO Murphy said in response:

But what I would say is, and I’ve been saying this to investors for about 6 months, we are not in a position to call the ball just yet on how big the custom silicon opportunity can be for next year. It’s still early, Vivek. I understand the investor appetite for this. I would say between us and our customers, we’re not fully — we don’t fully know how big this can be yet. So I’m going to need a little bit more time to probably size that for you. But what I can say is from when we first talked about AI two quarters back and what the opportunity was looking out to next year, it’s much, much higher. And that’s both on the custom side as well as on the optic side.

Source: Marvell Third Quarter FY 2024 Earnings Call.

Suppose you are a long-term investor interested in investing in a company that should be a massive beneficiary of the increasing adoption of generative AI and other forms of AI; Marvell should be on your list of stocks to research.

The company has decent fundamentals

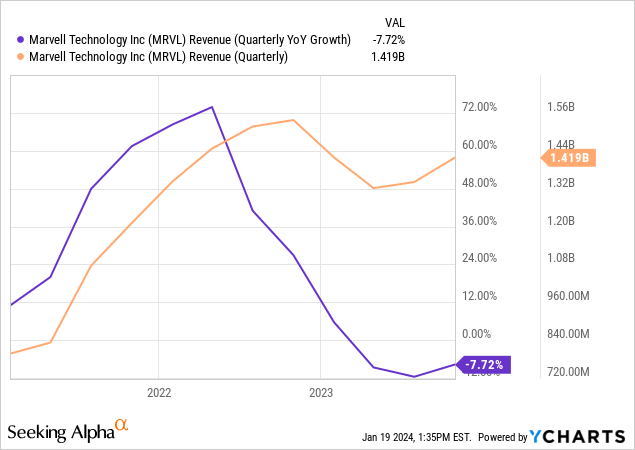

The company reported a third-quarter FY 2024 total revenue of $1.49 billion, a decline of 7.72% in a market with severe headwinds against Marvell growing its revenue. Despite the decline, the revenue exceeded the mid-point of management’s expectations and beat analysts’ revenue expectations by $20 million.

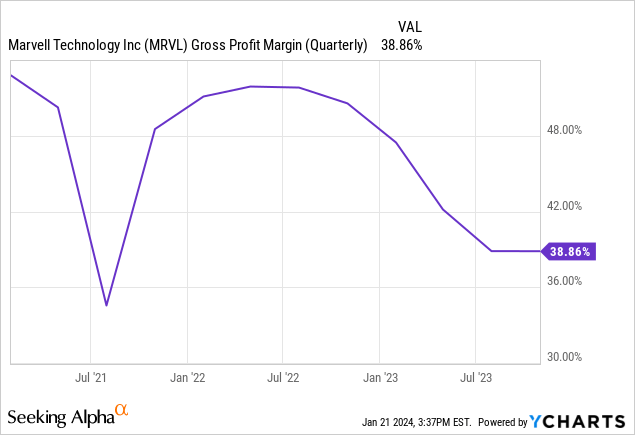

The chart below shows that the gross margin is down in the dumps. Marvell produced a GAAP (Generally accepted accounting principles) gross margin of 38.9%. Non-GAAP gross margin came in at 60.6%.

Management expected the gross margin to drop throughout FY 2024 due to an inventory correction. During the company’s fourth quarter FY 2023 earnings call, Marvell’s Chief Financial Officer (“CFO”) Willem Meintjes said that the company forecasted lower margins in the first quarter of fiscal 2024 (first quarter calendar year 2023) because of an “adverse revenue mix.” What is likely happened is that the company overproduced some products when times were good, and demand projections were more optimistic. Now, the company needs to clear out excess inventory by offering discounts or promotions, leading to lower margins on sales of those products. Management is vague about which specific products are in inventory hell. However, the data storage portion of its Data Center business and products in its Enterprise Networking and Carrier Infrastructure end market are likely culprits. CFO Meintjes said this inventory correction could last for the “next several quarters.”

In the first quarter of FY 2024, CFO Willem Meintjes said the following:

As you are aware, significant inventory corrections in certain businesses caused an adverse revenue mix, which impacted our gross margin. We are optimistic that inventory corrections will be largely done by the fourth quarter [of FY 2024] and that we will be shipping closer to end demand at that time. We have also put in place multiple cost reduction efforts to improve gross margin. Internally, we are optimizing headcount and further streamlining operations. Externally, we continue to partner with our strategic suppliers to drive more efficiency in the supply chain. We are confident that as a result of mix improvement and our cost reduction efforts, our non-GAAP gross margin will start to improve.

Source: Marvell First Quarter FY 2024 Earnings Call.

Optimizing headcount often translates into company layoffs. Marvell released four percent of its workforce, or 320 workers, in March 2023. In addition, the company is working closely with its suppliers to reduce unnecessary costs, improve delivery times, and quickly adapt to changing demand. CFO Willem Meintjes has also talked about how once the company gets through this period of an inventory correction, gross margins will improve toward the lower end of the company’s targeted range.

In the third quarter of FY 2024, the company CFO Meintjes said:

We expect our [Fourth quarter FY 2024] GAAP gross margin to be in the range of 48.2% to 50.7%. We expect our [Fourth quarter FY 2024] non-GAAP gross margin to be in the range of 63.5% to 64.5%, with the midpoint projected to be back to the low end of our long-term target model. Our forecast for this large sequential improvement is driven by expectations of a significantly stronger product mix and our ongoing cost optimization activities. Looking forward, we expect that product mix as well as the overall level of revenue will remain key determinants of our gross margin in any given quarter.

Source: Marvell Third Quarter FY 2024 Earnings Call.

The above commentary suggests that the inventory correction is waning, and cost improvement initiatives have begun to take effect — an excellent sign for FY 2025.

Since the beginning of FY 2024, management has focused on three things at the operating level:

- Prioritizing investments: The company focuses on projects and products likely to produce the most return on investment (“ROI”) or the most bang for the buck. It is cutting out or reducing the emphasis on low margin ideas.

- More efficiency: Management is laser-focused on reducing operating expenses (OpEx) while finding more ways to operate efficiently.

- A new strategic roadmap: The company has changed its strategic roadmap, which includes combining businesses to eliminate redundancies and operate more efficiently. CEO Murphy gave an example on the earnings call of combining businesses by explaining the custom ASIC and processor product groups have merged into a single organization.

As a result of the above actions, CEO Murphy said on the first quarter earnings call, “This discipline on expenses is expected to carry into fiscal 2025 and help us to deliver strong operating leverage going forward.” So, how are things looking so far?

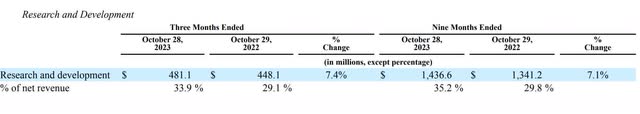

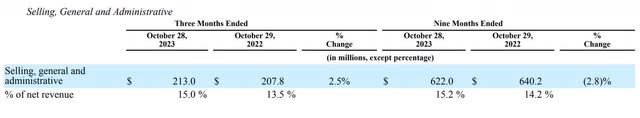

The following two images show GAAP Research and Development (“R&D”) as a percentage of revenue and GAAP Sales, General and Administrative (“SG&A”) as a percentage of revenue. Both metrics are up year-over-year. Moving R&D temporarily higher is understandable since Marvell invests significantly in R&D to differentiate some of its products from competitors. However, hopefully we will soon see SG&A driven lower.

Marvell Third Quarter FY 2024 10-Q

Marvell Third Quarter FY 2024 10-Q

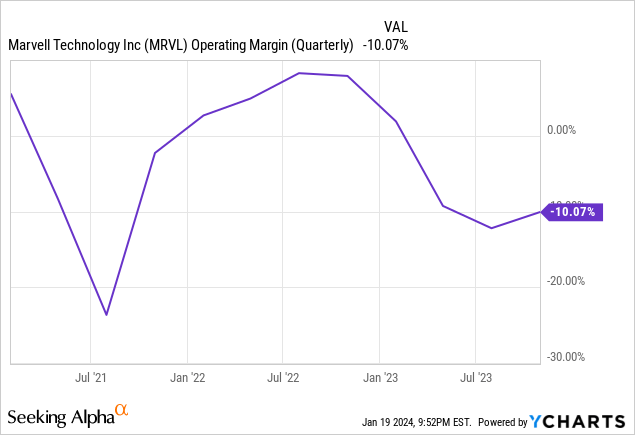

Total GAAP operating expenses, which include restructuring charges, were 49.1% of revenue compared to 43.6% last year. Total GAAP operating expenses were approximately $694 million. Investors should monitor these expenses for signs that Marvell can reduce OpEx as a percentage of revenue because the company has yet to make much progress in that area as of the third quarter. Marvell’s GAAP operating margin was approximately -10 % compared to a positive 6.9% the previous year.

The company produced a third-quarter non-GAAP positive operating margin of 29.8% versus a positive 36.7% in the previous year. The following chart shows reconciliations from GAAP to Non-GAAP operating margins.

| October 28,2023 | July 29,2023 | October 29,2022 | ||||

|

GAAP operating margin |

(10.3) % |

(15.3) % |

6.9 % |

|||

|

Other cost of goods sold |

7.6 % |

6.7 % |

0.8 % |

|||

|

Stock-based compensation |

11.2 % |

11.4 % |

9.5 % |

|||

|

Restructuring related charges |

0.2 % |

3.1 % |

1.0 % |

|||

|

Amortization of acquired intangible assets |

19.0 % |

20.3 % |

17.6 % |

|||

|

Legal settlement |

— % |

— % |

— % |

|||

|

Other |

2.1 % |

0.7 % |

0.9 % |

|||

|

Non-GAAP operating margin |

29.8 % |

26.9 % |

36.7 % |

Source: Marvell Third Quarter FY 2024 Earnings Release.

The company forecasts fourth quarter FY 2024 GAAP operating expenses of approximately $680 million and non-GAAP operating expenses of roughly $430 million. Suppose the company hits its fourth quarter forecasted targets of $1.41 billion in revenue and the mid-point of its targeted gross margins. In that case, non-GAAP operating margins should be 33.71%, and GAAP operating margins should be around 1%, which would show progress. When Marvell releases its fourth quarter FY 2024 report around February 29, 2024, please pay attention to whether gross and operating margins are improving, as that should go a long way in determining whether the company is emerging from its downturn.

Marvell produced a GAAP loss per diluted share of $0.19 in the third quarter, missing analysts’ estimates by $0.11, and the non-GAAP income per diluted share was $0.41, beating analysts’ estimates by $0.01. Management forecasts fourth quarter GAAP earnings per diluted share range from a loss of $0.08 to a gain of $0.02 per share and non-GAAP income per diluted share in the range of $0.41 to $0.51.

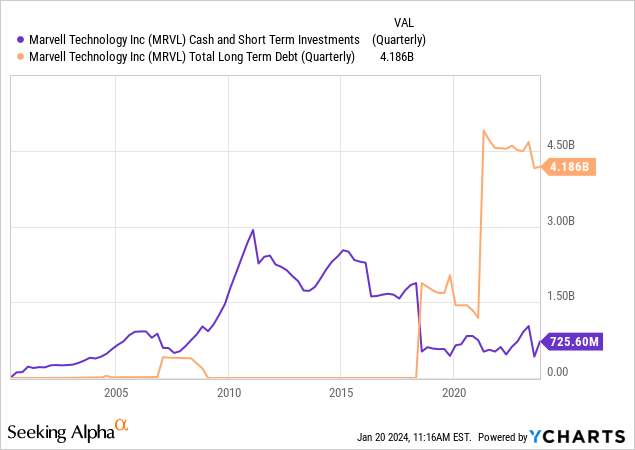

At the end of the third quarter, Marvell had $4.186 billion of cash and short-term investments against $725.6 million in long-term debt. The company reported a gross debt-to-EBITDA ratio of 2.21 times and a net debt-to-EBITDA ratio of 1.83 times. A net debt-to-EBITDA ratio of less than three generally means a company can pay its long-term debts. If that metric exceeds three, it is a red flag, signaling the company may become financially distressed. It has a quick ratio of 1.08, meaning the company can pay off its current debts.

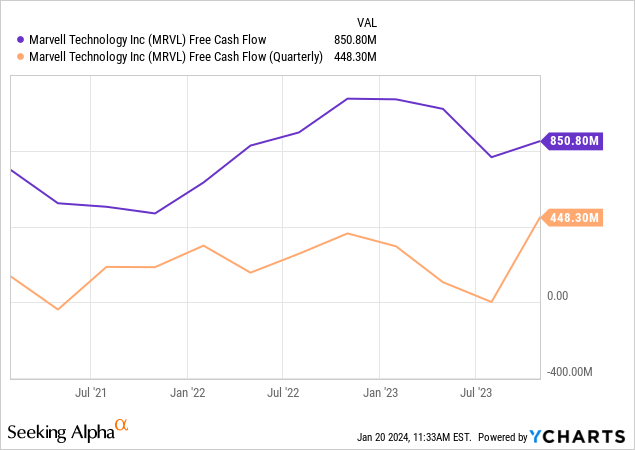

The company produced $488.30 million in quarterly free cash flow (“FCF”) in the third quarter and $850 in trailing 12-month FCF.

Last, the company issued $52 million in cash dividends and repurchased $50 million of stock during the third quarter.

Competition

Marvell has many different large domestic and international competitors in overlapping markets. Some of those companies have more financial and technical resources. Additionally, Marvell’s move into higher ROI markets exposes it to additional fierce competition from entrenched competitors.

Increasing consolidation in the Semiconductor market can also change competitive dynamics overnight, with some mergers potentially lessening competition and other mergers intensifying competition — the company’s latest 10-Q named several mergers that have or can intensify competitive pressures on the company. The acquisitions that it called out that would top my list as most likely to pressure Marvell are Broadcom (AVGO) acquiring VMware (VMW), NVIDIA (NVDA) acquiring Mellanox Technologies and Advanced Micro Devices (AMD) acquiring Xilinx.

Broadcom is Marvell’s most direct competitor in data center networking, enterprise networking, wireless connectivity, and custom silicon like ASICs. In most of the above markets, Marvell plays second fiddle to Broadcom and may have difficulty competing against Broadcom’s existing customer relationships if it fails to differentiate its products.

Another significant player, NVIDIA, competes in some areas of networking solutions with Marvell yet collaborates in others. NVIDIA’s Mellanox acquisition pressures Marvell’s business in Ethernet and other networking solutions. On the other hand, Marvell management recently highlighted in a video how it collaborated with NVIDIA to produce Israel-1, a new hyperscale generative AI supercomputer. This massive supercomputer uses Marvell-enabled optical interconnects to connect NVIDIA hardware. The video also discusses how Marvell has collaborated with NVIDIA for many years to provide interconnectivity solutions.

Lastly, AMD wasn’t much of a competitor until it acquired Xilinx, which makes competing devices to Marvell’s custom ASIC solutions. The combined entity of AMD and Xilinx could present a severe challenge to Marvell in the Edge computing space.

Other risks

Marvell has concentration risk. Most of its revenue comes from a small group of customers, and income from quarter to quarter can be lumpy. The company’s 10-Q states:

During fiscal year 2023, we had one distributor, whose revenue as a percentage of our net revenue was 10% or greater of total net revenues. In addition, net revenue from our ten (10) largest customers, including this distributor, represented 63% of our net revenue for the fiscal year ended January 28, 2023. Sales to our largest customers have fluctuated significantly from period to period and year to year and will likely continue to fluctuate in the future, primarily due to the timing and number of design wins with each customer.

Source: Marvell Third Quarter FY 2024 10-Q

The macroeconomy could throw a monkey wrench in the company’s plans. As of October 2023, the International Monetary Fund downgraded global growth for 2024 to 2.9%, down from the 3.0% it had projected in July 2023. If global growth continues to be slow, it could lower demand for Marvell’s products in its end markets.

Why you should consider buying the stock

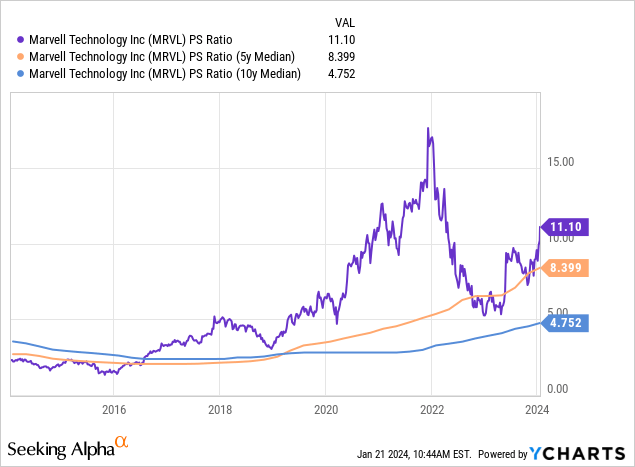

Based on traditional valuation methods, the market overvalues Marvell, and Seeking Alpha’s quant grades its valuation as an F. The chart below shows the stock is currently valued much higher than its five-year and 10-year median price-to-sales ratio.

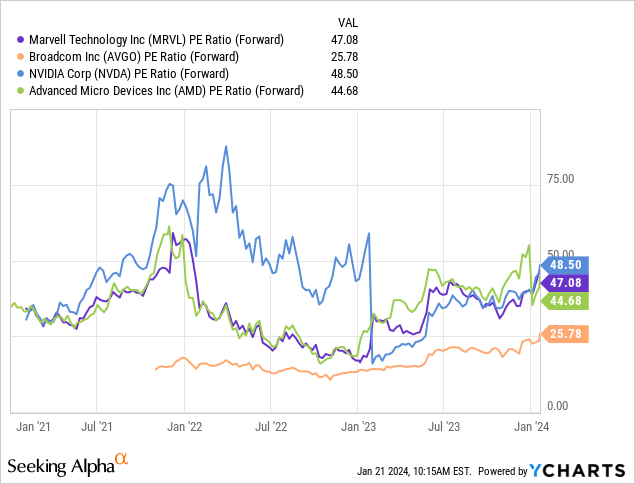

The following chart compares its forward price-to-earnings (P/E) ratio versus a few chip-making competitors. The table following the chart below shows the earnings that analysts expect Marvell to produce in FY 2025 (Calendar year 2024).

| Company name | Estimated 2024 Earnings growth |

| Marvell | 34.04% |

| Broadcom | 11.18% |

| NVIDIA | 64.38% |

| AMD | 46.89% |

Source: Seeking Alpha

The company is currently unprofitable, and you can make a good case that the market is overvaluing the stock based on its forward P/E ratio. However, if AI and cloud growth continue to expand revenue in the Data Center end market rapidly, the Enterprise and Carrier Infrastructure end markets recover within the next several quarters, and the company’s profitability initiatives pay off, Marvell’s profitability could snowball in calendar year 2024, potentially exceeding analysts’ growth expectations. The stock could be fairly valued at current prices if you have an optimistic view of Marvell’s 2024 prospects.

Let’s look at a reverse discounted cash value calculation to see the FCF growth valuation that the market is assuming.

Reverse DCF

|

FCF (Trailing 12 months) margin |

15.46% |

|

The third quarter of FY 2024 reported Free Cash Flow TTM (Trailing 12 months in millions) |

$851 |

| Terminal growth rate | 2% |

| Discount Rate | 10% |

| Years 1 – 10 growth rate | 26% |

| Current Stock Price (January 19, 2024, closing price) | $71.08 |

| Terminal FCF value | $8.755 billion |

| Discounted Terminal Value | $42.191 billion |

Although FCF growth of 26% over the next ten years may seem aggressive, Marvell has significant room to grow its FCF margin. For instance, the company most like Marvell, Broadcom, is a larger, established company with a longer record of accomplishment of consistent GAAP profitability and dividend payments. Broadcom achieved an FCF margin on a trailing 12-month (“TTM”) basis of around 49% in its latest quarter.

Marvell is a growing company still expanding its market share and investing heavily in R&D, which can impact short-term GAAP profitability and FCF. I don’t know if Marvell can achieve an FCF margin of 49%. However, I believe it can expand its FCF margin above 15.46%. The following table shows what the growth rate the current stock price assumes if the company can expand its FCF margin.

| FCF TTM margin | FCF growth rate |

| 20% | 22.5% |

| 25% | 19.3% |

| 30% | 16.7% |

| 35% | 14.7% |

| 40% | 12.8% |

Assuming it can reach an FCF margin of 30%, Marvell’s achievement of an FCF growth rate of 16.7% over the next ten years is within the realm of possibility. In the short term, the stock is at a high enough valuation that people with an investing horizon of a year or less are taking a considerable risk that the stock could drop on earnings disappointments. However, suppose you are a long-term growth investor who believes the company has invested in the proper growth areas and can achieve its profitability and efficiency goals; the stock is a buy at current prices. If you are a cautious investor, you may want to dollar-cost average into the stock.