De-dollarization has been a trending topic over the past year as the rise of BRICS combined with the growing U.S. debt and weaponization of the U.S. dollar have many questioning how long the USD can remain the world’s reserve currency in an increasingly multi-polar world.

According to Andrew Peel, executive director and head of digital asset markets at Morgan Stanely, “the recent growth in interest of digital assets such as Bitcoin (BTC), growth of stablecoin volumes and the promise of Central Bank Digital Currencies (CBDCs)” are also contributing to the shifting attitudes in the currency landscape, and these innovations “hold opportunities to both erode and reinforce the dollar’s hegemony in global finance.”

“Recent U.S. monetary policies, combined with the strategic use of economic sanctions, have prompted some nations to consider alternatives to the greenback,” Peel said. This is a notable development as USD comprises “nearly 60% of global foreign exchange reserves” despite the U.S. only contributing approximately 25% to global GDP.

This reevaluation is occurring at the same time as the European Union is working to strengthen the euro’s role in international trade, he said, especially for use in energy transactions and other key commodities. “This effort is part of a broader strategy to enhance the euro’s global standing, which could further diversify currency dependencies in international markets.”

Further complicating the picture is China, which is pushing for increased use of the yuan in international trade, “particularly through its Cross-Border Interbank Payment System (CIPS), challenging the dollar-centric Clearing House Interbank Payments System (CHIPS),” Peel said.

While this effort has achieved some success, with China seeing a “notable increase in the yuan’s share in global FX turnover and its use in commodity trade settlements,” the global foreign exchange reserve balances of yuan remain small around 2.5%, he noted.

“Inter-governmental organizations such as BRICS (comprising Brazil, Russia, India, China and South Africa), the Association of Southeast Asian Nations (ASEAN), the Shanghai Cooperation Organization (SCO), and the Eurasian Economic Union, which collectively represent a significant portion of global GDP, are also expressing interest in using local currencies for trade invoicing and settlements,” he said. “Some members have shown a willingness to trade in yuan, further indicating a shift in global currency dynamics.”

Peel said that for the yuan and euro to challenge the global dominance of the dollar, structural reforms and new settlement systems will still need to be implemented, but the “shift towards reducing dollar-dependency is evident, simultaneously fueling interest in digital currencies such as Bitcoin, stablecoins, and CBDCs.”

“Bitcoin, now 15 years old, kickstarted the digital asset movement,” he said. “Its appeal lies in its capped supply, algorithmic governance, and a decentralized ledger, or blockchain, independent of central banks’ influence.”

Peel said that despite the regulatory challenges that the industry has faced, “Bitcoin’s adoption has been remarkable,” with estimates that there are 106 million Bitcoin owners globally.

“Corporations like Tesla have incorporated Bitcoin into their balance sheet holdings, while El Salvador’s adoption of Bitcoin as legal tender and a reserve currency marks a significant step in national level acceptance,” he said. “The presence of Bitcoin ATMs in 84 countries further demonstrates its growing international reach. In terms of global scale, Bitcoin’s market capitalization is currently around the value of Switzerland’s GDP and, at its peak in 2021, surpassed that of Saudi Arabia.”

He said Bitcoin adoption has now moved beyond mere speculation and called the recent launch of 11 spot BTC exchange-traded funds (ETF) in the U.S. “a potential paradigm shift in the global perception and use of digital assets.”

Peel also highlighted the growing prominence of USD-pegged stablecoins, which have “risen as a critical component to facilitate trading digital assets like Bitcoin.”

“Designed initially for cryptocurrency traders, these stablecoins facilitate 24/7 trading and near-instant settlement on blockchain networks, offering a more efficient alternative to traditional financial systems,” he said. “Their utility extends beyond trading, serving as reliable value storage and a bridge between crypto and traditional banking, while offering benefits in cost, security, utility and efficiency in comparison to physical cash.”

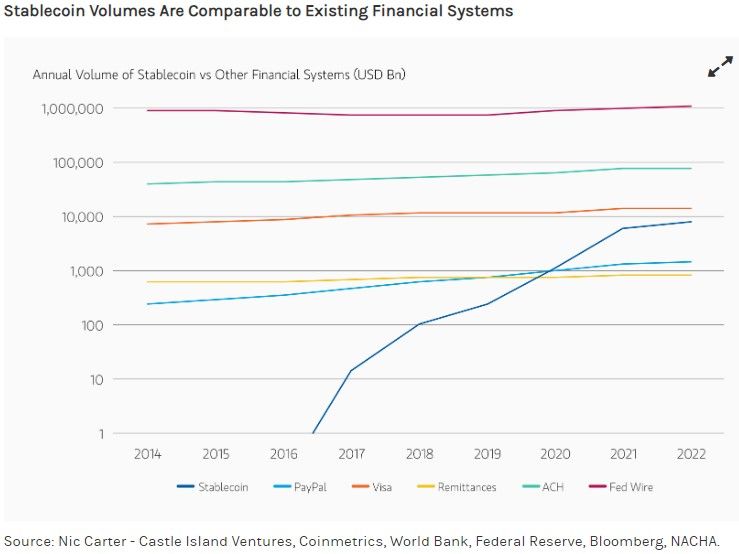

He said that stablecoins are now on an exponential growth curve globally, having processed close to $10 trillion on public blockchains in 2022, which rivals traditional payment giants like PayPal and even Visa.

“This has prompted major financial service companies to adapt,” he said. “For instance, Visa’s integration of Circle’s USD stablecoin (USDC) on Solana and PayPal’s introduction of its PayPal USD (PYUSD) illustrate the shift towards embracing blockchain efficiency in payments and cross-border transactions.”

“With their increasing importance, dollar-backed stablecoins are set to have a profound impact on the financial sector, potentially reshaping how money is moved across borders,” he said. “Rather than challenge the dollar’s dominance, their continued evolution and growing acceptance by mainstream financial entities underscore their potential to significantly alter the landscape of global finance and in fact reinforce the dollar as the dominant global currency.”

The interest in and adoption of stablecoins has led to rising interest in CBDCs as well, Peel noted. “By mid-2023, 111 countries, representing over 95% of global GDP, are actively exploring CBDCs, marking a significant increase from just a few years prior,” he said.

“Unlike decentralized cryptocurrencies and stablecoins, CBDCs centralize control over the underlying infrastructure and convert their nation’s currency into a purely digital form, equivalent to traditional fiat currency,” he explained. “Issued and regulated by central banks, CBDCs aim to modernize financial systems by leveraging the efficiency, transactional savings, and the benefits of distributed ledger technology (DLT), a permissioned version of blockchain technology, while ensuring oversight and control. Various studies have also highlighted an opportunity to leverage CBDCs to extend financial access to unbanked populations.”

He noted advancements in the digital yuan trials in China and the launch of CBDCs in the Bahamas and Nigeria, which so far have seen limited uptake.

“As CBDCs become more widely adopted and technologically advanced, they hold the potential to establish a unified standard for cross-border payments, which could diminish the reliance on traditional intermediaries like SWIFT and the use of dominant currencies such as the dollar,” he said. “Furthermore, CBDCs can enable significant innovation in financial services, such as the use of smart contracts for automating payments, making the concept of programmable money a practical reality.”

He cited the mBridge project by the Bank for International Settlements, which involves the central banks from China, Hong Kong, Thailand, and the UAE, as an example of the potential that smart contracts hold in facilitating efficient and secure cross-border settlements.

“The ongoing development and increasing adoption of CBDCs promises to reshape the global financial system, potentially influencing not just monetary transactions but also broader economic and geopolitical dynamics,” he said. “As the search by nation states for alternatives to the dollar continues, emerging digital currencies and stablecoins are fast developing into viable alternatives to traditional cash and in some cases, fiat currencies.”

Peel said that more and more countries and major institutions are recognizing the need to adopt these technological advancements for their core business processes, which “not only validates the technology and business use cases but also marks a transition towards more efficient, faster, and cost-effective international transactions.”

He noted that while the transition will be “gradual during the early adoption stages, they are expected to gain mainstream acceptance over time.”

“The interplay and nuances between traditional fiat currencies, Bitcoin, E-Money, and stablecoins are set to significantly influence the future of international trade and finance, potentially reshaping the global economic and financial landscape,” Peel concluded. “Investors and policymakers alike must pay attention and keep informed with the rapidly changing digital asset ecosystem, considering wide-ranging implications on global businesses and nation-states, as well as the macro investor landscape.”

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure accuracy of information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.