peepo

Aflac (NYSE:AFL) Q4 earnings per share trailed the average analyst estimate as its variable investment income ran $27M, or $0.04 per share, below the company’s long-term return expectations, the company said Wednesday.

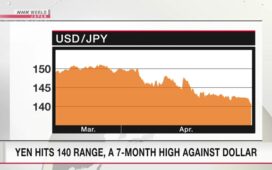

Also, the weaker yen/dollar exchange rate reduced adjusted EPS by $0.02. The adjusted figure also included an after-tax loss of $119M, or $0.20, related to novation of a reinsurance treaty with a third party that ceded back to the company at year-end 2023k.

Aflac (AFL) stock slid 2.9% in Wednesday after-hours trading.

Q4 adjusted EPS of $1.25, vs. the average analyst estimate of $1.45, fell from $1.84 in Q3 and $1.31 in Q4 2022.

Total revenue of $3.78B, missing the $4.39B consensus, dropped from $4.95B in the prior quarter and $3.95B a year ago.

Adjusted book value per share of $47.55 at Dec. 31, 2023, dipped from $48.44 at Sept. 30.

Q4 adjusted net investment income fell 5.4% Y/Y to $795M.

Aflac Japan net earned premiums fell 8.5% Y/Y to ¥272.1B ($1.89B), total adjusted revenue declined 3.5% to ¥371.1B; and adjusted net investment income climbed 13.5% to ¥97.8B.

Aflac Japan’s pretax adjusted earnings for the quarter increased 9.7% on a reported basis to ¥112.7B ($770M), primarily due to lower benefits and expenses partially offset by decreased revenue during the quarter. Pretax adjusted earnings increased 6.8% on a currency-neutral basis.

Aflac U.S. net earned premiums increased by 1.1% Y/Y to $1.4B; adjusted net investment income rose 9.9% to $211M, largely on higher variable investment income and a shift to higher-yielding fixed-incom investments; and total adjusted revenue climbed 1.1% to $1.6B.

U.S. pretax adjusted earnings were $302M, down 10.9% from a year ago, primarily due to higher adjusted expenses and benefits offset by higher adjusted net investment income.

Conference call on Feb. 1 at 8:00 AM ET.

Earlier, Aflac non-GAAP EPS of $1.25 misses by $0.20, revenue of $3.8B misses by $590M