Table of Contents

Show more

Show less

Investing might seem complex to beginners but in reality it can be pretty straightforward.

Plus, over the long term – and here we’re talking about periods of several years to decades – investing in assets such as stocks and shares has been shown to outperform the returns on cash deposits.

If you’re looking to grow your money, which may be particularly important when inflation is high and eroding the spending power of your cash, it might be worth considering your investment options.

What is investing?

Investing is when you buy an asset, such as shares or property, in the hope that you will make a profitable return over time.

That return can come in the form of income, such as rent or share dividends, as well as capital growth, for example when the value of a property increases or a share price rises.

Investment is not the same as saving, where you put money on deposit and receive interest. With an investment, your money (the original capital you invested) is at risk if the investment performs badly and falls in value.

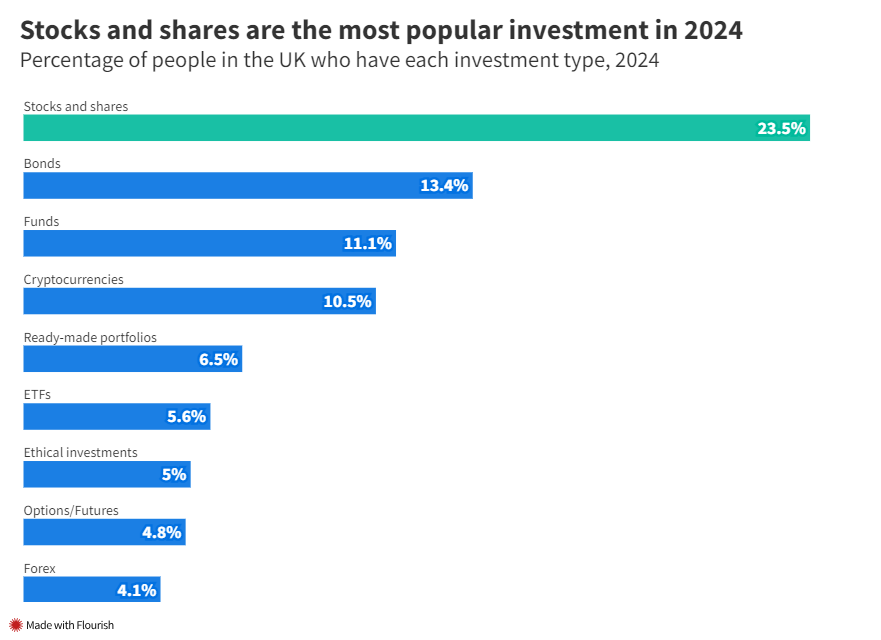

Some popular investments include:

- stocks and shares: investing in individual companies listed on the stock market

- equity funds: putting money into ‘pooled’ funds, such as unit trusts and investment trusts, that invest contributions from many investors into a range of shares (more on this below)

- property: either through direct ownership or via a pooled fund)

- bonds: fixed-interest investments where you receive a dividend back for effectively loaning money to the government or a company, with the face value of the bond subject to fluctuation according to demand.

As noted above, with most types of investment, such as equities (stocks and shares), funds, property and bonds, for example, there is a risk to your initial capital investment.

This means you could end up with less than you put in or losing your capital. That’s why you need to be comfortable with the risks involved in investing before you start.

Why should I consider investing?

Investing is a matter of personal choice and your attitude to risk. But there are a number of reasons you might want to consider investing, rather than putting available funds in a savings account.

For many people investing tends to mean putting money into equities, typically through a pooled investment fund, such as a unit trust or investment trust. The reason this tends to be a popular choice is because the entry level can be fairly low, many funds accept monthly contributions of £10 and upwards, and it can be tax efficient if you save in an ISA – more on this below.

Here are some of the advantages of investing in a fund:

- cash savings may not grow as fast – it’s important to have some cash savings put away for emergencies, but having all your money in cash could mean it might not grow as much over the years, compared to investing it

- compounding returns can significantly grow your investment – compounding – the process whereby dividends paid on your investments are ploughed back into your investment pot, so you then earn growth on the whole amount – can significantly increase the value of your investments over time

- Long-term growth – the longer you can leave your investments, the more you are likely to make in earnings as potential compounding will have more of an impact. Keeping money invested for longer also typically enables you to ride out the market dips that will inevitably happen over the duration of your investment.

Laura Suter, head of personal finance at investment platform AJ Bell, says: “While savings rates have risen recently, it’s important to see this as a small snapshot in time rather than the normal trend. History shows us that investing delivers higher returns than cash and inflation over long periods.”

What about the risks?

As mentioned already, investing is not without risk. The value of your investments can go down as well as up and you could get back less than you originally put in.

That said, investors can take steps to help minimise the risks, which might include:

- drip-feeding money in – if you’re investing in pooled funds such as unit trusts, it can make sense to make regular investments, such as £25 or £50 a month, rather than putting in a lump sum. This is because, if you invest a lump sum just as the market drops, this could cause you to panic at the losses. By drip-feeding money you can smooth out the peaks and troughs in performance

- only invest if you won’t be spooked by market falls – think about your investment and savings goals and the timeframe you have to invest. It may not be the best option to invest money you’re saving for a house deposit in the stock market if you know you will need this money in the next few years and you can’t afford to see the cash value reduce

- invest for the long term – equity investments should be viewed as a medium to long-term investment. Over a longer time frame your investment can typically ride out the peaks and troughs of the market

- diversify your investments – spreading your money between different types of investment is one way to spread and help reduce risk.

How can I invest in the stock market?

If you’ve decided you want to invest in equities the next step is to consider what and how you’ll go about it.

There are lots of ways to invest in stocks and shares but for beginners, pooled investments offer a more diversified approach than individual stock-picking.

For investment funds, you may want to think about whether or not you want an ‘active’ or ‘passive’ fund. There are pros and cons to each.

- Active versus passive funds

With active funds a manager picks the investments, often specialising and focusing on a particular geographic area or industry type and investing to fit a particular strategy to try to outperform the market. Fees on active funds tend to be higher than for passive funds.

A passive fund has no fund manager picking the stocks. Instead, passive funds use a computer to track a chosen index or indices, such as the UK FTSE 100. First-time investors often prefer passive index tracker funds due to their relative lower risk and lower fees, compared to actively managed funds.

- Will you put your investments in an ISA wrapper?

Tax treatment depends on one’s individual circumstances and may be subject to future change. The content of this article is provided for information purposes only and is not intended to be, nor does it constitute, any form of tax advice.

It can be tax efficient to invest within an ISA wrapper. That way you don’t have to worry about any tax liability on your investment income or gains.

Everyone has an ISA limit of £20,000 each tax year, and this can be split across different types of ISA – so you could split your allowance across a cash ISA and a stocks and shares ISA, for example.

Pensions are another tax-efficient way to invest for the long term. The money you put into a pension will be boosted by tax relief at your highest rate of income tax, subject to certain limits. For example a basic rate taxpayer who puts £80 into a pension will get this increased to £100 through tax relief. But with pensions you can’t access your investments until at least age 55 (and this is rising to 57 in 2028).

- Pick an investment platform

Before you start investing you’ll need to pick the platform that is right for you. Some will offer a lot of hand-holding and will typically guide you towards investments based on your risk profile. These are so-called ‘robo-advisers’. But investors are charged more for this service. Other providers will offer a pared-down investment range at a cheaper price.

Most platforms will also offer a full range of investments. You’ll need to weigh up how much choice you require and the charges (both for buying and selling and annual fees) you’re going to face before working out what is right for you.

Finally, Ms Suter at AJ Bell, says all investors, not just beginners, should be wary of following trends or investing in something they’ve heard about on social media or from friends: “Investors need to make sure they understand what they’re buying, and why they think it will make money – whether it’s a fund or a share.

Suggested Read: Best Trading Platforms For Beginners

“All too often investors are lured in by the promise of high returns or invest just because a friend has recommended it. But investors need to understand how the investment works and all the risks before committing their money.”

– Megan Rimmer, chartered financial planner at Quilter Cheviot

What are online brokers and robo-advisors?

As mentioned above, many investors find it helpful to invest via an online broker using a robo-advisor to help them build a portfolio of balanced investments.

The online broker is the platform you use to buy your investments, such as a stocks and shares ISA or individual funds, such as unit trusts.

The robo-advisor is part of this online platform. It’s an automated service which funnels the user towards certain investment choices based on their responses to a series of questions around appetite for risk and timeframes.

With some services, the robo-advisor will manage your investments on an ongoing basis, re-balancing the portfolio when required.

As the robo-advisor service is automated, it can’t be as tailored or bespoke as full independent financial advice. But for many investors it can be a good low-cost halfway house.

What can I invest in?

There are plenty of options when it comes to investing, from individual stocks to investment funds, bonds and even property. You may want to consider investing within a tax-efficient ISA if this is beneficial in your case and suits your needs.

Equity investments: you can invest in various stock markets around the world, either buying individual shares, or through index tracker funds or exchange traded funds. Alternatively you can buy unit trusts or investment trusts, and there are hundreds of different funds to choose from, each holding different stocks and shares and other assets and with different investment strategies.

By investing in UK funds, European funds or global funds, or a mix of different types of fund, for example, you can get a broader diversification of investments.

Bond funds: these are pooled investments that typically hold a range of government bonds and corporate bonds. Bonds are sometimes referred to as ‘fixed-interest securities’.

This is because investors are effectively loaning money to the bond issuer (government or company) who then pays an agreed amount of interest on the debt (the fixed interest). Bond funds can then be traded on the market, so investors can buy and sell at any time. As an asset class, bonds sit between the relative safety of cash and higher risk equity investments.

Property: There are many ways to invest in property. But if you can’t or don’t want to invest directly in one investment property, such as a buy-to-let or holiday home, you could choose to invest in property funds.

These funds tend to invest directly in property (typically commercial properties) or the shares of property-related companies, or a mix of the two. This way you can get exposure to any growth in property markets, even if you can’t buy an investment property outright.

Real Estate Investment Trusts (REITs) are another form of pooled property funds. A REIT must get at least 75% of their profits from property rental.

You should be comfortable that you understand the investments you choose, including the risks and any tax implications.

It can be advantageous to seek out a professional financial advisor before you start investing who can talk through your investment goals, timeframe and budget to work out a appropriate strategy.

What type of investment is best for beginners?

The investment that’s right for you as a beginner investor will depend on a range of factors, including your attitude to risk and the timeframe over which you want to invest.

Financial advisors tend to recommend using your tax-free ISA allowance up to your £20,000 annual ISA limit.

Lower-cost tracker or ‘index’ funds can be held within a stocks and shares ISA. These funds track the performance of an index, such as the FTSE100 or FTSE 250 for example, to offer diversified exposure to a broad basket of stocks and shares.

Alternatively, beginners could consider pooled funds such as unit trusts which are often tailored to different risk profiles, so a first-time investor might want to start with a low risk portfolio.

Both types of investment are available from online investment platforms. However, if you’re looking for a more tailored strategy or you need advice you should contact a professional independent financial advisor.

What return will I get from the different investment options?

When it comes to stocks and shares and investment funds, it is impossible to know how they will perform. It will always be the case that you might lose some or all of your money.

That said, the longer the timeframe you have to invest, there is an increased possibility that you’ll see a positive return. This is because the passage of time can smooth out any dips in performance – although again, it is important to stress that this is not guaranteed.

Remember: just because a particular investment fund has performed well in the past does not mean it will continue to do so.

But over time, and with a relatively low-risk investment strategy and reinvestment of any dividends received, you could start to see returns that out-perform those on cash accounts.

Investors who are not comfortable with this level of risk should instead consider fixed-rate savings bonds and cash accounts. While the interest rates may not be that high, a fixed-rate bond guarantees a fixed rate of interest and does not put your capital at risk.

What about investment charges?

However you choose to invest there are likely to be fees charged by the investment platform or provider.

In addition, there are likely to be trading fees, when you buy or sell fund units or individual stocks and shares, as well as annual management fees on the investment funds you hold. These are applied by the investment manager.

Over time, investment fees and charges can significantly impact on your overall returns, so it can pay to compare investment providers before you invest to find those with the most competitive fees.

Passive funds, such as index trackers, tend to have lower annual fees compared to actively managed funds.

How can a beginner get started with investing?

Before investing, here are a number of points to consider:

- have you paid off expensive consumer debts, such as credit cards or personal loans? It usually makes sense to use any spare cash to first pay off debt where you’re being charged high interest

- do you have a cash savings pot for emergencies? Most financial advisors recommend you have at least three month’s salary in an easy access account as a safety net (if you can afford it, of course).

We believe once these things have been addressed you can look to start investing. Ask yourself what are your Investment goals? Plus, decide on your budget, such as £50 or £100 a month, into a pooled investment fund. Some platforms allow you to invest as little as £10 a month.

You’ll then need to decide which investment funds suit your goals and which platform you will use, plus whether or not you’ll invest within an ISA wrapper.

Consider reviewing your investments on a fairly regular basis, once or twice a year is probably sufficient for long-term investments. Remember your investments are likely to fall as well as rise over time so try not to be overly concerned about short-term fluctuations.

Frequently asked questions (FAQs)

How much should I invest?

This is up to the individual investor. You should work out a budget and calculate how much you can afford to invest.

This might be monthly, for example, or you could aim to make regular lump sum investments, perhaps if you receive a bonus through work.

You should only invest what you are comfortable with losing, remembering that equity-linked investments carry risk. The value of your investments can fall as well as go up.

Will I be taxed on investments?

Tax treatment depends on one’s individual circumstances and may be subject to future change. The content of this article is provided for information purposes only and is not intended to be, nor does it constitute, any form of tax advice.

Depending on your returns there may be tax to pay on your investment gains, unless you are investing in a tax-free ISA wrapper.

Outside an ISA your investments may be liable to dividend tax or capital gains tax, but there are relatively generous limits for this. You can earn up to £500 from dividends without paying dividend tax.

Anything over and above this limit will be taxed, with the tax rate dictated by your income tax band. For more on dividend income read our guide to share dividends.

There may be capital gains tax to pay when you sell your investments, but the annual exempt amount for CGT is £3,000.

What is a tracker fund?

Tracker funds are passive funds that invest in a way that mirrors the movements in a particular index or indices, such as the FTSE 100.

There is no fund manager – the process is run by a computer. Tracker funds typically have lower fees compared to the management fees on actively managed funds.

When should I invest?

Investments should be viewed as long term plan. If you have at least five years for your investment to grow, for example, then it could be worthwhile to consider investing.

There is risk to your initial capital, but by investing for the long haul you should typically be able to ride out the ups and downs of the market. In an ideal world investors would buy into assets when their value is low and sell at the peak. But in reality it would be difficult to always time the market correctly.

That’s why most experts say investments are for the longer term.