Interest rates remain the main driver of the Forex (foreign exchange) market. More than any other factor, it is the decisions of central banks that drive currency values.

In recent weeks, investor attention has focused on Jackson Hole, where Federal Reserve (Fed) Chair Jerome Powell opened the door to a first rate cut in 2025 as early as September. A strong signal that is already shaking up the US Dollar (USD) and the major Forex pairs.

Why interest rates dictate Forex

The mechanisms are relatively simple: higher interest rates attract foreign capital, as they offer a more attractive return on Bonds and deposits denominated in the currency concerned.

Conversely, lower interest rates make the currency less attractive. In this way, interest rate differentials explain why one currency strengthens or weakens against another.

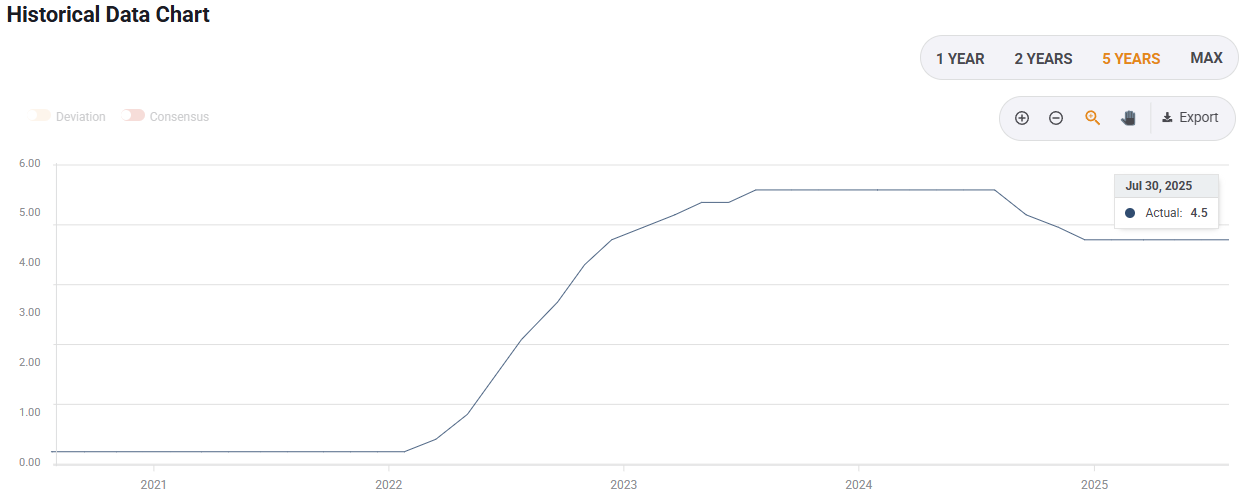

In the case of the United States, the Fed’s rate hikes in 2022 and 2023 propelled the Greenback, with the US Dollar Index (DXY) even reaching a twenty-year high.

But today, the cycle is reversing: inflation is falling, growth is showing signs of fatigue, and employment, the mainstay of the US economy, is weakening.

United States Fed interest rate. Source: FXStreet

Powell prepares markets for monetary easing

In his Jackson Hole speech, Jerome Powell acknowledged that US monetary policy remained “restrictive” and that the balance of risks was now shifting towards the labor market.

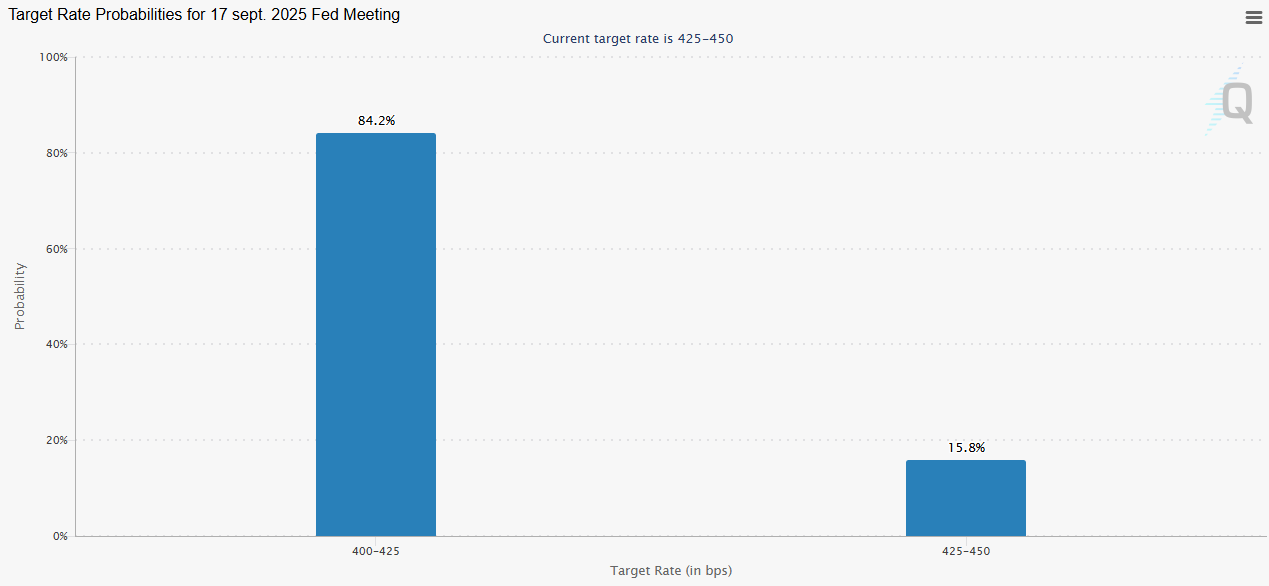

He mentioned the possibility of an adjustment as early as the September 17 meeting, confirming the expectations of many traders.

Markets were quick to react. Bond yields fell, and the US Dollar retreated against the Euro (EUR) and Japanese Yen (JPY).

According to the CME FedWatch Tool, the probability of a 25 basis point cut in September now exceeds 84%. Investors are even anticipating two further interest rate cuts between now and the end of the year.

CME FedWatch Tool. Source: CME Group

A direct impact on the US Dollar and Forex

In practical terms, a fall in US interest rates reduces the yield differential with other currencies. If the Fed eases its policy faster than the European Central Bank (ECB) or the Bank of England (BoE), the Greenback will lose its appeal and could weaken against the Euro or the British Pound (GBP). This is what we have seen in recent weeks, with the EUR/USD back above 1.15.

EUR/USD price daily chart. Source: FXStreet.

But the future remains uncertain. If inflation were to rise again, notably as a result of the US President Donald Trump administration’s tariffs, the Fed could slow down its cuts, thereby supporting the US Dollar.

Conversely, a marked weakening in the labor market would prompt Jerome Powell to accelerate easing, to the detriment of the Greenback.

The role of expectations

It’s important to remember that in Forex, it’s not just the decisions themselves that count, but above all, expectations.

Forex traders adjust their positions even before the Fed announces a move. Thus, a speech by Powell that is deemed “dovish” (accommodating) may immediately weaken the US Dollar, even if interest rates remain unchanged for the time being.

Conversely, a hawkish tone may strengthen the Greenback, despite a status quo decision.

A strategic turning point for traders

For market operators, this autumn could mark a turning point. The prospect of Federal Reserve rate cuts is reshuffling the deck, creating new opportunities for major pairs.

If the US Dollar weakens, emerging currencies and those of higher-rate countries, such as the Canadian Dollar (CAD) and Australian Dollar (AUD), could benefit.

Beyond the immediate news, this sequence reminds us of a fundamental truth: interest rates, by dictating global capital flows, are Forex’s number-one barometer.

For any investor, following Jerome Powell’s and the Federal Reserve’s announcements is not an option, but a necessity.